On 30 September 2019, the Auditor General presented to the Speaker of the National Assembly his report on the audit of the public accounts for the fiscal year ended 31 December 2018. The report could not have been presented to the Legislature because of the absence of sittings of the Assembly after 23 May 2019; the dissolution of Parliament on 30 December 2019; the holding of elections on 2 March 2020; and the five-month delay in declaring the results. Now that a new session of Parliament begins following the swearing of the new Administration, the report is expected to be laid in the Assembly at the earliest opportunity. Meanwhile, the Audit Office has taken the opportunity to upload the report to its website.

On 30 September 2019, the Auditor General presented to the Speaker of the National Assembly his report on the audit of the public accounts for the fiscal year ended 31 December 2018. The report could not have been presented to the Legislature because of the absence of sittings of the Assembly after 23 May 2019; the dissolution of Parliament on 30 December 2019; the holding of elections on 2 March 2020; and the five-month delay in declaring the results. Now that a new session of Parliament begins following the swearing of the new Administration, the report is expected to be laid in the Assembly at the earliest opportunity. Meanwhile, the Audit Office has taken the opportunity to upload the report to its website.

In today’s article, we highlight the key findings of the 2018 Auditor General’s report. His 2019 report is due for presentation to the Speaker at the end of this month.

Statements and accounts to be submitted to the Auditor General

The statements and accounts to be submitted for audit examination and certification are the accounts of the budget agencies comprising the appropriation accounts, receipt and disbursements statements, and the consolidated financial statements of the public accounts. The latter consists of:

(a) Statement of revenues and expenditures in the form of the End-of-Year Budget Outcome and Reconciliation Report;

(b) Financial reports of extra-budgetary funds;

(c) Schedule of the issuance and extinguishments of all loans;

(d) Schedule of Government guarantees;

(e) Statement of contingent liabilities;

(f) Financial reports of Deposit Funds;

(g) Schedule of the public debt;

(h) Financial reports of any other accounts approved by the Minister of Finance; and

(i) Such other financial information that the Minister deems necessary to present fairly the financial transactions and financial position of the State.

Statements (a) to (g) were submitted to the Auditor General, except those relating to extra-budgetary funds and contingent liabilities. As regards (h) and (i), the following additional statements were submitted:

(a) Receipts and Payments of the Consolidated Fund;

(b) Expenditure of the Consolidated Fund compared with the Estimates of Expenditure;

(c) Expenditure in respect of those Services which by Law are directly charged upon the Consolidated Fund, otherwise known as Statutory Expenditure;

(d) Receipts and Payments of the Contingencies Fund; and

(e) Assets and Liabilities of the Government.

Auditor General’s opinion on the statements and accounts

Of the twelve sets of financial statements submitted for audit examination, the Auditor General’s certification in the form of an audit opinion relates to only seven statements. No audit opinion was provided for the following:

(a) Receipts and Payments of the Consolidated Fund;

(b) Expenditure of the Consolidated Fund as com pared with the Estimates of Expenditure;

(c) Statutory Expenditure;

(d) Appropriation accounts of budget agencies; and

(e) Statements of receipts and disbursements by budget agencies.

The International Standards on Auditing (ISAs) and the International Standards of Supreme Audit Institutions (ISSAIs), which the Auditor General uses in the conduct of his audit, require him to express an opinion on all the financial statements presented to him. Without such an opinion, legislators and the public at large would be at a loss to ascertain his overall conclusions on the fair presentation of the statements and compliance with applicable laws, regulations and circular instructions.

The last time an opinion was rendered in respect of all the statements and accounts presented for audit was in respect of 2015. An explanation from the Auditor General would therefore be helpful in understanding why he has chosen to abandon this practice. This is especially so, considering that the opening paragraph of his audit opinion makes specific reference to his audit of ‘the Public Accounts of Guyana, which comprise the Consolidated Financial Statements, the Accounts of all Budget Agencies, the Appropriation Accounts and the Statements of Receipts and Disbursements’.

Of the seven statements for which the Auditor General expressed an opinion, unqualified opinions were issued in respect of three – Receipts and Payments of the Contingencies Fund; Schedule of Issuance and Extinguishments of Loans; and Schedule of Government Guarantees. The Government had guaranteed a $30 billion loan taken by the National Industrial and Commercial Investments Ltd. to assist in the restructuring of the Guyana Sugar Corporation. This amount was, however, not shown in the Schedule of Government Guarantees and attracted no comment from the Auditor General.

