Guyana’s economy grew by 4 per cent in the first half of this year as key sectors expanded and the overall growth rate for the year is now projected to be 4.5 per cent, slightly down from the 4.6 per cent projection contained in Budget 2019 but up from the 4.4 per cent revised estimate in April.

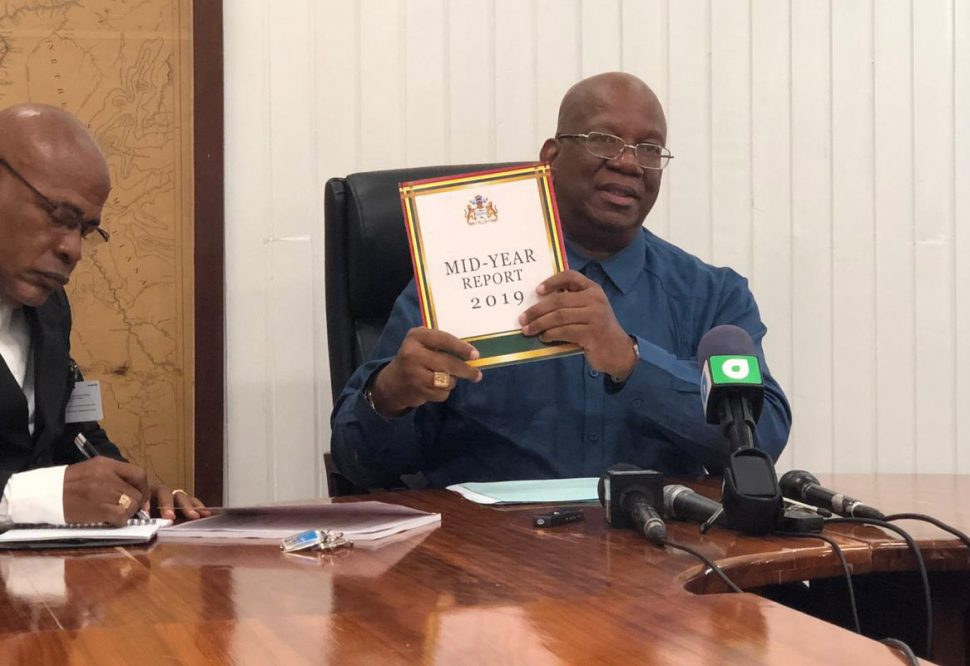

“Growth continued to be broad-based with notable expansions in key sectors such as rice, forestry, gold, manufacturing, construction, wholesale and retail trade, and financial and insurance activities,” says the Mid-Year Report 2019 of the Ministry of Finance, which was released yesterday. The report covers the first half of this year.

Speaking at a press conference yesterday morning at the Ministry of Finance’s Board-room, Minister of Finance Winston Jordan said 2019’s half year performance compares “extremely favourably” with 2018’s revised half year growth rate covering the same period, which was 5 per cent.

Jordan said that 2019’s half-year growth rate has been achieved despite weaker growth in the global economy and “relatively unfavourable” commodity prices in a number of sectors.

As it relates to those commodity prices, Jordan observed that the price change for the country’s major traded commodities were mostly negative for the first half of this year when compared to the same period in 2018. For rice, the global average price declined by 6.1 per cent while timber prices also weakened by 1.3 per cent. Sugar prices remained relatively unchanged though there was a slight increase in June.

As it relates to the contributing sectors, rice grew by 3.7 per cent despite the threat of a paddy bug infestation earlier in the year. “This increase was due to improvements in both the number of hectares harvested and the yield,” the report said. Other crops also grew by 4.8 per cent.

The gold subsector expanded by 4.4 per cent, which Jordan said was spurred by declarations of small and medium scale miners. Gold declared for the first half of this year amounted to 300,674 ounces.

Forestry also expanded by 8.5 per cent, which Jordan said was driven by small and medium concessionaires. Manufacturing grew by 3.6 per cent driven by rice and other manufacturing, which saw increased output of pharmaceuticals, beverages, edible items and timber products.

The construction sector also expanded by 8.2 per cent on account of both public and private investments while the services sector expanded by 4.6 per cent.

Expansions were also recorded for sand and stone production at 9.2 per cent and 15.1 per cent respectively, which, Jordan said, has been consistent with the growth in the construction sector.

Meantime, there were contractions in several key sectors. The sugar industry contracted by 2.7 per cent and the report observed that the Guyana Sugar Corpora-tion (GuySuCo) fell short of its production target for the first crop by 1 per cent with output reaching 33,531 metric tonnes of sugar. GuySuCo estimates that production for the second crop will be 73,516 metric tonnes, resulting in a growth rate of 2.3 per cent in 2019, down from the 15.6 per cent forecasted at the time of the budget, the report said.

