Yesterday was International Anti-Corruption Day. It marks 15 years since the United Nations Convention Against Corruption (UNCAC) was adopted as well as 25 years since Transparency International came into being. UNCAC is the largest international anti-corruption treaty. To date, a total of 186 countries are signatories to the Convention. To commemorate this day, UN Secretary-General António Guterres had the following to say:

Yesterday was International Anti-Corruption Day. It marks 15 years since the United Nations Convention Against Corruption (UNCAC) was adopted as well as 25 years since Transparency International came into being. UNCAC is the largest international anti-corruption treaty. To date, a total of 186 countries are signatories to the Convention. To commemorate this day, UN Secretary-General António Guterres had the following to say:

Corruption robs societies of schools, hospitals and other vital services, drives away foreign investment and strips nations of their natural resources. It undermines the rule of law and abets crimes such as the illicit trafficking of people, drugs and arms.

Tax evasion, money laundering and other illicit flows divert much-needed resources for sustainable development. The World Economic Forum estimates that the cost of corruption is at least $2.6 trillion – or 5 per cent of global gross domestic product. And according to the World Bank, businesses and individuals pay more than $1 trillion in bribes each year.

Corruption begets more corruption and fosters a corrosive culture of impunity. Millions of people around the world have gone to the ballots this year with corruption as one of their top priorities. On International Anti-Corruption Day, let us take a stand for integrity.

Last week, we highlighted the performance of the economy in 2018 and the key budget proposals for 2019, as contained in the Minister’s budget speech. We now have the benefit of sight of the actual budget documents which are in three volumes. Volume I is the main document while the other two volumes provide supplementary information. Volume II contains mainly qualitative information on the various programmes and activities such as objectives, strategies, indicators of achievement, and expected outcomes and impacts. It is an integral part of programme budgeting also known as results-based budgeting. Volume III provides specific information on each capital expenditure project such as the estimated cost, expenditure to date, foreign and local financing, and proposed expenditure for the budget year.

