With the State Assets Recovery Agency (SARA) embarking on a probe of how two small companies without the capacity to drill for oil were able to lock down prime offshore acreage near to ExxonMobil’s key oil find days before the 2015 general elections, the spotlight will likely be on the key decision maker, then Minister of Natural Resources Robert Persaud.

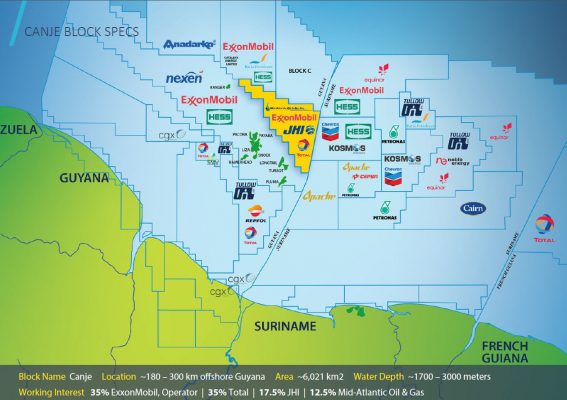

More than a year ago, on March 25th, 2018, the Sunday Stabroek reported on the concerns about JHI and Mid-Atlantic Oil and Gas Inc (MOGI) gaining access to the Canje block and later farming in big players like Total in what would be lucrative deals. Another company, Ratio also secured a deal.

While the APNU+AFC government had taken a hands off approach on these deals, the State Assets Recovery Agency (SARA) has begun to turn the heat up by announcing an investigation of the awards to the two companies based on whistleblower information.

Such has been the publicity and interest surrounding the probe that JHI and MOGI have taken out whole page advertisements in the daily newspapers to defend the deals. However, there has been silence from Persaud despite numerous attempts by the Sunday Stabroek to contact him. Former President Donald Ramotar, who signed off on the controversial awards, told the Sunday Stabroek last week that he believes that Persaud should make a public statement.

Persaud yesterday told this newspaper that he will make contact when he returns to Guyana. “Will make contact upon my return,” he said, although he did not specify when he will be returning to Guyana.

By their own admission in the advertisement in the June 7th edition of Stabroek News, JHI and MOGI say that negotiations for the Canje block began in March 2013. This was the exact period in which ExxonMobil was beginning preparations to finally begin a drilling programme in the Stabroek Block, where in May 2015 it made a major find.

With a general election just days away, Ramotar signed off on deals that he said were presented by Persaud. The big question has always been why in a transition period between administrations would such a major deal be concluded – and in secrecy – and why it couldn’t wait until after the general elections.

Observers say that in a farming-in arrangement for the Canje block, JHI and MOGI stand to make extraordinary gains from just having the licence and without the ability to drill for oil. JHI and MOGI have as their principals John Cullen and Edris Dookie, respectively, both of whom had a long association with Canadian oil company CGX, which had been pursuing the drilling of oil wells here since 2000. Observers say that both Cullen and Dookie might have over time become aware that Exxon’s ability to accurately pinpoint wells could lead to major discoveries.

For JHI, MOGI and Ratio, there would clearly be interest in locking down areas like Canje and all that had to be paid for a licence was US$2,000 or $400,000. For this pittance, a farmed-in major like Total could purchase a large block for a significant payout either upfront or once oil was found. No information has been made public on the financial relationship between the small companies and their partners although it is expected that the Guyana-Extractive Industries Transparency Initiative (GY-EITI) should present such information to the public.

Observers say what Ramotar and Persaud would have to explain is what policy led to a PPP/C government decision to licence these small companies, the financial considerations involved and whether it should have been clear to all that such licensing should be to major companies.

Financial backing

While JHI and MOGI may not have had the financial wherewithal to conduct offshore

exploration themselves, they demonstrated that they had financial backing during their negotiations for the licences, Ramotar told the Sunday Stabroek last week.

Ramotar said that while the contracts for the two blocks would have been formally agreed to days before the 2015 General Elections, the investors – Dookie, a Guyanese, and Cullen, a Canadian – pursued investing in Guyana years before and at a time when there were no oil interests and this country was “begging” investors to come.

