However hard we try, it is difficult to think of an international industry that has been harder hit by COVID-19 than the airline industry. Jobs in multiple sectors have been decimated and most assessments of a likely time frame for a global economic recovery are skeptical about putting anything even remotely resembling a time frame on the normalisation of the industry.

Yesterday, Thursday, October 1, the industry was scheduled to sink into further doldrums with 40,000 workers facing loss of jobs unless the US Congress could come up with an aid package to further delay what is widely believed to be the inevitable.

The workers have been, up until now, reportedly benefitting from a US$25 billion payroll support programme to America’s airlines that have kept thousands of flight attendants, baggage handlers, gate agents, and other categories on partial pay.

That deal ran out yesterday and with international air travel now reportedly down by about 70 per cent from last year, some carriers were making it clear earlier this week that without further aid they will have no option but to cut jobs. Two US airlines, Delta and Southwest have said that their success in accessing private capital markets have, at least for now, removed lay-offs from the table.

The COVID-19 related losses in the international airline industry have been jaw-dropping with reports suggesting that collectively, the four largest US airlines have lost some US$10 billion in the second quarter of this year alone. What is frequently overlooked is the stunning knock-on effects of a reduction in air travel which means less demand for rental cars, hotels and restaurants, and a host of other attendant services. Reduced air travel means aircraft manufacturers too, have understandably cut thousands of jobs.

US aviation analyst Burkett Huey is quoted as saying that the prevailing crisis in the sector amounts to the “steepest demand shock for commercial aviation in human history.”

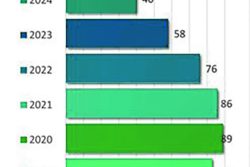

The International Air Transport Association on Tuesday lowered its full-year traffic forecast, disclosing that it now expects 2020 air travel to fall 66 per cent from 2019, compared to its previous estimate of a 63 per cent decline.

Seemingly unable to secure the kinds of bailouts which their US counterparts have managed to secure until now, European airlines are reportedly bracing themselves for years of financial trouble and have long moved to cut jobs even as some of them manage to secure state-financed rescue loans.

Germany’s Lufthansa reportedly benefitted from a multi-billion dollar state bailout but proceeded, nonetheless, with further staff cuts after a summer spike in vacation travel dwindled last month. British Airways’ parent company IAG is set to cut some 12,000 of its 42,000-person workforce.

The US Congress’ contemplation of a second round of airline aid is reportedly hung up in debate over a larger national relief package for local airlines.