The livestock subsector also saw a reduction by 8.1 per cent in the first half of 2019. “This was as a result of a decline in broiler meat production and, to a lesser extent, milk production, which fell by 8.2 per cent and 1.6 per cent respectively,” the report said.

The fishing sector also contracted by 12.2 per cent. This was caused by the invasion of the sargassum weed, which provides a habitat and source of food for many aquatic species and has proven disruptive to fisher folk across the Caribbean. Specifically to Guyana, the shrimp subsector was particularly hit by the invasion, declining by a whopping 36 per cent for the first half of the year, the report revealed.

Bauxite also saw a decline by 2.9 per cent, largely due to the month-long industrial action by workers of the Russian-owned Bauxite Company of Guyana Inc early in the year.

“Given the majority of production areas demonstrated strong growth, these collectively were more than enough to offset the few areas of reduction. Given this outlook, we have revised the end of year growth rate to 4.5 per cent from the 4.4 per cent that we had revised in April…and it is more or less in line with the 4.6 per cent that we had targeted at the time of the budget,” Jordan said.

He emphasised that every year since the APNU+AFC government took office; the economy has grown.

Meantime, in terms of other indicators, in the first half of this year, the overall balance of payments registered a deficit of US$86.9 million, which is 37.9 per cent smaller than 2018’s half-year’s deficit of US$139.8 million. This was supported by a higher surplus on the capital account, despite a higher current account deficit.

As it relates to money supply, as compared to the same period last year, this expanded “robustly” by 9.5 per cent to $408 billion. The report said that was the fastest half-year growth since June 2012, supported by expansion in both narrow and broad money of 13.1 per cent and 6.9 per cent to $175.7 billion and $232.4 billion respectively.

Currency issuance also expanded at the fastest rate in four years by 12.7 per cent to $108.1 billion, which offset growth in holdings of commercial banks of 18.4 per cent to $7.2 billion. Quasi money also grew by 6.9 per cent at the end of June to $232.4 billion, the fastest rate of growth for this period since 2013.

The inflation rate from December 2018 to June this year reached a moderate 1.6 per cent, which the report said was due to higher food prices. The 12-month inflation rate at the end of June, which grew to 2.4 per cent, was also driven mainly by higher food prices.

Meantime, net domestic credit of the banking system grew by 14.1 per cent to $33.4 billion, supported by an expansion in both private and public sector credit, which Jordan said, indicates a high level of consumer and business confidence, despite claims from the opposition and other persons that investor confidence has taken a hit.

In terms of the fiscal sector, the fiscal position of the non-financial public sector reflected a deficit of $0.9 billion, a reversal from the surplus of $31.2 million for the same period last year. This was due to increases in Central Government current and capital expenditure, which grew by $10.8 billion and $6.1 billion, respectively.

As it relates to revenue, the report said that in spite of the revenue-reducing measures that were announced in this year’s budget, revenue collection totalled $115.9 billion at the end of June, a 6.1 per cent increase above the same period last year. This was due primarily to increased collections from all the major tax types.

While the Government’s non-interest recurrent expenditure budget for this year was $213.1 billion, due to supplementary provisions of $4.4 billion, this was revised to $217.5 billion. By the end of the first half of this year, the sum of $93.1 billion, or 42.8 per cent of the revised budgeted sum, was expended, which represents an increase of 5.2 per cent over the same period last year.

As it relates to public debt, the report revealed that at the end of June, Guyana’s stock of total public debt amounted to US$1,657.8 million, an increase of 1.5 per cent when compared to last year’s position for the same period of US$1,634 million.

Jordan said that while further growth is expected, there are “ifs and buts” especially as it relates to the challenge of the political environment that has been triggered since December last year – a reference to the no-confidence motion passed against the government in the National Assembly.

“In a sense, it has accelerated because quite frankly, since 2015 we have had a challenging environment but it has been made more difficult in December 2018 and that remains and that will have an impact on growth. Of course this unfavourable weather that we have been experiencing well into August – that used to be a dry period in the past – could have an impact on the agricultural sector and also the mining sector,” the minister said.

Jordan was asked about how he predicts the political situation and uncertainty. He added that its impact in the first half of the year was negligible.

“Perhaps [the growth rate] could have been higher had it not been for bauxite, and bauxite was not troubled by the political environment. And, of course, prior to that, bauxite had its own issues with RUSAL and the [United States of America]. Had it perhaps not been for bauxite and maybe even the paddy bug infestation that had troubled the rice sector, the 4 per cent growth could’ve been five, six. So those had nothing to do with political issues,” he said.

Going forward, Jordan said that they have tried to take a conservative approach and unless there are spontaneous “wildcat strikes” in the sugar industry or something happens to rice that has nothing to do with the paddy bug or so, they do not see political action having any effect on their target growth rate of 4.5 per cent by the end of the year. This, he said, is reflected by the fact that they have revised the figure upwards by one per cent.