Introduction: Pillars

Introduction: Pillars

Today’s discussion concludes my evaluation of the tenth and final topic on the list of “top-10 development challenges”, which Guyana will face, as it starts to receive its petroleum revenues next year. As promised last week, I shall start with an introduction of the “four pillars” on which the Fiscal Transparency Code rests.

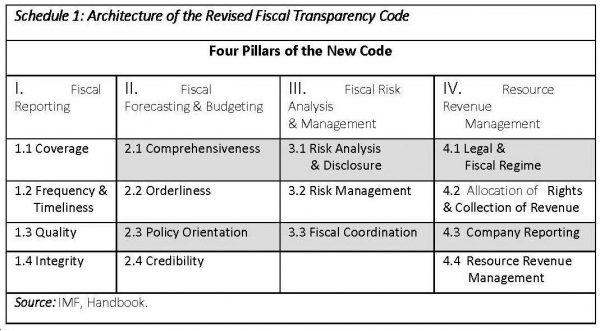

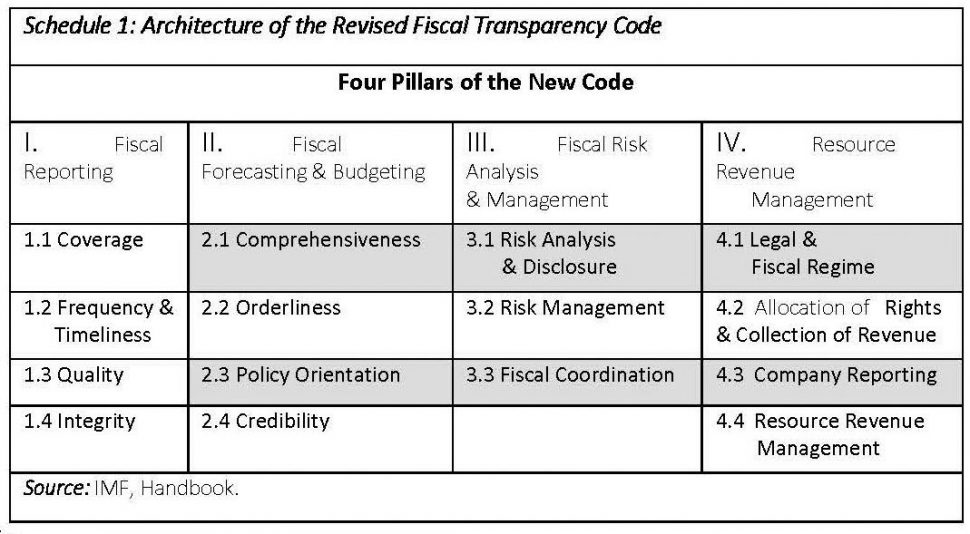

Pillar 1 refers to fiscal reporting. It requires “the availability of relevant, comprehensive, timely and reliable information on the government’s fiscal operations and performance”. There are 12 principles under Pillar I. These are grouped into four dimensions of fiscal reporting namely, coverage, frequency and timeliness, quality, and integrity. Pillar II refers to fiscal forecasting and budgeting. It requires a clear statement on government’s budgetary objectives, policy intentions, and projections for the evolution of its public finances. Similarly, there are 12 principles under this pillar, grouped into four dimensions of fiscal forecasts and budgets namely: comprehensiveness, orderliness, policy orientation and credibility.

Pillar III refers to fiscal risk analysis and management. It requires the coordinated management of disclosure, analysis and management of risks for public finances. This pillar is also based on 12 principles, but it is grouped into three dimensions of fiscal risk, namely, management, analysis, and disclosure of risk. Pillar IV refers to natural resource revenue management. It requires the provision of a transparent framework for the ownership, contracting, and taxation of natural resources. It too has 12 principles and is grouped under four dimensions namely, legal and fiscal regime; allocation of resource rights and revenues; company reporting, and resource revenue management. Schedule 1, summarizes this information for convenience.