UK petroleum company, Tullow, yesterday announced the discovery of oil in commercial quantities in the Orinduik Block, underlining the vast resources in the Guyana Basin and increased projected wealth for the country.

Tullow Oil Plc is the operator of the block via its wholly-owned subsidiary Tullow Guyana B.V. and has as its partners French oil major Total, Canadian company Eco Atlantic (Guyana) Inc and Qatar Petroleum in an arrangement that is still to be clarified with local authorities.

Tullow holds 60%. Eco Atlantic originally held 40% but now has 15% after a deal in which Total exercised an option for 25%. Last month it was announced that Qatar Petroleum had supposedly struck a deal for 40% of Total’s 25% stake or 10%.

The discovery in the Jethro-1 exploration well was announced locally yesterday just after 2 am by Director, Depart-ment of Energy, Dr. Mark Bynoe in a release from the Ministry of the Presi-dency (MoTP). The time was scheduled to enable Tullow to have a conference call with investors in London.

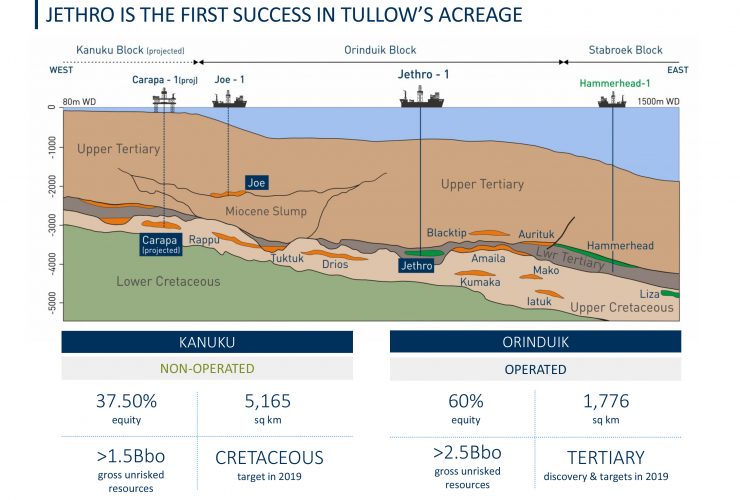

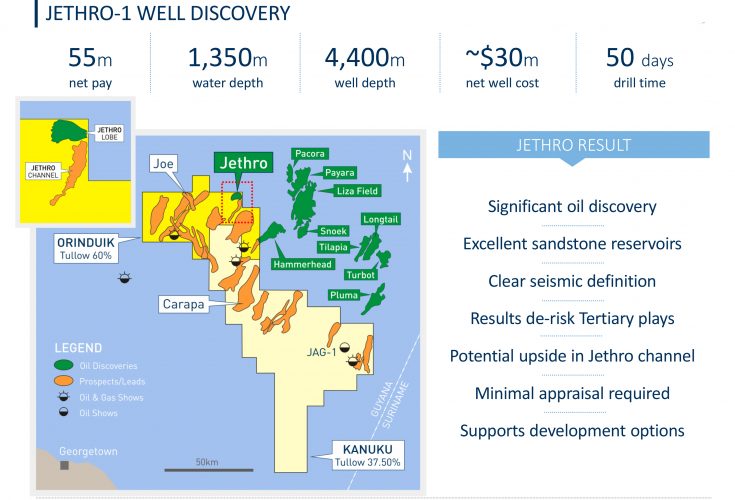

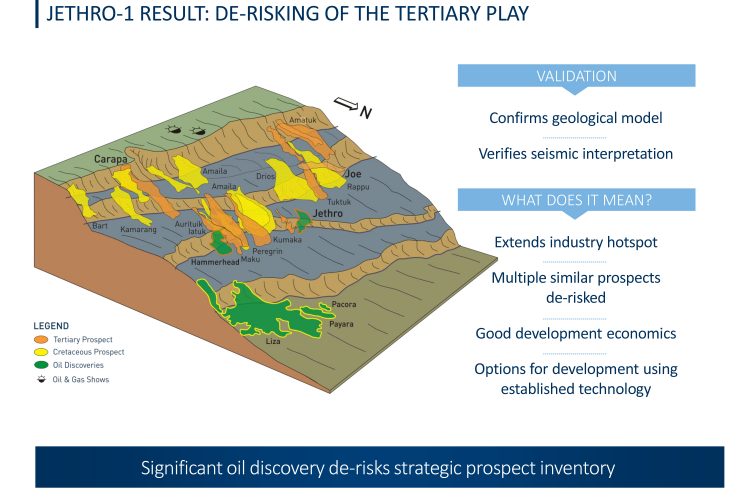

According to the MoTP release, the Jethro-1 well was drilled by the Stena Forth drillship to a total depth of 4,400 metres in approximately 1,350 metres of water. Bynoe said the Jethro-1 well comprises high-quality oil-bearing sandstone reservoirs of Lower Tertiary age.

