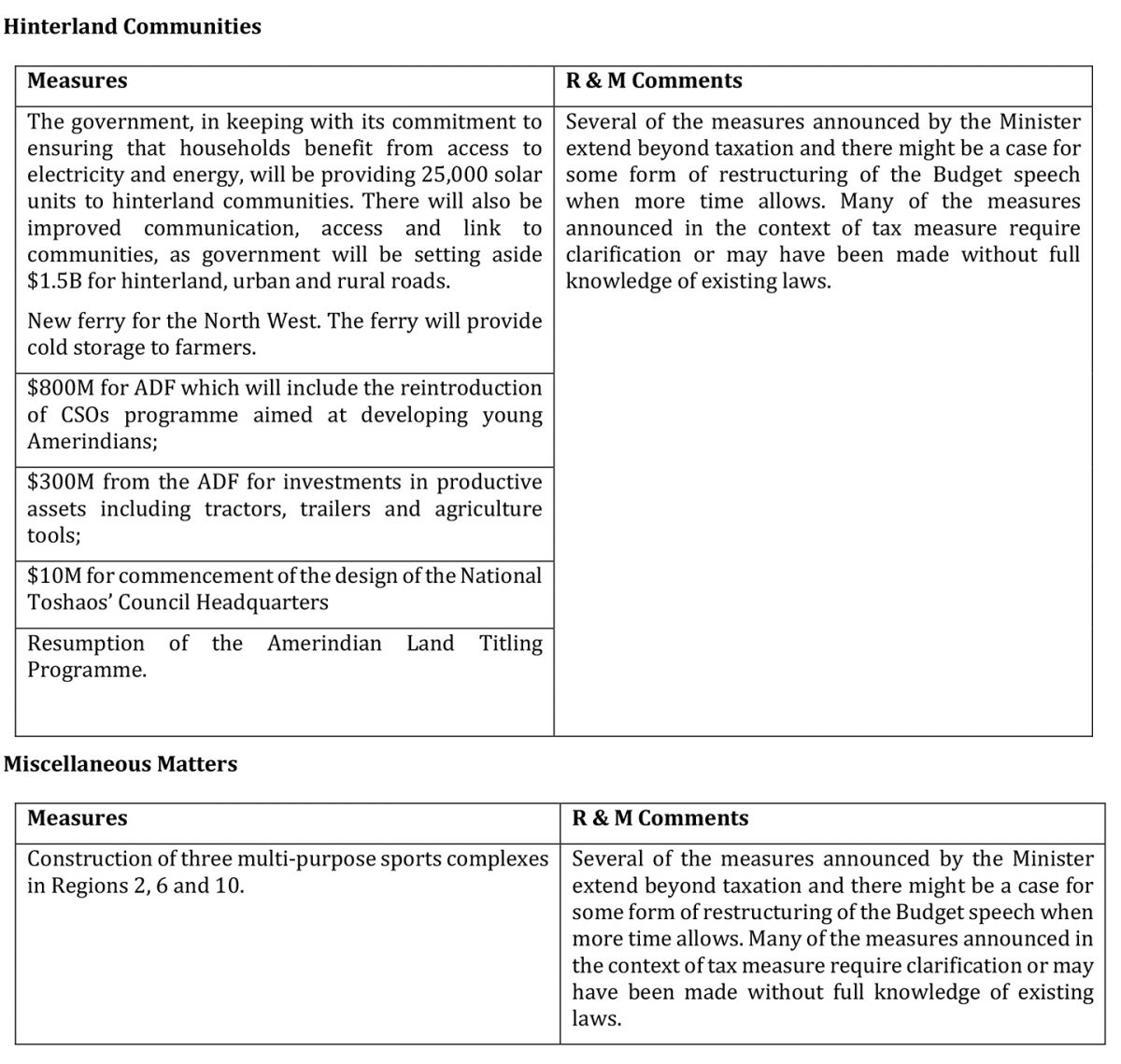

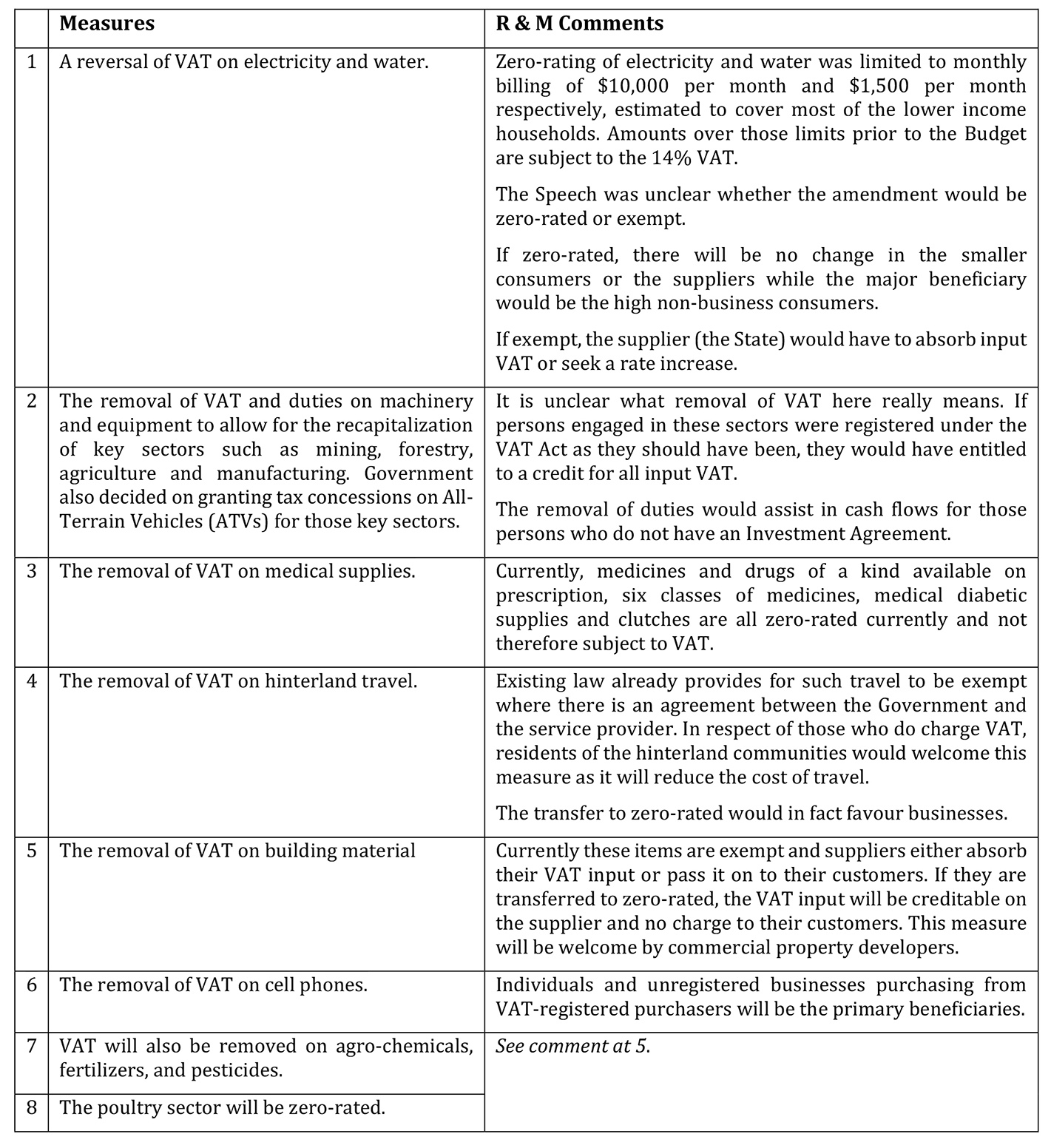

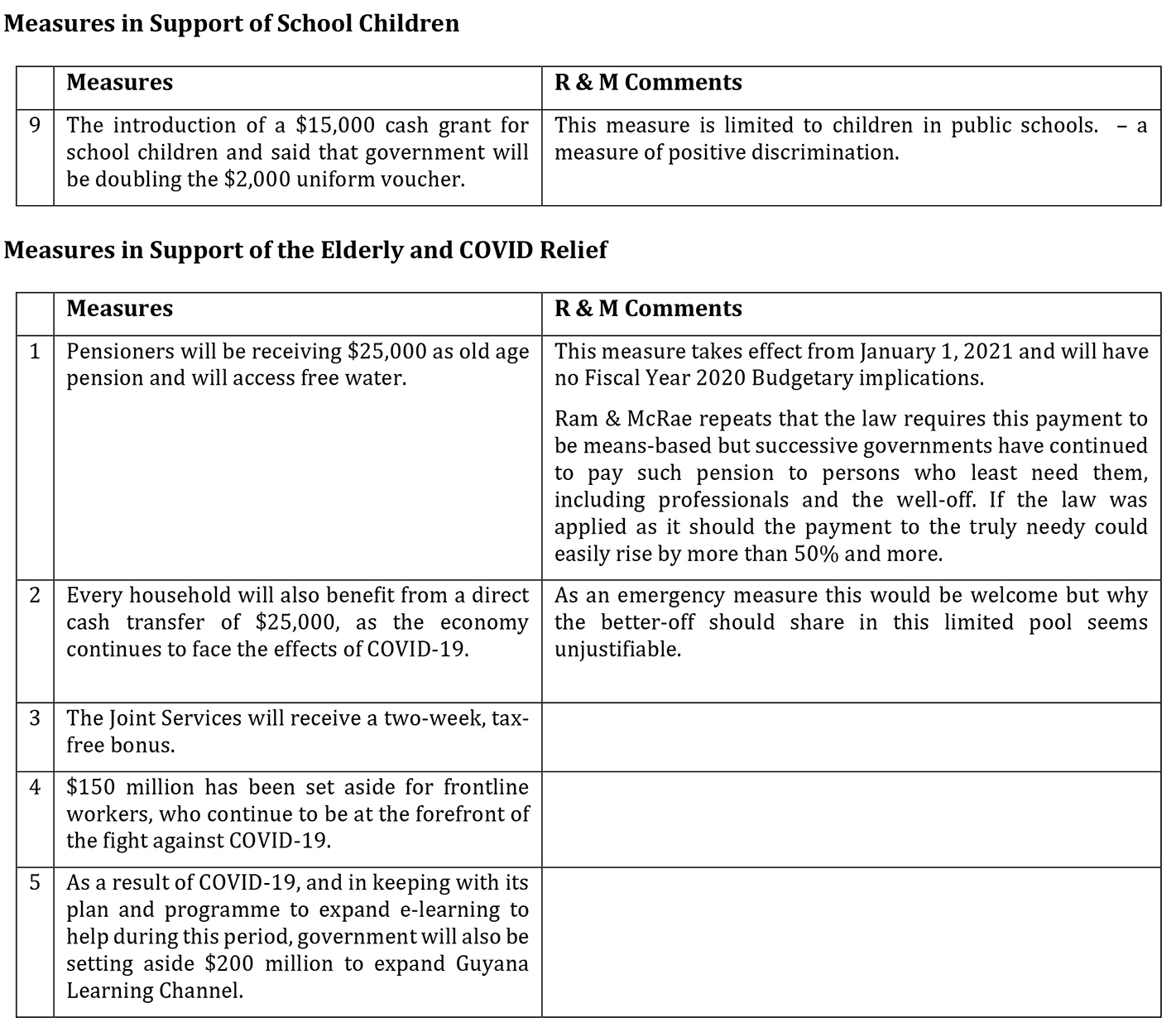

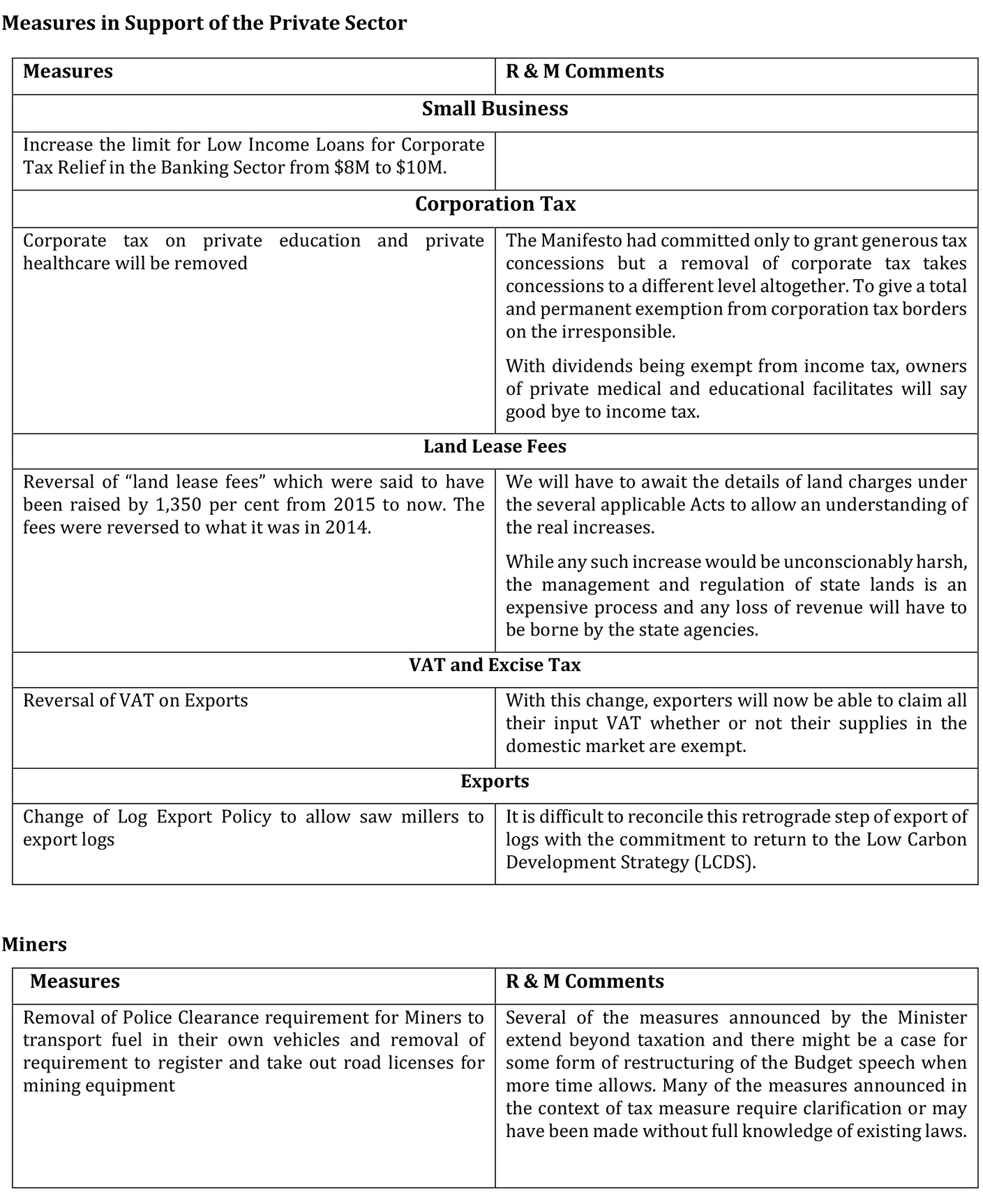

In this section we consider the measures announced by the Minister, analyse them, evaluate their impact and discuss the extent to which they provide useful economic benefits to stakeholders. Section six of the 2020 Budget Speech contains some thirty-two Budget measures. This follows the forty-five in 2019 and twenty-five in 2018. The proposed changes are subject to statutory amendments. Those concessions in relation to School children and pensioners will take effect from the first of January 2021while the other measures come into effect from the 1st of October 2020.

