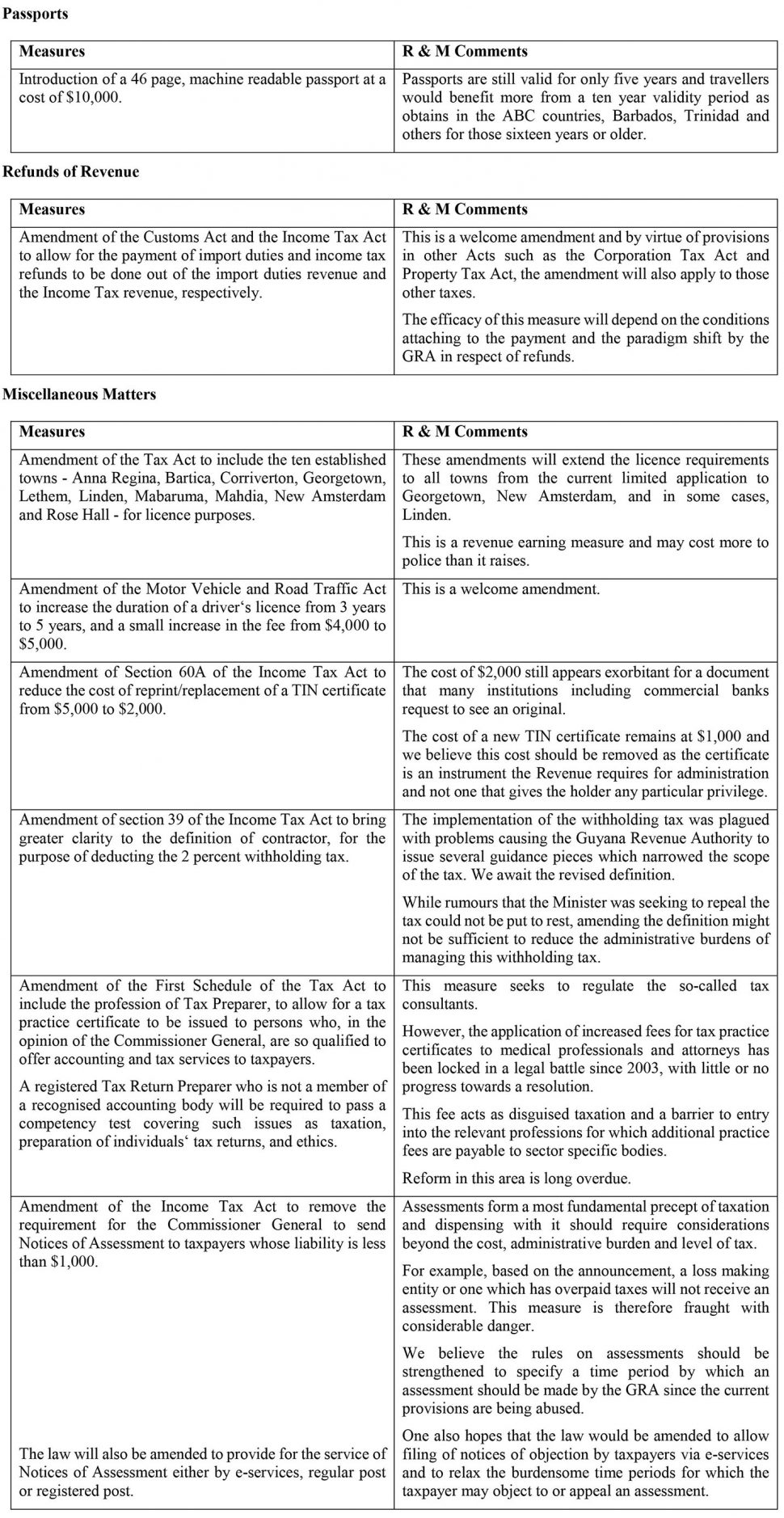

In this section we consider the measures announced by the Minister, analyse them, evaluate their impact and discuss the extent to which they provide useful economic benefits to stakeholders. Section 6 of the 2019 Budget Speech contains some forty-five Budget measures. This follows the staggering number of fifty-seven in 2017 and twenty-five in 2018. The proposed changes are subject to statutory amendments and are likely to take effect from January 1, 2019.

We now look at these measures and offer our comments.

The Minister has had the benefit of at least two tax studies and recommendations for reform. A piecemeal approach of multiple amendments in every Budget Speech while weel-intentioned can result in complications and anomalies and the embarrassment of subsequent reversals.

While many of the measures provide incremental benefits, the removal of exemptions from Capital Gains Tax is likely to spark heated debate.

Again, few measures have their associated price tag and it is therefore not possible to assess their budgetary impact.

Tax laws cannot be divorced from tax administration as demonstrated by a recent letter in the media (Stabroek News 23 November 2018) alleging that the “(Guyana Revenue Authority has) embarked on a campaign of disallowing anything and everything that is submitted, and then demanding astronomical amounts in additional assessments.”