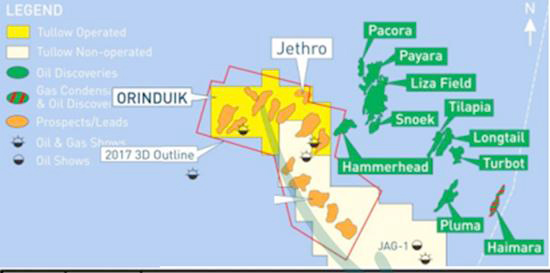

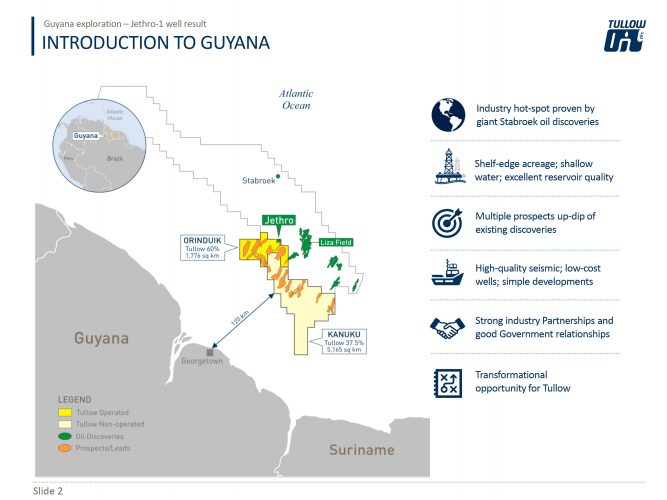

The discovery is significant as it is the first reputed commercial find outside of the Stabroek Block which has seen ExxonMobil hitting 13 major finds since May 2015. Tullow’s discovery will likely attract even more investor interest to the Guyana Basin and the other blocks where plans are underway for exploratory drilling. The Stabroek Block has already been assessed at around six billion barrels of oil equivalent and counting. The Orinduik Block is west of the Stabroek Block and fits like a Lego piece atop the Kanuku Block in which Tullow also has an interest.

“This is a major development for the Co-operative Republic of Guyana (CRG) as it adds to the further de-risking of the deep and ultra-deep zone. Furthermore, it offers significant potential for the diversification of the CRG’s hydrocarbon production base,” Bynoe said, according to the release.

He said that the well encountered 55m of net oil pay which supports a recoverable oil resource estimate that exceeds Tullow’s pre-drill forecast.

“The Department of Energy … is encouraged by the prolific rate of discovery in the CRG and will continue to work assiduously and conscientiously to extract optimum value from these resources for all the peoples of our country,” the Director stated.

Bynoe said that this new discovery demonstrates the vastness of Guyana’s natural resources while reminding that Guyanese stand to benefit significantly from the oil finds and must therefore continue to be aspirational and focused with a transformational mindset.

With this new find, Tullow will now evaluate the data from the Jethro-1 discovery and determine the appropriate appraisal protocols. When ExxonMobil begins lifting oil next year it would be nearly five years since its Liza-1 well discovery in May of 2015.

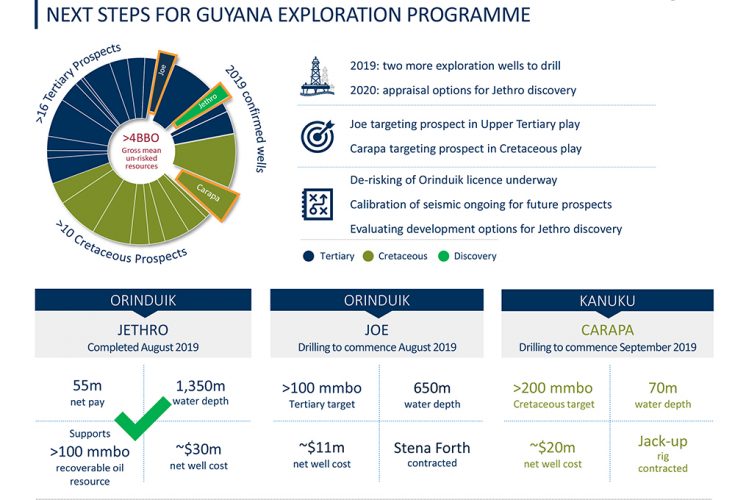

Bynoe stated that the Jethro discovery significantly de-risks other Tertiary age prospects on the Orinduik Block, which includes the shallower Upper Tertiary Joe prospect. Drilling should begin there later this month after the termination of operations at the Jethro-1 well.

Tullow Oil’s Paul McDade, Chief Executive Officer, stated yesterday: “This substantial and high value oil discovery in Guyana is an outcome of the significant technical and commercial focus which has underpinned the reset of our exploration portfolio. It is an excellent start to our drilling campaign in the highly prolific Guyana oil province. We look forward to drilling both the Joe and Carapa prospects in our 2019 drilling campaign and the material follow-up exploration potential in both the Orinduik and Kanuku licences.”