Another agreement between the Government of Guyana and Ratio Energy Limited and Ratio Guyana Limited (now Cataleya Energy Limited), the former incorporated in Gibraltar and latter in Guyana, was signed on April 28th, 2015, only two weeks shy of the elections.

Ramotar maintains that the companies did nothing illegal in their later farming out of their blocks as it is normal in the industry and stressed that as far as he knows, there were no insider information given to the companies because they signed at a time when there was no oil found.

“Looking back, everyone has 20/20 vision and you have a controversy now over the award because oil was found. When Dookie came, there was no oil or evidence that there was oil and people should know that he was here years before,” Ramotar said.

“Dookie was with CGX. He was one of the founders. He was one of the most persistent. When everybody was collapsing and you had people skeptical and pulling out, and we were begging people to invest, Dookie was there and was trying to get the oil thing going. He didn’t drop from the sky. When he was kicked out from CGX he pursued it on his own because he always believed we had oil here. He is not an unknown entity and that is what I am saying,” he added.

However, questions have been raised about government not knowing about potential oil given that Persaud had two days after JHI registered as a company, announced in an interview that hydrocarbons were found by ExxonMobil. His ministry had put out a statement on May 6th informing that ExxonMobil’s subsidiary, Esso Exploration & Production Guyana Limited (EEPGL) had found hydrocarbons but that it was too early to know if it was in commercial amounts.

And in the case of Ratio, its contract was signed one month after EEPGL had begun drilling in the offshore Stabroek Block. Exxon’s Deepwater Champion vessel was reported on the way to begin drilling on March 2nd of 2015 but the company had made a decision to mobilise for works here since September of 2013. ExxonMobil now has a 50% stake agreement with Ratio Guyana and the parent company Ratio Energy Limited. There is no information on the terms of the 50% stake.

Appeal

Last year March, Ramotar had told this newspaper that while he understands that “the buck stops with me,” Persaud had made a case for JHI and Mid-Atlantic Oil and Gas Inc.

“I don’t know if Robert felt sorry for Dookie but he appealed to me. No, don’t get me wrong—I don’t want anyone saying I’m trying to pass the buck –but he [Persaud] said that he [Dookie] would get reputable partners. He also appealed to me that for one, you know, the amount of work he did in the past here, when no one was even having a conversation on oil and so forth. He appealed and explained that the man did a service to the country and he was sticking with it and even when he fall out CGX, he stuck and gave us whatever help because this was new to us… and was that kind of appeal. So, I eventually gave in you know,” he said.

The PPP/C’s reasoning for the award to two start-up companies that had no experience in oil and gas exploration or finances for such undertakings, brings into question if this country should have waited and sought out big oil companies instead.

It is against that background that Jan Mangal, former Oil and Gas Advisor to the David Granger-led APNU+AFC administration, claims that this country would have lost out on millions of United States dollars through the deals as the bulk of earnings will go to the companies and not taxpayers.

While both JHI and MOGI just over a week ago issued a joint statement in which they maintained that their dealings were above board, this newspaper reached out to both Dookie, Cullen and Vice President of JHI Scott Young. This newspaper was told that Dookie is currently out of the country and returns on Monday while emails to the JHI principals referred Sunday Stabroek to their press statement.

Ratio’s principals have not spoken. Ryan Perreira is the Guyana representative for Ratio which has interest in the Kaieteur Block. However, the company’s Ethan Eisenberg had last year said that the company had interests since 2013, although he did not specify when in 2013. Again, that would have been when ExxonMobil had begun to mobilise for its May, 2015 drilling. Eisenberg said that discussions were halted when a vessel working for Anadarko was seized by the Venezuelan navy, in the same year.

He had also stated that his company was well known in Gibraltar and had founded the renowned Leviathan gas field in the Mediterranean Sea.

The companies that have blocks in the deep water area, offshore Guyana, are: Repsol and Tullow Oil (the Kanuku Block); Tullow (the Orinduik Block); Anadarko (the Roraima Block); Ratio Oil (the Kaieteur Block); ExxonMobil, CNOOC Nexen and Hess (the Stabroek Block); ExxonMobil, Mid Atlantic and JHI (the Canje Block); CGX (the Demerara and Corentyne blocks); ON Energy; and Nabi. All were granted contracts during the PPP/C’s time in office.

