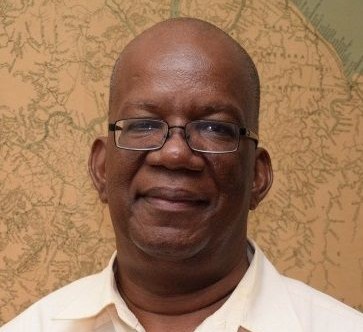

Minister of Finance Winston Jordan yesterday fired back at United States Ambassador Perry Holloway for the latter’s recent opinion piece on prioritizing a Sovereign Wealth Fund (SWF) saying it gives the impression that government was not moving in this regard when it’s the total opposite.

“The suggestions contained in the Op-Ed may give the impression that the GCRG (Government of the Co-operative Republic of Guyana) and, by extension, the Ministry of Finance, under whose remit the drafting of the legislation for the SWF falls, has not made significant progress on this important piece of legislation. That impression is misinformed,” a release from the Ministry stated.

Jordan also cautioned not only Holloway but all partners this country works with on expressing views on what should be this country’s priorities.

“We would like to recommend that our partners exercise restraint when pronouncing on Guyana’s national priorities, and to refrain from making premature statements on its petroleum resource management, given the existing challenges of managing expectations and avoiding the Dutch disease,” he said.

“The Ministry of Finance welcomes direct engagement with our partners as we navigate these pivotal moments in the history of our country’s development,” he added.

In an Op-Ed, published in this newspaper last Tuesday and titled ‘Prioritising a Sovereign Wealth Fund, Preparing for Prosperity Now’, the US envoy said that while he lauds the steps this country is taking to develop a sovereign wealth fund, his writings were a reminder to Guyana’s citizenry that their input remains instrumental to ensuring the appropriate mechanisms are in place to protect prosperity and to pave a pathway to long term growth. As such, he urged the populace to remain committed throughout the process and implementation of mechanisms, for he believes that the results of a model oil producing country are realistic and they could make it happen.

“In writing this, I do not intend to imply that work is not being done to develop a sovereign wealth fund. In fact, I strongly commend the Government of Guyana for working on a draft bill and preparing to have a fund in place by 2020. Instead, I want my comments to encourage the people of Guyana to believe in transformative change as something that is possible,” Holloway penned.

“I want to inspire them to remain committed to the conversations ahead because they will be necessary and important. The input of the Guyanese people into the process will be instrumental to ensure the appropriate funds and mechanisms are in place to protect prosperity and pave a pathway to long-term growth. Ultimately, that is what will mark success, not a specific type of fund, although excellent examples exist, but a fund that builds on a future aligned with prosperity and hope,” he added.

The US diplomat emphasized that as Guyana considers its future, it will not be enough simply to have a “rainy day fund” or even an investment fund, but to institute a revenue and investment framework that protects and effectively leverages wealth to transform the nation.

“As the development of a long-term vision for a green, sustainable economy continues, I hope conversations will continue to prioritize implementation of a strong comprehensive sovereign wealth fund bill, in the broadest sense, that is transparent, independent, inviolable, and non-partisan,” he posited.

“Let us be clear. When I speak of a sovereign wealth fund, I am talking about a fund that will immediately begin to invest in education, health, infrastructure, agriculture, and security. I am referring to a concerted effort by all stakeholders to start a continuous conversation on how best to implement fiscal plans that directly address the needs of all Guyanese now. The urgency cannot be understated. Difficult decisions are ahead, whether that involves identifying the right talent to manage the fund (wherever it is found), or even making the difficult decision to borrow at concessional rates that will not be available tomorrow to develop the present. However, the investment today will pay off tomorrow. The development of a comprehensive sovereign wealth fund is the opportunity Guyana has been expecting to leverage the prosperity of the future into the development of the present. It is the right call and sends the right message to the Guyanese people and international donors and investors alike, that, above all else, Guyana is ready to come to the table with a plan that puts long-term, sustainable fiscal planning at the service of today’s progress, while protecting tomorrow’s future,” he added.

Holloway said that he believes in Guyana and from evidence of its already exhibited hard work and vision, that it has the potential to become not only a petroleum producer, but also a future example of what is possible with technological innovation, hardworking people, political vision, and an appropriate legislative and regulatory framework.

“Now, Guyana can show the world that it is possible to get a legal framework right, even when many other countries have not. Too much is at stake, and decisions, albeit measured and well-considered, must lead to decisive action in the implementation of a fund. I know I am optimistic about Guyana’s potential success and so is the world,” he said.

‘Impression’

Stabroek News reached out to Minister of Natural Resources Raphael Trotman for an update on government’s preparations for the fund but he directed the newspaper to Jordan as the draft legislation was with him.

Jordan’s release said that the piece by Holloway gave the impression that his ministry, which is responsible for the drafting of the legislation for the fund, and by extension government was not making significant progress.

“The suggestions contained in the Op-Ed may give the impression that the GCRG and, by extension, the Ministry of Finance, under whose remit the drafting of the legislation for the SWF falls, has not made significant progress on this important piece of legislation. That impression is misinformed,” his statement read.

He posited that while his ministry appreciates the spirit of the Op-Ed, he wanted to make clear that the establishment of a SWF is already designated a priority for the government, emphasizing that it is government and citizenry that will decide on the tenets of the SWF.

Jordan relayed that the foundation for the establishment of a SWF begin one year after the APNU+AFC government took office and was announced at a seminar on preparing for first oil, where he had announced that it would be priority.

He said that he also had highlighted the objectives of such a Fund and listed them. There are, according to the Finance Minister, to advance critical development and investment needs within the country (via the national budget); to address issues of stabilisation of the economy, and to ensure savings were made to guarantee inter-generational benefits from the extraction of this finite natural resource.

Those objectives, he said, reflects a comprehensive framework that will guide the prudent management of future oil revenues for the benefit of current and future generations, in keeping with the government’s agenda.

“Therefore, government’s investment expenditure will be driven by the Green State Development Strategy (GSDS) – our national development plan – and, by the development priorities articulated and implemented through the National Budget, which has an established consultation cycle of its own,” he said.

Noted also was that in developing the draft SWF legislation, the Ministry of Finance is currently receiving support from the Commonwealth Secretariat.

Jordan said not only will the intended legislation be laid in the Parliament by the end of this year, but that a green paper on the subject will also be published and that consultations will occur subsequently.

Comparing Guyana to Norway, Jordan said that country which is promoted as a model in petroleum resource management, did not create a Sovereign Wealth Fund until several years after its first oil.

“It is important to note that as a new oil producing nation, Guyana is ahead of many countries, having already taken the initiative to establish a Fund of this kind,” he said.

However, the fact that Guyana is doing better than most, he said, does not mean that the establishment of such a Fund is not immediately necessary, but rather, it demonstrates the government’s commitment to good governance, transparency and accountability, by ensuring that a legislative framework is in place to safeguard our national patrimony, prior to the commencement of oil production.