Yet Another Year of Deficit Budgeting

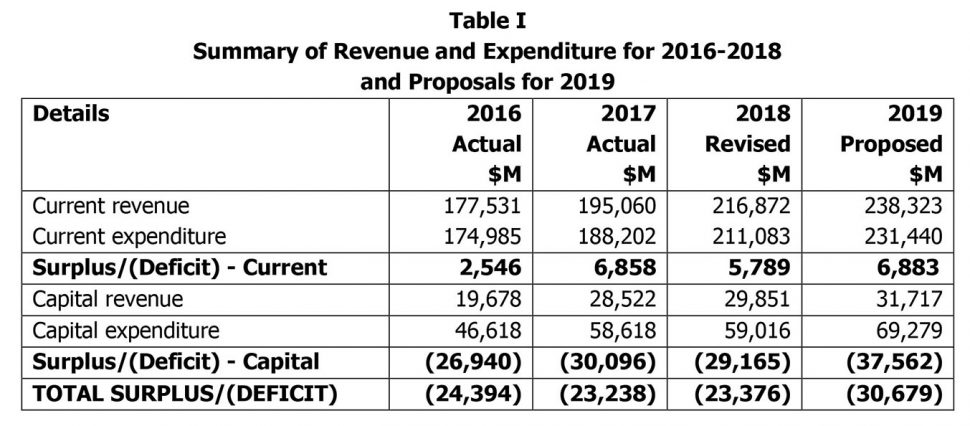

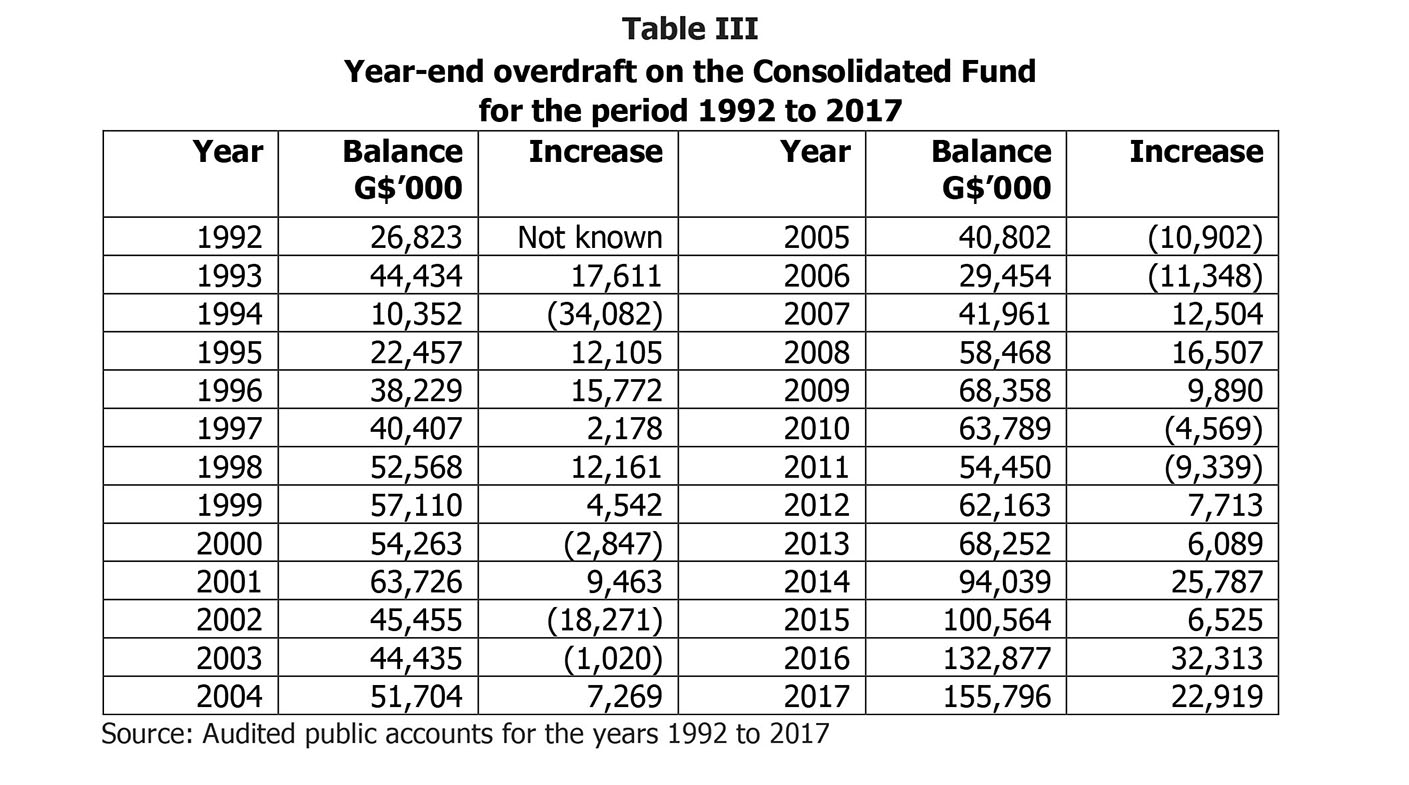

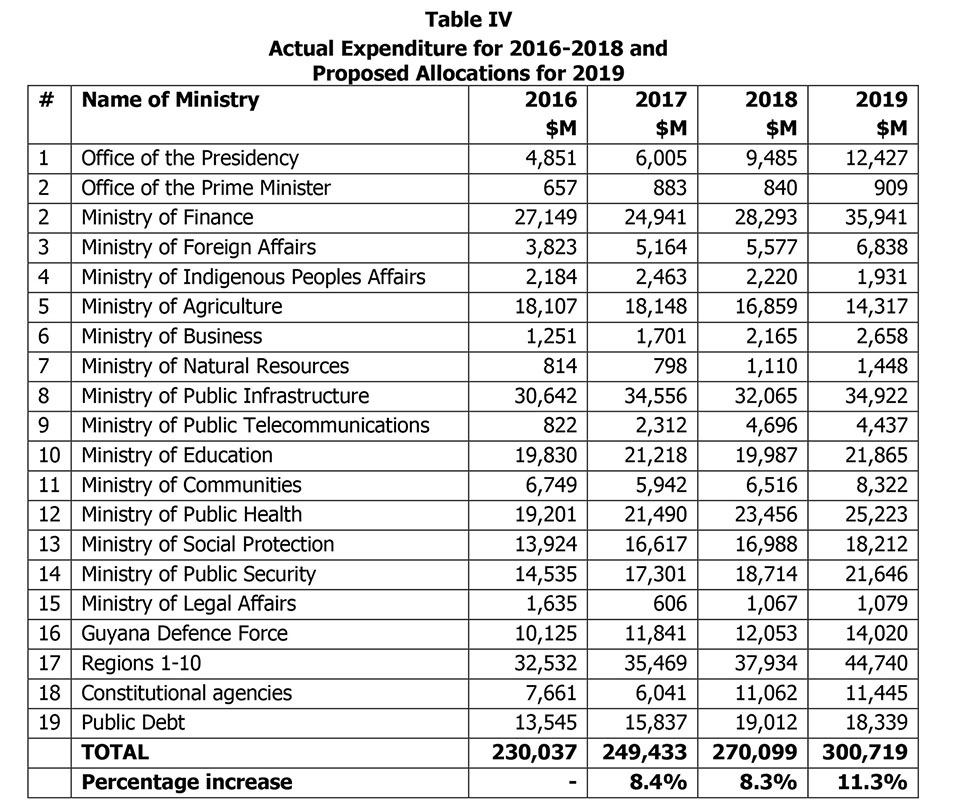

The proposed budget for 2019 for both current and capital expenditure is $300.7 billion, an increase of $30.6 billion, or 11.3 percent over the revised 2018 budget. Anticipated revenue collections (current and capital) amount to $270.0 billion, giving an overall budget deficit of $30.7 billion, as shown at Table I.

As can be noted, the deficits are in relation to capital expenditure for which in several instances the evidence over the years suggests inadequate planning; poor selection of contractors and consultants; ineffective monitoring; and a lack of proper accountability. Projects that readily come to mind include: the Skeldon Estate Factory; the Amaila Falls Hydro Project; the Fibre Optic Cable Project; One-Laptop Per Family; Specialty Hospital; East Bank and East Coast Demerara Road Rehabilitation; and the Cheddi Jagan International Airport Expansion Project, not to mention the D’Urban Park Project. To this list, we must add the construction of the Marriott Hotel which was funded from the proceeds of divestment of State entities/assets and dividends received from public corporations and other entities in which controlling interest vests in the State.