The Auditor General has qualified his opinion on the End-of-Year Budget Outcome and Reconciliation Report; and the Schedule of the Public Debt. He also disclaimed his opinion on the remaining two statements – Financial reports of the Deposit Fund; and the Statement of Assets and Liabilities of the Government. A qualified audit opinion is issued where there are reservations/disagreements of a material nature that affect the fair presentation of the related financial statements. On the other hand, a disclaimer of opinion relates to reservations/disagreements of such a fundamental nature that the external auditor is unable to express an opinion on the related financial statements.

An examination of the detailed findings contained in the Auditor General’s report revealed that there were no material findings that impacted adversely on the fair presentation of the End-of-Year Budget Outcome and Reconciliation Report (both revenue and expenditure); and the Schedule of the Public Debt, to justify a qualified opinion. The same can be said of the Statement of Assets and Liabilities of the Government which received a disclaimer of opinion.

As regards the remaining five statements and accounts for which he has not rendered an opinion, the Auditor General’s conclusions at the end of the relevant sections of his report indicate reservations/disagreement of a material nature. However, nothing adverse was reported to justify such conclusions in respect of the Receipts and Payments of the Consolidated Fund; Expenditure compared with the Estimates of Expenditure; and Statement of Statutory Expenditure.

In view of the above as well as a review of the entire report, it would suggest that the Audit Office needs institutional strengthening to ensure full compliance with the ISAs and ISSAIs, especially in the area of reporting. The new PAC, which has the enormous task of examining the public accounts for the backlogged years 2015 to 2018, has a role to play in ensuring this is done. One hopes that the constitution of the nine-person parliamentary committee will include persons with technical and profession experience in public financial management if it is to hold the Government accountable for its financial stewardship.

Executive summary

The following are the main findings contained in the executive summary of the report:

Overpayments to contractors and misallocation of expenditure

Overpayments totalling $166.076 million were found based on the physical verification of the related works, of which $20.041 million was recovered. One contractor received an advance payment of $53 million for the construction a school in Georgetown but the site was abandoned after the driving of piles. In addition, amounts totalling $71.042 million relating to capital works were incorrectly charged to current expenditure. There was also evidence of the “cutting and holding” of cheques at the end of the year in anticipation of the completion of the works in the new fiscal year, which practice is prohibited under FMA Act.

Breaches in the Procurement Act

In five Regions, several instances were noted where in the procurement of goods and services, the restricted tender approach was used instead of open tender. There was also evidence of abuse of the system of quotations.

Incidentally, the tenure of office of four of the five members of the Public Procurement Commission came to an end a year ago and there have been no replacements since then. The Chair’s tenure will expire next month. One hopes that the appointment of all five members will be made as soon as the new PAC is activated, and that there will be public advertisement for the positions, shortlisting of applicants, interviewing, and finally selection strictly on the basis of merit, and not based on political considerations.

Overdraft of the Consolidated Fund

The overdraft on the new Consolidated Fund at the beginning of 2018 was $89.928 billion. At the end of the year, it was reduced to $64.448 billion. This was mainly due to amounts totalling $48.379 billion representing proceeds from the medium-term (182- and 364-day) Treasury Bills being deposited into this account instead of the Monetary Sterilisation Account as well as the recorded fiscal deficit of $27.478 billion in 2018. There is also an old Consolidated Fund bank account with an overdraft of $46.776 billion.

In our article of 24 August 2020, we had stated that the Sterilisation Account was set up in 1993 to remove excess liquidity in the system. Proceeds from the issue of medium-term Treasury Bills are deposited into this account out of which payments are made as the Bills mature. According to the notes to the public accounts, the related liability on these Bills ‘should be exactly offset by the monetary sterilization bank account, creating a fully funded liability’. We had stated that it is a requirement of Section 61 of the FMA Act for the proceeds of any borrowing by the Government to be paid into the Consolidated Fund. Be that as it may, the net result would be roughly the same since payments will have to be made for the Consolidated Fund as the Bills mature. Nevertheless, the inconsistency in accounting policy does create some complications to ascertain the true balance on the Consolidated Fund.