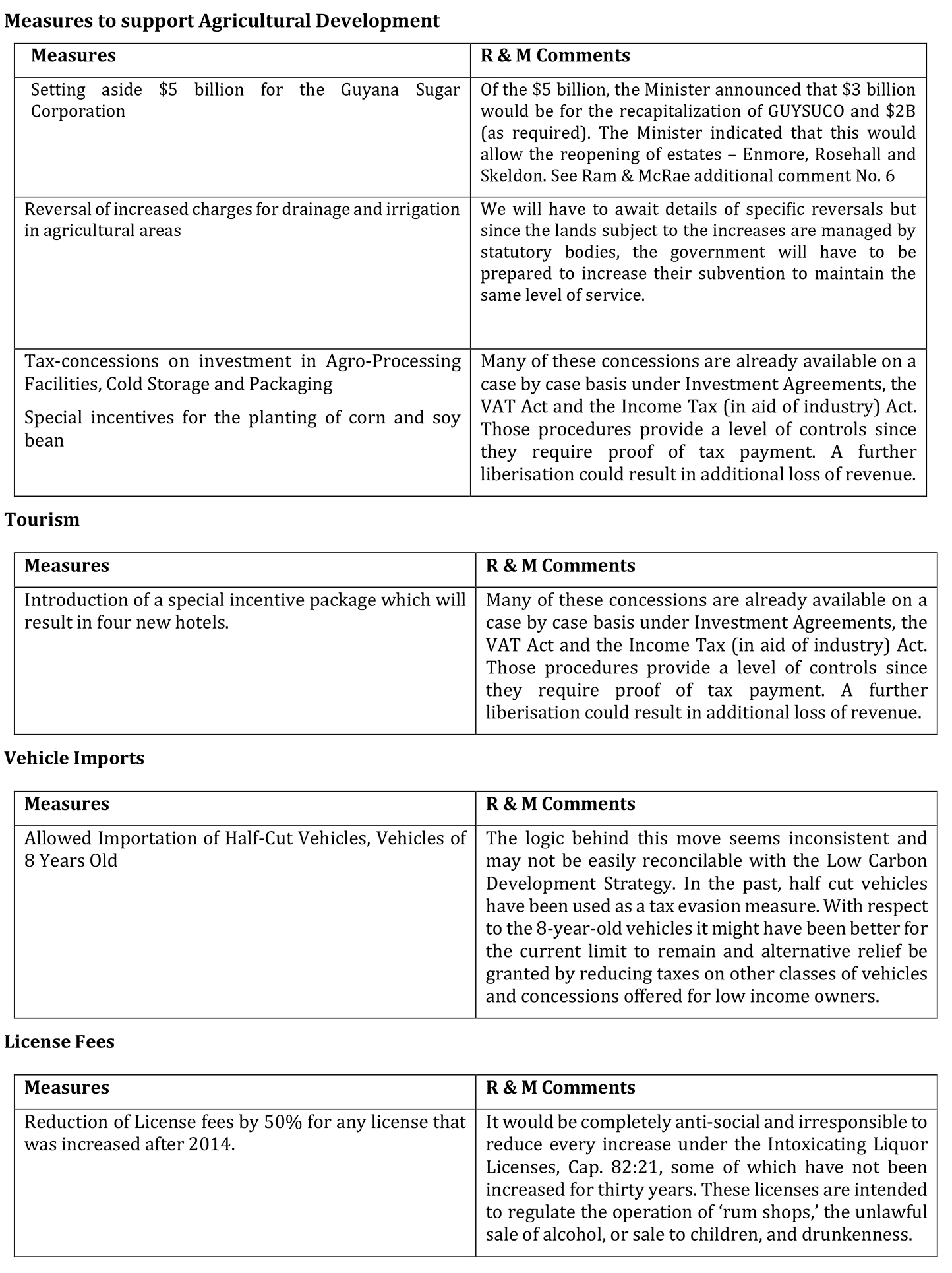

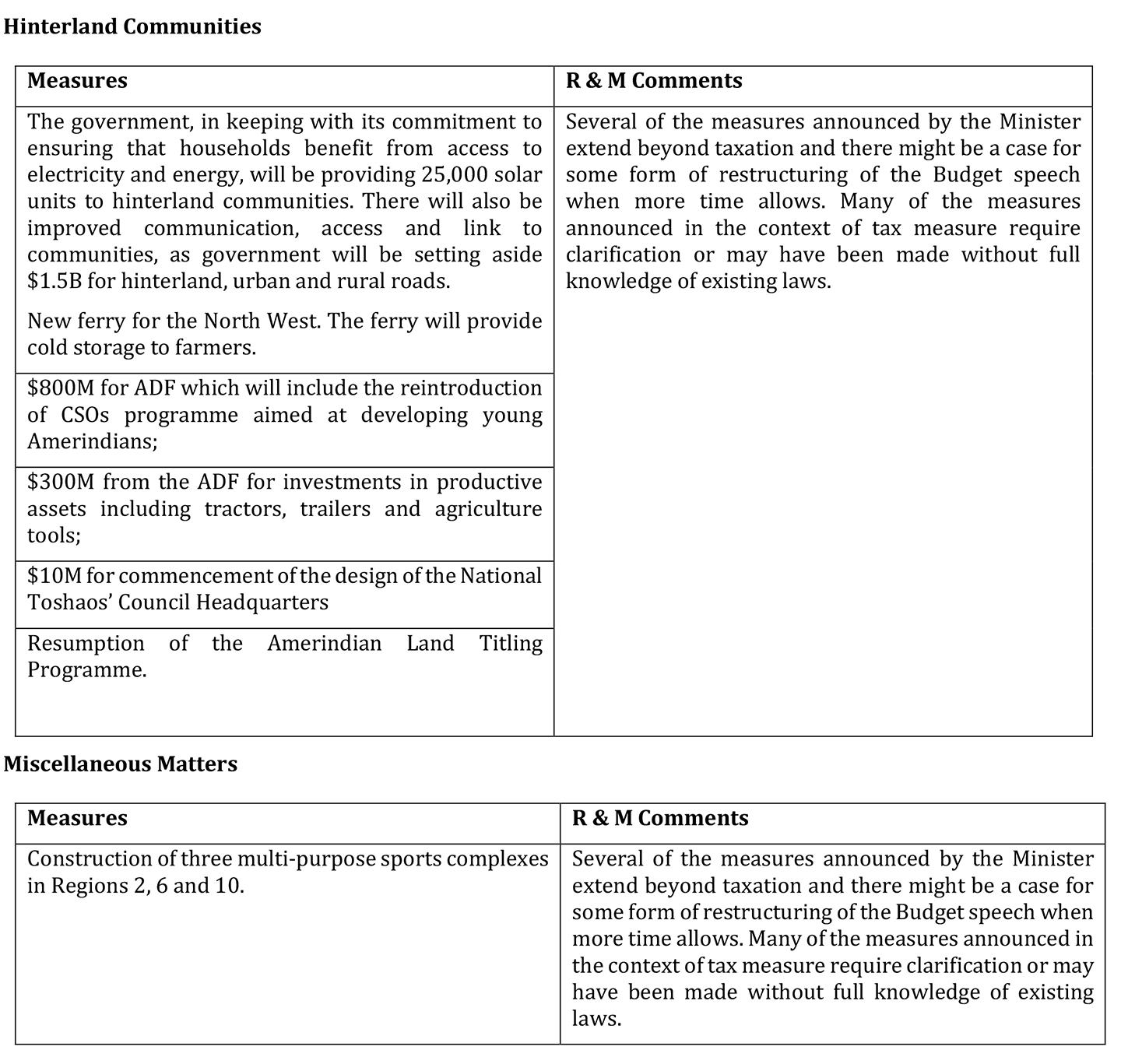

We now look at these measures and offer our comments.

Ram & McRae comments

We repeat what we said of the 2015 Budget Speech: The Minister has had the benefit of at least two tax studies and recommendations for reform. Tax changes require a structured approach to avoid the creation of inequities and imbalances. It also requires persons to pay their fair share of taxes. The positive standout would be the sensible restoration of VAT on exports and a return to the $30 million ceiling of the mortgage interest relief. The negative standout would be the virtual abolition of taxes on income of private, for profit educational facilities.

The Government needs no reminding that the private sector seldom willingly passes on tax savings to its customers. Responding to the permanent tax cuts for for-profit health care service providers, the CEO of the country’s largest privately-owned hospital welcomed, of course, the permanent tax exemption without a word about passing on the savings to its patients.