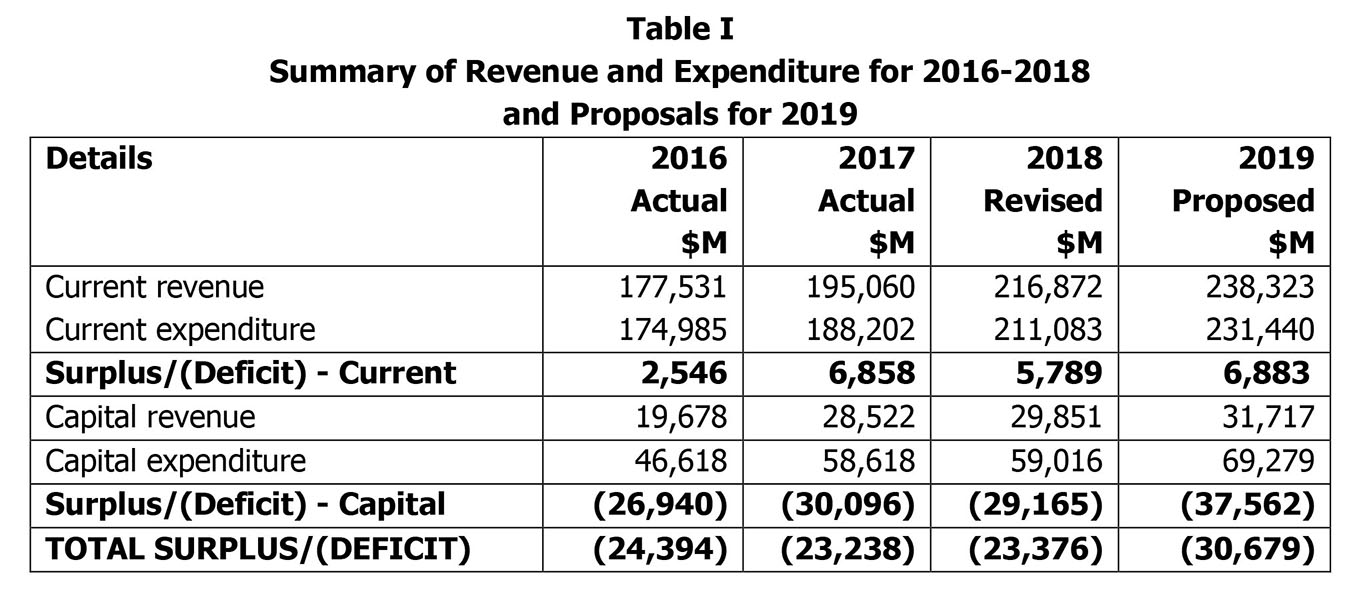

During the period 1992-2013, the total recorded deficit was $103.525 billion, giving an average of $4.706 billion per annum. In contrast, during the period 2014-2018, the total recorded deficit was $103.962 billion, giving an annual average deficit of $20.792 billion – a more than four-fold increase. In other words, the deficit incurred in the last five years exceeded that incurred in the 22 preceding years. This situation will be further exacerbated by the 2019 budget proposals. The position is summarized at Table II.

This state of affairs is obviously highly undesirable and unhealthy. It needs to be reversed by taking appropriate measures to move towards a system of balanced budgeting. In this regard, each budget agency should consider cost-cutting measures, while at the same time the Administration should initiate a comprehensive review of all government programmes and activities to determine their continuing relevance and impact, based on cost/benefit analyses as well as affordability.

