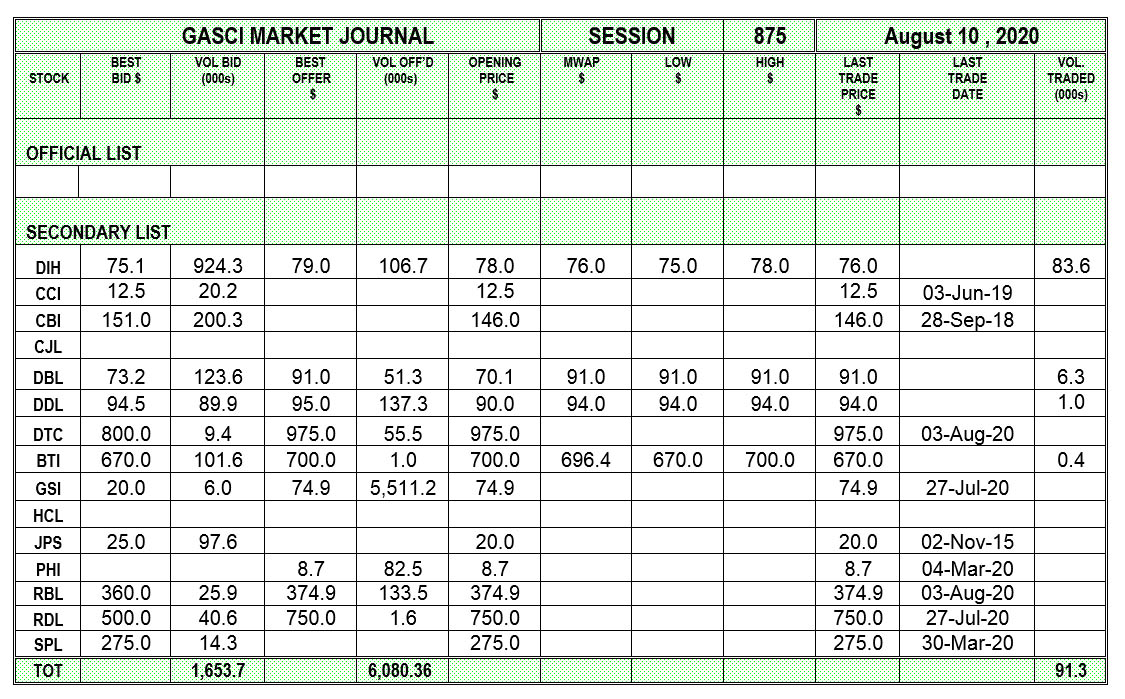

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 875’s trading results showed consideration of $7,285,038 from 91,295 shares traded in 15 transactions as compared to session 874’s trading results which showed consideration of $1,827,276 from 14,130 shares traded in 12 transactions. The stocks active this week were DIH, DBL, DDL and BTI.

Banks DIH Limited’s (DIH) five trades totalling 83,578 shares represented 91.55% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $76.0, which showed a decrease of $2.0 from its previous close of $78.0. DIH’s trades contributed 87.19% ($6,351,608) of the total consideration. DIH’s first trade of 1,245 shares was at $78.0, its second trade of 500 shares was at $75.1, its third and fourth trades totalling 2,360 shares were at $75.0, while its fifth trade of 79,473 shares was at $76.0.

Demerara Bank Limited’s (DBL) four trades totalling 6,340 shares represented 6.94% of the total shares traded. DBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $91.0, which showed an increase of $20.9 from its previous close of $70.1. DBL’s trades contributed 7.92% ($576,940) of the total consideration. All of DBL’s trades were at $91.0.

Demerara Distillers Limited’s (DDL) single trade of 1,000 shares at $94.0 represented 1.10% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $94.0, which showed an increase of $4.0 from its previous close of $90.0. DDL’s trade contributed 1.29% ($94,000) of the total consideration.

Guyana Bank for Trade and Industry Limited’s (BTI) five trades totalling 377 shares represented 0.41% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $696.4, which showed a decrease of $3.6 from its previous close of $700.0. BTI’s trades contributed 3.60% ($262,490) of the total consideration. BTI’s first two trades totalling 330 shares were at $700.0, while its third to fifth trades totalling 47 shares were at $670.0.

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

TERM OF THE WEEK

Firm Price: A guaranteed price.

Source: Dictionary of Financial and Securities Terms.

Contact Information: Tel: 223 – 6175/6

Email: [email protected]

Website: www.gasci.com

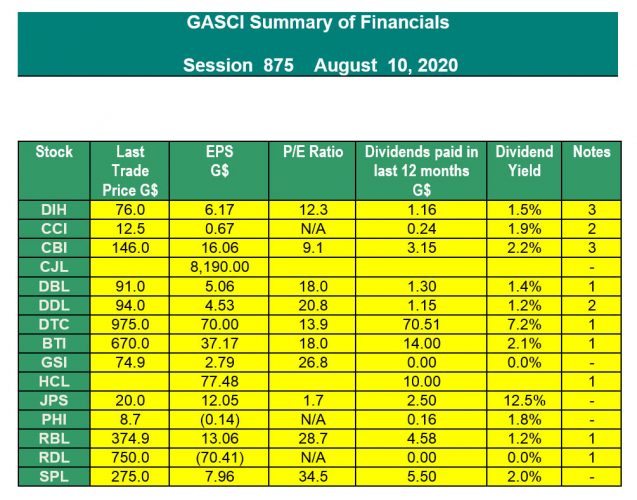

Notes

1 – Interim Results

2 – Prospective Dividends

3 – Shows year-end EPS but Interim Dividend

4 – Shows Interim EPS but year-end Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2016 – Final results for CJL and PHI.

2018 – Final Results for GSI, and JPS.

2019 – Interim Results for HCL and RDL.

2019 – Final Results for CCI, BTI, DDL, DTC, and SPL.

2020 – Interim Results for CBI, DBL, DIH and RBL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.

The market information provided here is provided for informational and educational purposes only and is provided on a time-delayed basis. GASCI does not guarantee the accuracy or completeness of any information contained on this page. Although the information has been obtained by GASCI from sources believed to be reliable, it is provided on an “as is” basis without warranties of any kind. GASCI assumes no responsibility for the consequences of any errors or omissions. GASCI does not make or has not made any recommendation regarding any of the securities issued by any of the companies identified here nor the advisability of investing in securities generally for any particular individual.