Dear Editor,

Dr. Clive Thomas devoted about half of his recent piece, `Navigating Guyana’s Development Challenge – 8,’ (SN, 19 August) to the idea of absorptive capacity. He takes the output gap as a proxy for absorptive capacity and said it was “essential” to keep “track of the condition of this metric [output gap].” The task of estimating the output gap he left to the “statisticians.” The rest of this essay grapples with the output gap. All data for the discussion were obtained from the World Bank.

First, the output gap, a proxy for absorptive capacity, is not a static, once-upon-a-time metric. It evolves dynamically over times for the simple reason that it depends upon two time-dependent variables. Dr. Thomas did not offer a definition of absorptive capacity, but the phrase may be taken to refer to the ability of an economy to absorb additional resources (land, labour, capital, managerial talent) to enhance its productive capacity without becoming overheated. One way, as suggested by Dr. Thomas, to gauge absorptive capacity is to estimate the difference between actual and potential output. Potential gross domestic product (GDP) is defined as the level of output an economy can produce at a constant inflation rate. Although an economy can temporarily produce more than its potential level of output, that comes at the cost of rising inflation. As Dr. Thomas says “potential output/GDP is therefore the maximum amount of goods and services Guyana can produce at full capacity when it is most efficient. Further, just as actual GDP fluctuates upwards and downwards, so too does a country’s output gap.”

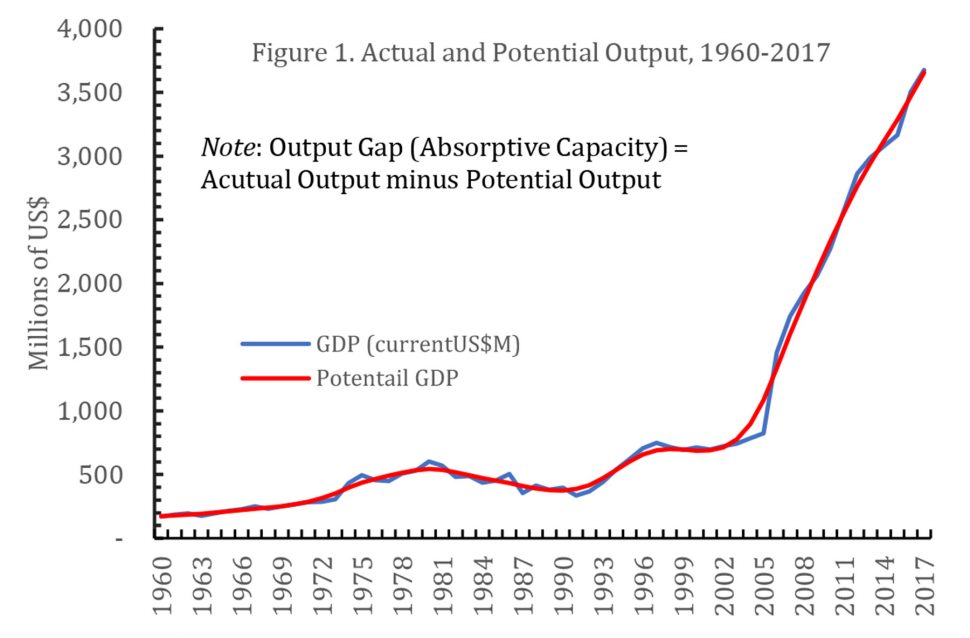

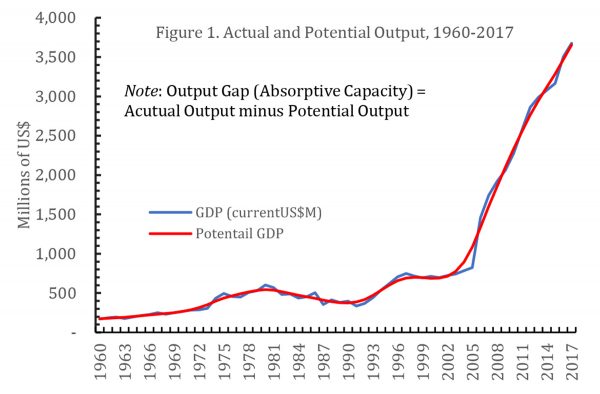

Potential output depends upon the capital stock, the potential labour force (which depends on demographic factors and participation rates), the non-accelerating inflation rate of unemployment (NAIRU), and labor efficiency. The thing about potential output is that it is unobservable and, therefore, has to be estimated. One way to construct potential GDP is by fitting a trend line through actual GDP. Looking at a short sample period, however, may lead to an inaccurate estimate of potential. Here we estimate potential output from 1960 to 2017, a period of 57 years. While potential output is trend output, there are cyclical variations around it so that GDP has two components: trend or permanent and cyclical. In the language of statistics/econometrics, the cyclical component is called noise, which is defined as the difference between actual and trend output. It is this noise component that Dr. Thomas seems to suggest could be used as a proxy for absorptive capacity.

