Last week, we began a discussion of the Estimates of Revenue and Expenditure for 2019 which have since been approved by the National Assembly. The related Bill, which authorizes the withdrawal of $277.4 billion from the Consolidated Fund to meet the cost of the Government’s programmes and activities, is expected to be assented to by the President before year-end. An additional sum of $23.2 billion has been provided to meet statutory expenditure such as the servicing of the public debt and the cost of operations of constitutional agencies, giving a total of $300.6 billion to be expended in 2019. However, anticipated revenue collections amount to $270.0 billion, giving a budget deficit of $30.6 billion.

Last week, we began a discussion of the Estimates of Revenue and Expenditure for 2019 which have since been approved by the National Assembly. The related Bill, which authorizes the withdrawal of $277.4 billion from the Consolidated Fund to meet the cost of the Government’s programmes and activities, is expected to be assented to by the President before year-end. An additional sum of $23.2 billion has been provided to meet statutory expenditure such as the servicing of the public debt and the cost of operations of constitutional agencies, giving a total of $300.6 billion to be expended in 2019. However, anticipated revenue collections amount to $270.0 billion, giving a budget deficit of $30.6 billion.

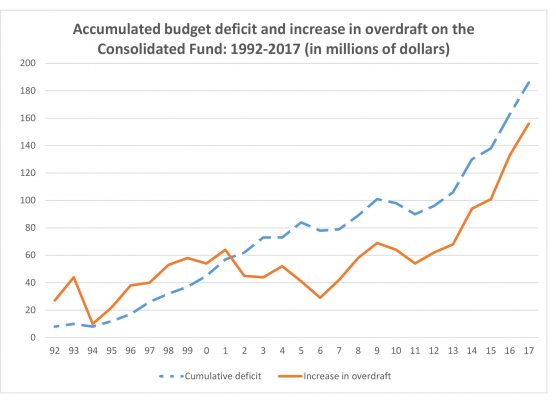

We had expressed our deep concern about continuing practice of having deficit budgeting. This has increased four-fold in the last five years, compared with the average annual deficit during the period 1992 to 2013. These deficits have the effect of progressively increasing the overdraft on the Consolidated Fund. Having examined the reports of the Auditor General for the years 1992 to 2017, we had estimated that the overdraft would reach $210 billion by the end of 2019. The Minister of Finance has, however, disputed this figure, claiming that the Governor of the Bank of Guyana has confirmed that as of 7 December 2018, the overdraft on the Consolidated Fund was $62.157 billion.

Readers are directed to page 479 of the 2017 Auditor General’s report which shows the Statement of Current Assets and Liabilities of the Government as at 31 December 2017, prepared by the Accountant General and duly certified by the Minister of Finance. In that statement, the new Consolidated Fund Account No. 407 and the old account No. 400 showed overdrafts of $109.1 billion and $46.8 billion respectively, giving a total overdraft of $155.9 billion as at the end of 2017. Readers are also referred to pages 28-29 of the Auditor General’s report where these two figures are repeated, and there is a graph showing the movement of the overdraft on these two accounts from 2004 to 2017.

The old Consolidated Fund Account No. 400 was overdrawn by some $46.8 billion as at the end of 2003 and had not been reconciled since 1987. Based on a recommendation I had made when I was Auditor General, the Government opened a new Consolidated Fund Account No. 407 to start from a clean position, going forward. However, very shortly thereafter this new account went into overdraft due to expenditure exceeding revenue. Meanwhile, the overdraft on the old account remains intact up to the time of writing, with no attempt being made to liquidate it and close the account. The main argument put forward against the closure of this account was that it had to be reconciled first.

Given the passage of time, it would be extremely difficult, if not impossible, to obtain the necessary documentation to proceed with the reconciliation. In any event, no useful purpose will be served trying to do so, since the balance is unlikely to be affected. We reiterate our recommendation that the overdraft on Account No. 400 be transferred to the new Consolidated Fund bank account and the account closed off. This is not only good financial management practice but also a prudent one.