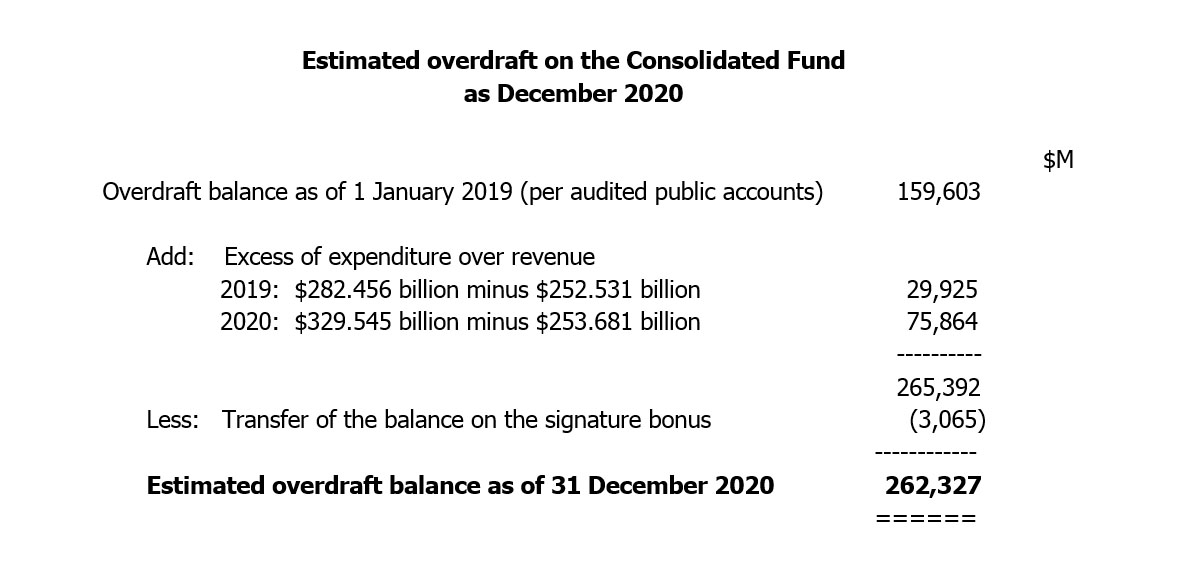

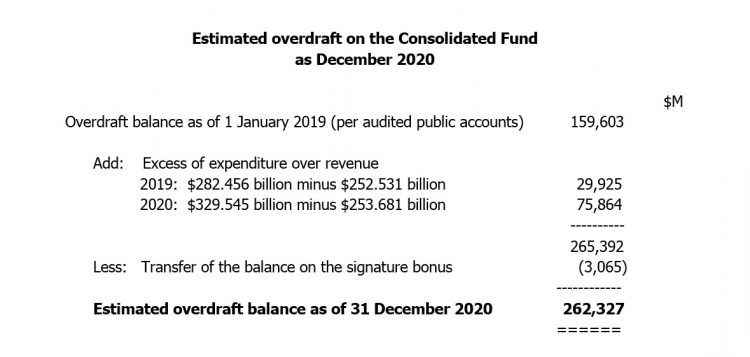

We had also estimated, in the absence of audited accounts for 2018, the overdraft on the Consolidated Fund to be $183.511 billion at the end of 2018, inclusive of the overdraft on the old Consolidated Fund. With the audited accounts for 2018 now available, the actual overdraft at the end of 2018, excluding the medium-term Treasury Bills deposits, was $159.603 billion, a difference of $23.908 billion, mainly due to the fiscal deficit of $27.478 billion.

On the assumption that for 2020, there will be 100 percent achievement the budgeted outcomes in relation to revenue and expenditure, the estimated overdraft on the Consolidated Fund at the end of 2020 is $289.463 billion as computed below. In practice, however, there are likely to be variances in terms of both revenue and expenditure:

Other matters

Other areas of concern include the following:

Non-presentation for audit of 582 payment vouchers valued at $811.752 million;

Drugs and medical supplies delivered to the Regions lacked adequate documentation in support of the amount of $1.956 billion expended;

Accountability for the purchase of fuel and lubricants for some Regions needed to be improved;

High vehicle maintenance costs observed for some Regions;

Recording of receipts and issues of drugs and medical supplies needed to be improved at the various regional health institutions;

Supporting documents, such as bills and receipts, relating to payments for the procurement of goods and services valued at $1.411 billion, remained outstanding at the time of reporting;

Some critical posts in the Regions remained vacant;

High incidence noted of self-employed persons not filing tax returns with the Revenue Authority; and

50 percent of the recommendations made in 2017 remained unimplemented.