Eco Atlantic’s Chief Executive Officer Gil Holzman said of the find: “We are thrilled to report this exceptionally exciting discovery. This is a revolutionary moment for Eco. It has been a long path of hard work for our team, and with today’s announcement we feel our first rewards have justified our journey. We have been very confident in the prospects of the Orinduik since we first decided to make a licence application in February 2014, based on a strong recommendation from our team at Kinley Exploration.

“I always believed that Eco would create exceptional stakeholder value, for our shareholders, and the people of Guyana alike, and I am so proud that we have made this exciting discovery…”

Reuters yesterday reported that Tullow’s share price had jumped by 20% on initial reports of the oil find.

It reported Tullow’s McDade as saying that Jethro-1 is expected to hold more than 100 million recoverable barrels of oil, in excess of expectations. The company will start drilling a second well, Joe-1, this month.

“It looks like we have something we would develop. It looks like we have a long-term business in Guyana,” McDade told Reuters.

Signing

In January 2016, Minister of Natural Resources, Raphael Trotman, signed a Petroleum Prospecting Licence and Production Sharing Agreement with the joint venture team of Tullow Guyana B.V. and Eco (Atlantic) Guyana Inc. for the 1801sq. km Orinduik Block which is a fraction of ExxonMobil’s Stabroek Block

Tullow spudded the Jethro-1 well on July 4th this year.

Tullow and its partners were in May this year exempted from a range of taxes as per its Production Sharing Agreement (PSA) with the government, even as Minister of Finance Winston Jordan had explained that the company first became involved in oil exploration in Guyana in 2008. Then, it obtained equity and subsequently participated in the drilling of the Jaguar-1 well with CGX in 2012. “As in many of these activities, this well failed to reach its target depth as safety was a concern,” he said.

The 69-page PSA commits the two contractors to pay a royalty of 1%, while profits will be shared on a sliding scale.

Article 11 of agreement, which addresses “Cost Recovery and Production Sharing,” explains that the government will receive 50% of profits earned from the first 25,000 barrels of oil, 52.5% from the next 25,000 barrels, 55% from the next 15,000 barrels, 57.5% from the next 15,000 barrels and 60% for production above 80,000 barrels.

Under its much criticised agreement with Exxon, Guyana is to earn a 2% royalty and 50% of the profit oil.

Another major difference appears in Article 5 of the Tullow/Eco agreement, which notes that the contractor is not required to relinquish any area of the contract at the end of the initial petroleum prospecting licence if they decide to renew. A relinquishment of 25% of contract area is required for all renewals after the first in other PSAs.

Under Article 19, Tullow and Eco Oil will pay US$25,000 annually for the training of locals. It is the smallest sum of any of the contracts released by the government last year.

But Tullow has promised that it will focus heavily on developing local content.

“We are very pleased with the current interpretation work that has been completed at Tullow, Gustavson and within Eco and have a great deal of confidence in our joint efforts to date. The additional discoveries on Exxon’s Stabroek Block, including the most recent Hammerhead-1 that is on our 3D survey, enables us to see the formations ramp up onto Orinduik. These have greatly helped us to further understand the play. Ten key leads have been identified on Orinduik to date. The partners will carefully consider in the coming months the prioritisation of the leads for drilling as we continue work on the drilling engineering and the environmental permitting,” Eco’s co-founder and Chief Operations Officer, Colin Kinley, had said last year.

“We have identified the potential for close to 2.5 billion barrels of recoverable oil and 2.45 trillion cubic feet of associated gas. These are very meaningful numbers for all the partners and most importantly the people of Guyana. Three of the targets we have identified have estimated Probability of Success calculated at 22.4 per cent at this stage. This risking is extremely good for any company on a single lead, let alone three. As noted in the previous announcement, we continue to de-risk the play and are approaching this with a conservative and focused approach”, Kinley had added.

French company Total exercised its option to purchase a 25% interest in the Orinduik Block in September last year.

On July 29th this year, Qatar Petroleum said it was taking up a 40% interest in Total’s 25% stake.

The new developments in the nascent oil and gas industry come as the APNU+AFC government is in limbo as a result of the December 21st 2018 motion of no confidence that was successfully passed against it and the requirement for early general elections. Several important pieces of legislation related to local content and the Petroleum Commission remain to be presented to the National Assembly for debate and approval. It is unlikely that the government will be able to present this legislation to Parliament as it has been described as having caretaker status by the Caribbean Court of Justice.

Canadian High Commissioner to Guyana, Lilian Chatterjee on her Twitter feed yesterday offered congratulations to Holzman and Kinley “on their success in finding oil in the Orinduik block off Guyana”.

Founded in 1985, Tullow is an independent oil & gas, exploration and production group, quoted on the London, Irish and Ghanaian stock exchanges. The Group has interests in over 80 exploration and production licences across 15 countries.