Shown below is a graph we have generated indicating the strong positive correlation between the accumulated budget deficit over the years and the mounting overdraft in the Consolidated Fund:

It is evident that we need to take appropriate measures to reverse this worrying trend, which in the private sector would have led to bankruptcy a long time ago. We had suggested that budget agencies should engage in cost-cutting exercises aimed at reducing their budgetary allocations without compromising the quality of service rendered. At the same time, a comprehensive review of all government programmes and activities should be undertaken to determine their continuing relevance in terms of their outputs, outcomes and impacts. In the absence of any dedicated effort to ensure a diversified economy, our only hope is the receipt of oil revenues. This is unlikely to materialize in a substantial way in the next five years or so, considering the need for ExxonMobil to recover the cost of its investment at its earliest opportunity, the volatility of oil prices on the world market, and the Government’s liability of US$900 million in pre-contract costs, among other factors.

It is evident that we need to take appropriate measures to reverse this worrying trend, which in the private sector would have led to bankruptcy a long time ago. We had suggested that budget agencies should engage in cost-cutting exercises aimed at reducing their budgetary allocations without compromising the quality of service rendered. At the same time, a comprehensive review of all government programmes and activities should be undertaken to determine their continuing relevance in terms of their outputs, outcomes and impacts. In the absence of any dedicated effort to ensure a diversified economy, our only hope is the receipt of oil revenues. This is unlikely to materialize in a substantial way in the next five years or so, considering the need for ExxonMobil to recover the cost of its investment at its earliest opportunity, the volatility of oil prices on the world market, and the Government’s liability of US$900 million in pre-contract costs, among other factors.

Section 60 of the Fiscal Management and Accountability (FMA) Act permits the Minister to approve of advances in the form of an overdraft on an official bank account to meet cash shortfalls during the execution of the annual budget. However, all such advances must be repaid on or before the end of the fiscal year during which the overdraft was taken. The Act defines “official bank account” as a bank account opened on behalf of the Government for the purpose of receiving and having custody of public moneys, and for making authorized payments on behalf of the Government. Section 51 also refers to public moneys at the credit of the Consolidated Fund to be kept in an account styled as the “Official Consolidated Fund Account” at the Bank of Guyana. The overdraft on the Consolidated Fund in effect constitutes borrowing from the Bank of Guyana, an autonomous institution governed by its own legislation and with oversight by a board of directors. The question therefore is: Does the incurrence of the overdraft on the Consolidated Fund without repayment before year-end constitute a breach of the FMA Act?

Contracted Employees cont’d

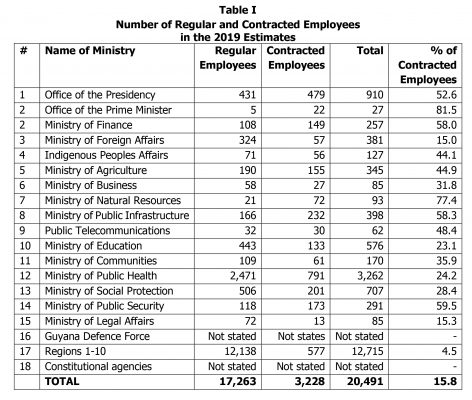

As indicated in last week’s column, the 2019 Estimates show that contracted employees account for $9.1 billion or 18.5 percent of the total wages and salaries, down by 2.8 percent compared with 2018. We suggested that the Administration needs to work assiduously towards having a fully integrated Public Service with uniform pay and grades, as recommended by the Harold Lutchman Commission of Inquiry. Table I shows the number of persons employed on a contractual basis, compared with those on the regular establishment. It does not include the constitutional agencies, the army, teachers, nurses, policemen, firemen and prison officers.

Topping the list is the Office of the Prime Minister (81.5%), followed by the Ministry of Natural Resources (77.4%), Ministry of Public Security (59.5%), Ministry of Finance (58%) and the Office of the Presidency (52.6%).