All companies had to pay the Guyana Geology and Mines Commission (GGMC) US$2,000 for their application fees to be processed.

Only Friday it was reported by this newspaper that Canadian company Frontera paid a US$33.3 million signing bonus to CGX Energy Inc when the two agreed to a joint venture agreement where the former company would get a 33% stake in the two offshore blocks. Just for comparison sake, Guyana’s signing bonus post the major discovery of the Liza well was US$18 million.

It was the Sunday Stabroek which had reported on March 25, 2018 that in the run up to the May 11th, 2015 general elections, in which the PPP/C was voted out after over two decades in power, Ramotar had signed a contract with JHI for the Canje Block. MOGI and ExxonMobil, which is Block Operator, also have participating interests in the Canje Block. In February of last year, French oil major Total announced that it had bought a 35% working interest in the Canje Block, in an agreement it signed with both JHI and MOGI. The two companies, it said, will retain a shared 30% interest alongside operator ExxonMobil.

Clearing his desk

Ramotar said last week that his position on why the companies were given the blocks has not changed as he did not believe that he would lose the 2015 General Elections, although he was forced to call elections early because of the threat of a No-Confidence Motion. He said too that in the lead up to the elections, he was clearing his desk of files that had been pending for more than a year.

“I never thought we would lose the election. I still think the election was screwed up against me in the first instance. Listen, the ministry [of Natural Resources] people came to me with things pending, things we were dealing with. At the time, I didn’t consider I was doing anything wrong morally or otherwise, even now. I clear up my desk of things and those things were pending for more than a year,” he said.

“It was my intention to have as much people as possible drilling. We also had the issue with Venezuela, so getting people in that area was a good thing for this country. I go back to stress that Shell gave up their whole block for US$1 and they left this country. Everybody has an opinion now because oil was found but they do not know what it was then. What if oil was not found? Everyone talks about Dookie but he believed in the oil and he lived it. He was always convinced that there was oil and he said they [his company] had alliance. This very ExxonMobil had to be threatened to come in. Do they know we had to threaten ExxonMobil that we would take back the [area] before they came in? I don’t know what else is there for me to say on this issue,” he added.

Asked if he was so confident in returning to office why the contracts could not wait for a few more weeks given that they were already on hold for over a year and it would have been the prudent thing for a government to do, Ramotar said that it is “not as easy as that sounds.”

“We knew Exxon was drilling, yes, but there was no guarantee of oil, that is what I am saying. We were trying to get investors to develop our hydrocarbon potential,” he said, while explaining that for decades it was said that Guyana had potential but no oil in commercial quantities were found.

He said that persons pitching investment ideas are not dissimilar to that in any other industry and GGMC’s technical and other due diligence processes would have reported back to him that the small company investors’ proposal’s “panned out.”

On the issue of his government or the Ministry of Natural Resources having insider information about possible start up works and information that could be leaked to persons who would then seek to use it to attract investors, Ramotar said that he is not aware and that he could only speak from his perspective.

He said again that he believes that Persaud should address the issue and pointed this newspaper to contact him.

Since last year this newspaper has reached out to Persaud but to no avail. He has not returned calls, emails or messages.

Addressing the PPP/C’s use of a full-page advertisement in the May 8th 2015 issue of this newspaper to announce that oil was found, Ramotar chalked it up to “electioneering and campaigning gimmicks.” “That was just campaigning because even though the headlined said oil strike the body of that ad said it was hydrocarbons which was just an indicator of oil,” he said.

“It is like a newspaper headline, newspapers do that all the time. The details are in the story and the details were there. We never said oil in commercial quantities; what we said was ‘a strong indicator of the evidence of oi,l, there is a difference,” he added.

Meanwhile, Exxonmobil has been following reports on the issue and said that they have followed all lawful procedure. “We’ve seen the media reports on the issue. We have not been contacted by the government. ExxonMobil followed all applicable laws and regulations in acquiring our government-approved licences,” Public and Government Affairs Officer Deedra Moe told the Sunday Stabroek, when contacted.

As it pertains to the SARA investigation, she said, “I can’t speak for others, but JHI/Mid-Atlantic Oil & Gas put out statement last weekend that addresses some of your questions.”