(Trinidad Guardian) A TT$12 billion in debt, much of which is due in one year’s time, total employee costs amounting to 50 per cent of operating costs and an overtime bill of TT$22 million a month are some of the issues the board of State-owned energy company Petrotrin must deal with.

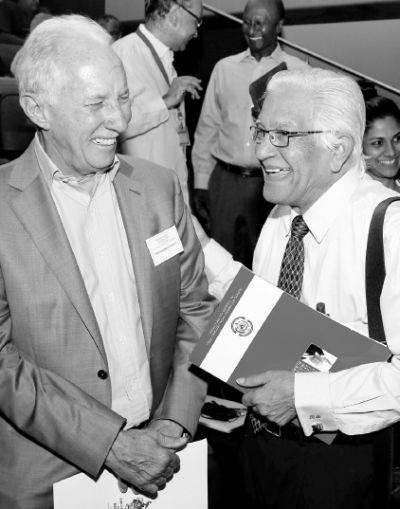

The grim picture was painted by chairman Wilfred Espinet at a conference titled Macroeconomic Conversations hosted by the University of the West Indies in collaboration with Guardian Media Ltd at UWI’s St Augustine Campus yesterday.

Added to the heavy debt is the fact that the company gives out some 5000 meal vouchers per month to people working only in the refinery and one particular member of management who had reported for duty but they had been unable to fire him.

Referring to the $12 billion debt, in particular, Espinet said, “Faced with a huge balloon payment of $850 million US dollars…these are the things we came in and found in the company.”

He said a company like Petrotrin, which is involved in such high capital expenditure, ought to have a different structure in terms of employee cost.

“It has an extraordinary cost that could not possibly be sustained,” he added.

He said the overtime bill was “institutional overtime,” adding that in the company’s balance sheet to date there were 183,000 days of leave accumulated to the workforce.

“That’s 502 years … that’s two hundred and twenty-something million dollars worth of leave accumulated. The worse part of it is that nobody has any record keeping of anybody in Petrotrin.

“We have an employee who is identified in a managerial position at four and a half years of being there and he has not attended one full week of work and the process of getting him out is impossible because you have what is called natural justice,” Espinet said.

He noted that the taxpayers had therefore now become a victim.

“Every single Trinidadian has a substantial amount of debt and I’m talking about the vagrants on the street, so if they’re not going to pay it somebody else going to pay it,” Espinet said.

He said if T&T wanted to remain competitive in the oil industry the board of Petrotrin must take charge of its operations.

“You’re dealing with the impossible. It is a challenge of unbelievable dimension. We came in and we started to cut cost and reduce waste,” he said.

“One of the big fallacies I want to remove is the price of oil has caused this. That is absolutely false. Petrotrin’s cost of operation is a problem. The management is a problem. When the cost of oil was US$110 a barrel we were losing money.”

He said initiatives like the gas to liquids project had also cost the company large sums of revenue.

Former Barbados Prime Minister Owen Arthur, who delivered the feature address focusing on small states, said developmental challenges faced by such countries could be minimised and overcome by appropriate policy choices and more importantly, by the sustained forging of a coherence between the mix of policies and the choice of strategies that a country chooses.

Regarding trade, Arthur noted, “In respect of trade facilitation, as vetted by the World Bank’s statistic performance index and the cost to export a container, the Caribbean region enjoys the dubious distinction of having the worst indices of any group of countries in the world.”

He said beyond such determinants of trade, the region has been showing significant slippage on matters that can generate high levels of investment.