(Trinidad Guardian) Exit packages for the more than 3,000 employees at state-owned Petrotrin are being worked out but the company is in no position to say how much this exercise will cost, what exactly will be offered or how soon payments will be made.

What seems certain, however, is that the company will have to borrow money to meet the payments to staff once packages are decided upon.

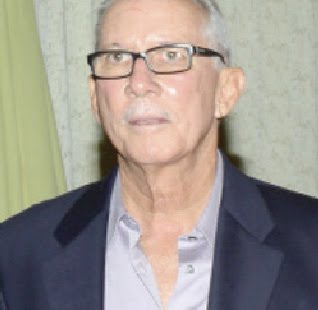

But Petrotrin chairman Wilfred Espinet told the T&T Guardian yesterday that the company is going to try as much as possible to “cushion the hardship” which employees will face.

“We will try to soften the blow as much as we can in a way that is affordable. The company has no interest in seeing people go through hardship, we will try to alleviate as much of that as possible,” Espinet said.

He said teams have been put together to work with the unions to discuss the details of the separation packages, pension and how they can bring the plant down in an orderly fashion.

So where will the money to pay the workers come from?

“Well, we have to borrow it! You have a company with no money and you have to pay off the debt, where you going to get it? Borrow it!”

He said while some people are clamouring to pay the workers “plenty money and keep them on, how does that work, where do you get the money to do that?”

Espinet said the national community must come to the understanding that “when I borrow money is your children money I borrowing and I am trying to convey that to people, stop getting into these la-la land things. Let us stop making this place some kind of Alice in Wonderland for us to believe this is how it works.”

Espinet said counselling will be offered to workers “in terms of the impact on people psychologically and counselling in terms of where they may find other opportunities and so on.” The compensation to be paid to workers, he said, could provide them with “an opportunity to redirect their focus.”

He admitted there are “no guarantees” that the new model of Petrotrin would work,” but said the guarantee is that proper management will produce the right results.

“We have to be careful we don’t fall into the same trap of going back to the same process. You have to get the right people there, you going to have to drill, you going to have to do a number of things. The most important thing at this stage is to make it into a condition where it can pay the existing debt. Having done that we will look at the next stage,” Espinet said.

Espinet lamented that Petrotrin had got to the stage that it had because of those who had the mission to lead the company in the past. “Petrotrin has been mismanaged and whether or not people knew it, I would say yes they knew because they were doing it to their benefit and they all benefitted from it. There were very high people involved. They see it losing money year in year out and they did not understand that it could not go on forever.”

He said harsh decisions had to be taken because “if we don’t preserve what value we have we will destroy it and everybody will go down. We are hoping that what we are doing will preserve the value because it is destroying value at a hell of a rate.”

He said an analysis of the company indicated that if the refinery was kept open they will $2 billion a year.

“Put that in the context of what is the working population of Trinidad and Tobago, which is about 700,000 people, and they are the ones who are going to be paying that a year to keep 1,700 people employed,” he said.

“You want to say we should have 1,700 people take us all down? I have a little bit of difficulty with that. The purpose of the refinery cannot be to employ 1,700 people.”

He again dismissed the allegation from the Oilfields Workers’ Trade Union (OWTU) that a private company is behind the scene waiting to get Petrotrin’s assets.

“That is playing on people’s emotions. Self-preservation is a major driving force in it. He (Roget) thinks people trying to close down his union, but what interest would I have in doing that?”

Asked whether there had been any discussion with the French company Perenco about Petrotrin, Espinet said, “The answer is absolutely not.”

Perenco bought over the assets of Repsol from BP and had brought the cost of production per barrel of oil down considerably, according to Espinet. But he said contrary to what the union was saying there is no conspiracy to bring in any company.

He said the urgency of the decision had to do with the bullet payment of US$850 million due in August next year.

“That bond payment is not guaranteed by the Government explicitly, but it is implicitly guaranteed by the Government. That means that the bondholders expect that the Government is going to pay if Petrotrin can’t pay it, which it can’t in its current state,” Espinet said.