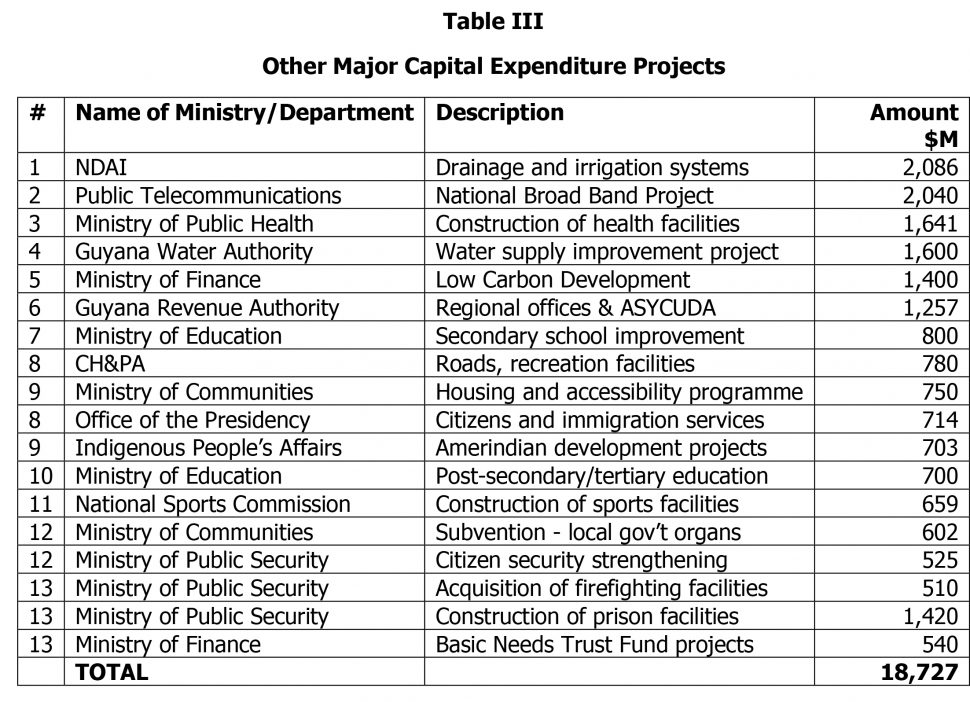

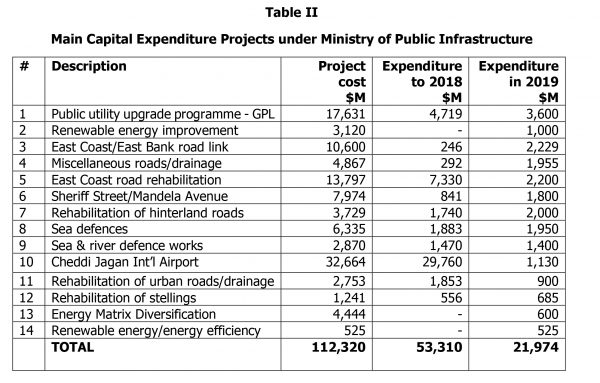

The total budgeted capital expenditure for 2019 is $69.279 billion, compared with $59.073 billion in 2018, an increase of $10.206 billion or 17.3 percent. The Ministry of Public Infrastructure accounts for $31.7 percent of the total capital expenditure. The main projects to be undertake by this ministry are shown at Table II:

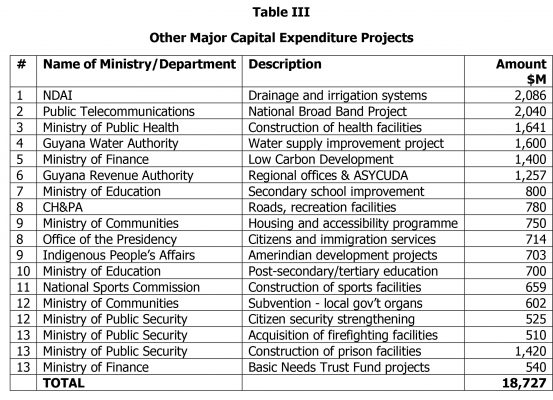

While the Cheddi Jagan International Airport is slated for completion next year at a cost of approximately US$160 million, it does not appear that this will be so for the East Coast Demerara Road Rehabilitation Project. Citizens will therefore continue to endure the existing chaos and undue travel delays as a result of the construction works being undertaken. Of particular note, is the absence of any provision for the construction of the new Demerara Harbour Bridge for which a feasibility study has already been conducted. Other major capital expenditure projects are shown at Table III: