As Minister Edghill proudly declared “this administration is decidedly pro-Guyana, pro-private sector”. To show that this was not mere rhetoric, the Minster gave the example of a decision to construct a road and cited “job creation, opening farmlands and generating economic activity of a certain value.” (emphasis added). Nothing like enhancing the lives and welfare of the residents or the reduction of transportation costs.

Labour received little notice except for the re-institution of a separate Ministry of Labour, and very troublingly, there was no indication of how the Government plans to deal with the increasingly serious financial problems facing the National Insurance Scheme. The Minister admitted that income levels remain ‘below-par’ and that both current public and private sector minimum wages are inadequate for a reasonable standard of living. But instead of identifying how the Government will address this major problems, the Minister chose to address a number of tax measures many of which will favour businesses and the better off in our society.

Businesses are particularly pleased with the tax measures of which the exemption from corporation tax for health care and private education ranks and rankles. The one size fit all cuts by 50% of the increase in license fees necessarily fail to address those eminently sensible specific increases including those under the Intoxicating Liquor Licensing Act (Cap82:01). The blanket reversal of land charges fails to take account of the grave abuse of small farmers by rapacious landlords operating in the agriculture sector and the varying rates of land charges across the country.

The Budget contains several measures which positively address the needs of Amerindians, the poorest segment of the Guyana population. Time may not have permitted the government the opportunity to address the plight of the coastal communities, the villages, and the perennially deprived areas such as Albouystown, Plastic City and Tiger Bay which cry out for redevelopment. In delivering a Budget days after the swearing in of the Irfaan Ali Administration, the budget team in the absence of a substantive Finance Minister did a reasonable job. The flip side of this of course, was the absence of any consultation with stakeholders including labour, civil society and the private sector. The latter group should however have no cause to complain as segments of its membership received more than they could have wished for.

We are concerned that the tax measures might not all have been sufficiently well thought out, and that these could make future tax reform and later tax measures particularly difficult for the Administration and the country.

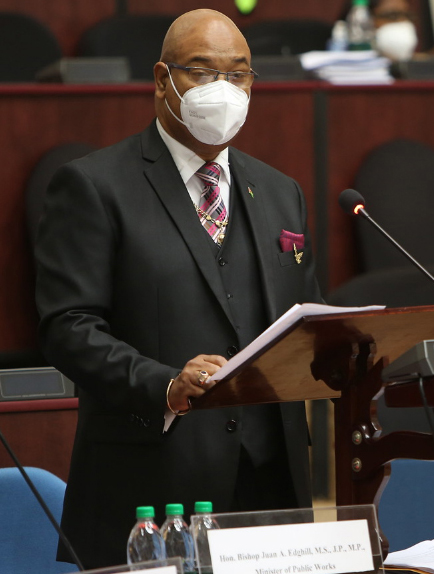

The Minister announced that the PPP/C (sic) will engage the Oil and Gas Companies in better contract administration/renegotiation. We welcome this announcement. See Commentary and Analysis for further discussion.

To use the famous cliché, this is the largest Budget ever. The question is whose Budget? As parliamentarians move to the debate on the Budget Speech, they will first have to understand that what is presented as Budget 2020 really covers three stages – the APNU+AFC Administration up to August 2, the two months of August and September and the three months of October 1 to December 31. Technically, in respect of revenue and spending, this is not Budget 2020 but Projections 2020. We regret and apologise that we could offer no clarification or assistance in this regard and assure readers that this is not for want of trying.

The PPP/C does not have a good record of early budgets. Since Budget 2020 is considered as an emergency Budget and since the budget process for 2021 should by law have already begun, it is imperative that that process begin immediately.