The Bank of Guyana (BoG) will soon have the ability to grant temporary financial bailouts to commercial banks in order to protect depositors from losses similar to those incurred when the Globe Trust and Investment Company Limited (GTICL) collapsed in 2004.

This will become possible with the enactment of the Bank of Guyana (Amendment) Bill, which was passed last evening by the National Assembly.

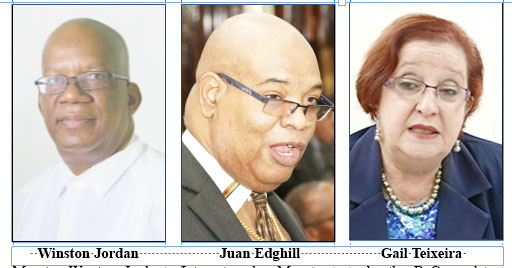

Also passed by the House was the National Payment Systems Bill (NPSB), which will clear the way for a more structured use of electronic payment methods within the country. Additionally, the Deposit Insurance Bill, which like the other two was tabled by Finance Minister Winston Jordan, was also up for consideration last night and it too was expected to be passed.

The proposed legislation is part of the efforts to modernise the local financial sector in line with recommendation from the 2016 Financial Sector Assessment Programme (FSAP) conducted by the World Bank and the International Monetary Fund (IMF).

While the bills received support from both sides of the House during their consideration, as did the Financial Institutions Amendment Bill (FIAB) that was passed on Thursday evening, the opposition Members of Parliament (MPs) voiced concern that together they make the BoG regulator, enforcer, monitor, big brother and competitor.

PPP/C MP Juan Edghill began last evening’s lament during the consideration of the National Payment Systems Bill by arguing that Section 4 sets up the BoG as the regulator, supervisory authority and an operator or participant.

“According to this bill, the regulator is also an operator,” he repeatedly intoned.

Jordan did not directly respond to this assertion. However, a reading of the bill shows that while Section 4 (2) grants the Bank the power to establish, own, operate and participate in the ownership or operation of payments systems, these powers are granted in order to fulfil the role enshrined in Section 4(1) which is to provide facilities for systems, their operators or their participants.

The concern was once again raised during discussion of the BoG (Amendment) Bill, with opposition Chief Whip Gail Teixeira stating, “you have already crowded out everyone else with foreign exchange, you are now going to crowd out everybody else on the gold market…We dealt with the Bank as regulator and enforcer simultaneously in the last bill [NPSB] and in the bill before that [FIAB] monitor and big brother, now in this bill we have the Bank getting involved in not just dealing with banks and other entities that may have trouble but it is allowing the Bank, it’s slipping in that the Bank, will now be dealing with precious metals.”

She was at the time referring to the amendment to Section 40 of the Principal Act. This amendment allows the BoG to “operate in the financial markets by buying and selling outright, either spot or forward or under a repurchase agreement, and by lending or borrowing claims and marketable instruments, as well as precious metals.”

Teixeira and several other speakers questioned whether this provision did not grant the BoG the opportunity to compete against commercial banks within the financial market.

“Why would you want the BoG to be the entity buying reserves of gold? You will create a situation where the Bank of Guyana will outmanoeuvre everyone else. This is not a healthy situation; it will have a monopoly of gold… no one has explained why the bank is doing this,” Teixeira argued.

“If we are taking the Central Bank into the market, we are crowding out the private sector,” Edghill argued, while fellow PPP/C MP Anil Nandlall asked how were other operators to feel secure when their supervisor and regulator would be competing with them.

He claimed that the provision radically altered the playing field, while PPP/C MP Irfaan Ali posited that the specific provisions of Section 40 were in direct conflict with the primary objective of the Principal Act and likely to create price distortion and instability.

Jordan, however, argued that one of the roles of the Central Bank is to ensure monetary and price stability and part of that process is that it has to intervene at such times either in the case of the foreign exchange market to provide foreign exchange when there may be a shortage or to mop up in terms of buying from the market when there is an excess.

He reminded that in 2017, the BoG intervened in the market to stop usury, rapacious dealings and to stop foreigners from coming and buying up Guyana’s foreign exchange and causing problems in the market.

“That is the role of the Central Bank,” he stressed, while adding that it is the interest of both sides of the House that the economy remain stable so if the bank needs strengthened powers to ensure that it can carry out its regulatory function then that should have the unanimous support of the House.

Despite the concerns enumerated by the opposition speakers, the bills were passed with their support.

The BoG (amendment) Bill amends four sections of the Principal Act in lien with recommendations of the 2016 FSAP.

The recommendations specifically noted that despite seemingly comfortable liquidity buffers today, it is critical to adopt an emergency liquidity assistance policy and procedures to ensure prompt temporary infusions of liquidity to solvent but illiquid banks via the BoG. “Key actions would include clearly designating the facility to be used for emergency liquidity assistance, setting eligibility conditions, clarifying terms and conditions for the facilities’ use, particularly on collateral requirements, introducing systems for enabling prompt acceptance, valuation and management of collateral and providing clear and sound policy guidance to preclude the use of emergency liquidity assistance for open bank assistance or public bailout capital infusions. The regime shall be used exclusively in systemic situations and only under strict parameters when the BoG could also relax mandatory reserve requirements,” an extract from the FSAP report read by Jordan noted.

He stressed that functioning as a lender of last resort has been a fundamental function of central banks for centuries and is one element of the safety net it provides the economy, with others including deposit insurance, resolution and licensing powers.

Meanwhile, the NPSB encompasses a broad range of areas, including licensing, fees and charges and money transfer agencies.

It is part of government’s efforts to upgrade the laws, regulations and infrastructure for a safe, efficient and modern payments system and addresses “the whole of the services that are associated with the sending, receiving and processing of orders of payment or transfers of money in domestic or foreign currencies, issuance and management of payment instruments, payment systems, clearing systems, including those processing securities, arrangements and procedures associated to those systems and services, and payment service providers, including operators, participants, and any third party acting on behalf of them, either as an agent or by way of outsourcing agreements, whether entirely or partially operating inside Guyana.”