Overdraft on the Consolidated Fund

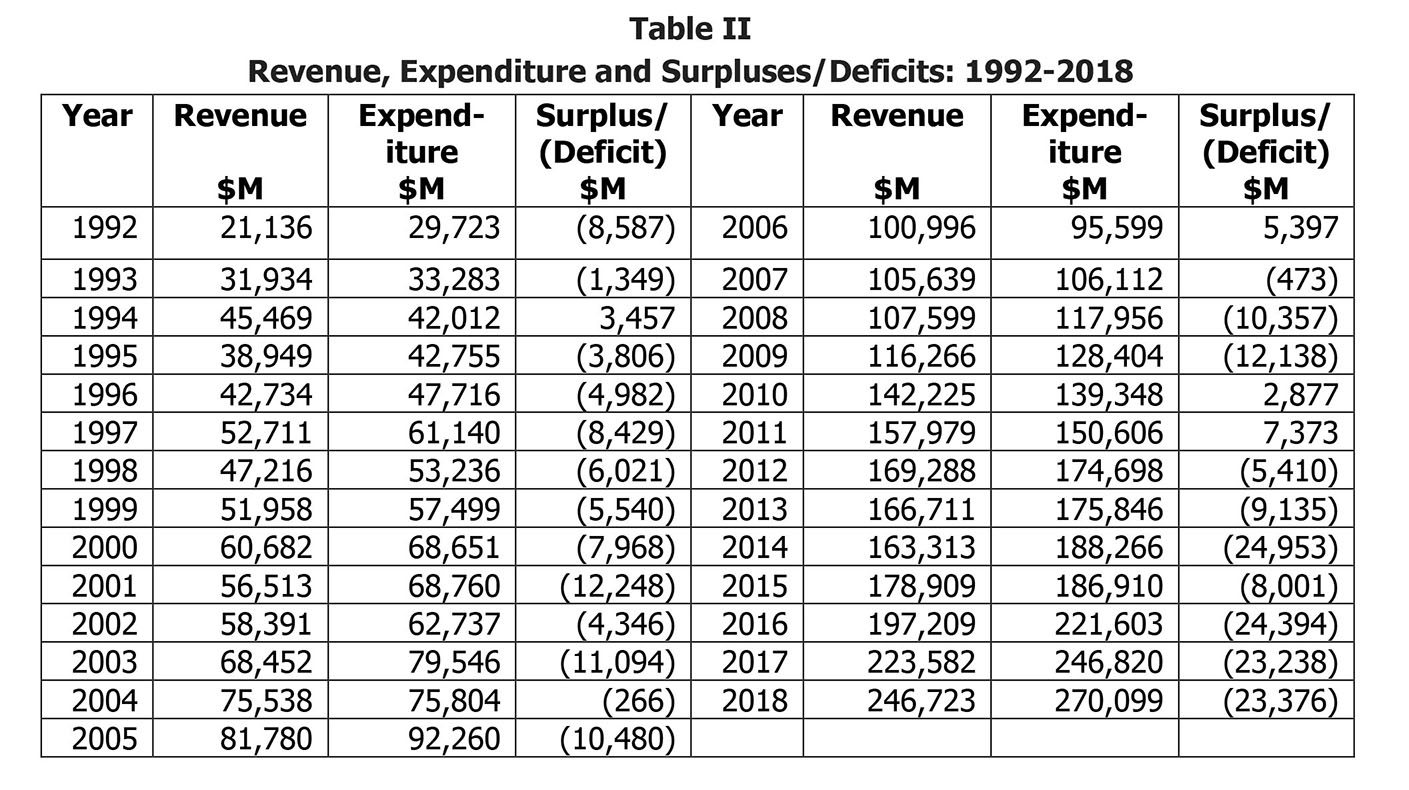

A logical consequence of nearly three decades of deficit budgeting is its impact on the funds held in the Treasury. At the end of 1992, the Consolidated Fund was overdrawn by $26.823 billion. Except for years 1994, 2006, 2010 and 2011 where surpluses were recorded, there has been a progressive increase in the overdraft, as deficits were recorded. At the end of 2018, the Consolidated Fund will be overdrawn by $180 billion. Taking into account the 2019 budget proposals, the overdraft will increase to $210 billion at the end of 2019. The position to the end of 2017 is summarized at Table III.

It has been the practice for information on the Consolidated Fund to be presented within the budget documents to enable legislators to view the budget proposals in the context of the availability of funds in the Treasury to meet the proposed expenditure, taking into account anticipated revenue collections. However, over the years compliance has been uneven. In particular, there has been no reporting in the 2018 and 2019 Estimates of the status of this account. Indeed, legislators appear unconcerned about the sources of financing of the budgetary proposals when the approve of such proposals.

Budgetary Allocations by Ministries/Departments/Regions

The proposed budgetary allocations by Ministries/Departments/Regions for 2019 are summarized at Table IV.

The proposed allocations for current expenditure, excluding the payment of State pensions, amount to $189.3 billion, compared with $171.3 billion, an increase of $18.0 billion or 10.5 percent. Employment costs account for $70.9 billion or 37.5 percent, while the remainder relates to Other Charges, such as materials and supplies, travelling and subsistence, fuel and lubricants, and repairs and maintenance.

Contracted employees account for $9.1 billion or 18.5 percent of the total wages and salaries, down by 2.8 percent compared with 2018. The Government had begun integrating these employees into the regular Public Service, as recommended by Harold Lutchman Commission of Inquiry. It is evident that significantly much more work is needed to have a fully integrated Public Service with uniform pay and grades.

Other Employment Costs have increased from $6.2 billion to $11.6 billion, or 87.1 percent. While this subhead of expenditure is used to meet increases in wages and salaries, an explanation for this steep increase appears necessary.

– To be continued –