There are several ways to estimate potential output. One of the most frequent used technique is the Hodrick-Prescott filter, which extracts a trend component by introducing a tradeoff between a good fit to the actual series – GDP in this case – and the degree of smoothness of the trend series. My fiddling with econometrics plots actual GDP and potential GDP. The resulting graph shows that the gap between actual and trend output is very small. In twenty-seven of the 57 years the economy operated below potential output. The output gap – excess capacity – averaged 6.8 percent of actual GDP. For the remaining thirty years, the economy operated above potential output that exceeded actual GDP by an average of 4.6 percent. During the entire period, 1960-2017, the Guyanese economy functioned with less than 1 percent slack.

But there is something strange going on here. If the economy is operating at near full capacity, meaning that its absorptive capacity is almost to its limit, then higher inflation becomes a real risk. Since data on inflation are available only for 1995-2017, let’s consider this twenty-three-year period.

During these years, the economy operated with spare capacity of less than half a percentage and inflation was 6.5 percent. In the three years, 2003-2005, when absorptive capacity was highest (16.6 percent of GDP), inflation averaged about 5.9 percent. In the three years (1997, 2006 and 2007) when the economy was operating at around 8 percent above potential output, inflation was 7.5 percent. From 2008 to 2017, the economy was operating at full capacity, meaning its absorptive capacity was non-existent, and inflation averaged a tepid 2.2 percent. When absorptive capacity was largest during this period (31.3 percent in 2005), inflation was 6.9 percent. When absorptive capacity was non-existent and the economy functioning at the highest point above potential output, (3.4 percent in 2012), inflation was a 2.4 percent.

During these years, the economy operated with spare capacity of less than half a percentage and inflation was 6.5 percent. In the three years, 2003-2005, when absorptive capacity was highest (16.6 percent of GDP), inflation averaged about 5.9 percent. In the three years (1997, 2006 and 2007) when the economy was operating at around 8 percent above potential output, inflation was 7.5 percent. From 2008 to 2017, the economy was operating at full capacity, meaning its absorptive capacity was non-existent, and inflation averaged a tepid 2.2 percent. When absorptive capacity was largest during this period (31.3 percent in 2005), inflation was 6.9 percent. When absorptive capacity was non-existent and the economy functioning at the highest point above potential output, (3.4 percent in 2012), inflation was a 2.4 percent.

What does this all mean? It means that higher inflation is no more closely associated with an economy operating below capacity as above capacity! And that when the economy is functioning at about capacity inflation is around a third of what it is when the economy is underperforming or when it is overheated. It seems that the non-accelerating rate of inflation for Guyana’s economy is about 2.2 percent. When that level of inflation is reached, it suggests that the economy is functioning at capacity and therefore does not have the ability to absorb additional resources, including the traditional factors of production. With an absorptive capacity that is almost non-existent, the only way to expand the economy’s capacity is to invest in infrastructure, plant and equipment, technology, and human capital (education, nutrition and, more generally, health), and getting policies right. An important implication follows, which is that an economy functioning with little absorptive capacity and a relatively stable rate of inflation will also have a certain rate of unemployment that is consistent with the two features. In the case of Guyana, that rate seems to be around 15 percent, which it has been for the longest while. We seem locked in a low-level equilibrium trap. Dear oil, please save us!

This analysis leads to three conclusions. First, absorptive capacity in the sense of excess capacity is not a development challenge for Guyana. Rather, the real challenge is to expand the productive capacity of the economy. Second, neoclassical macroeconomics (mainstream economics) is not strictly applicable to a poor, under-developed, disarticulated (absence of strong inter-sectoral or intra-sectoral linkages) economy such as Guyana. The very idea of such an economy operates at full capacity is untenable. A healthy dose of structural and Post-Keynesian economics seems more suitable but our love-hate relationship with the IMF lends no support to this idea. The third issue relates to Dr. Thomas’ proposed cash transfer to each household (the CTHH proposition as I have dubbed it in another newspaper). If the economy does not have the absorptive capacity, meaning that it is functioning at, near or below, its potential since 2008, the injection of the vast amount of cash the CTHH proposition implies will simply pump up excess demand and drive up inflation significantly. Some of the excess demand will leak out via imports, which will worsen the current account of the balance-of-payments. Just to offer an insight: the CTHH will double consumer demand from around the mid-2020s or so while the productive capacity of the economy will only inch forward (hope I am wrong on this!).

If only our politicians get policies right, become more business-friendly, build better institutions that function on the basis of transparency and accountability, and prioritize human development above selfish and tribal motives, then the developmental prospects of Guyana will be rosy instead of gloomy.

Yours faithfully,

Ramesh Gampat