Today’s column continues the discussion on Rystad Energy’s recent modeling of the “cost of delay of the Payara project”. It focuses mainly on further clarification of 1) economic externalities and the distinction between private cost and social cost, along with 2) offering a summary look at causes of delay studies in the oil and gas sector.

As revealed last week, private costs for the Payara project are provided by the international oil companies’ own funds (equity) and borrowed funds (debt). Together these costs are not equal to the social costs of the project. The latter combines private costs with other costs, which are external to the project but are nonetheless borne by society. Although not provided for by the project operator, such external costs affect the selling price, level of output, resources usage and petroleum reserves available in Guyana. Because of all the above considerations, every cost of delay analysis is ultimately contingent on which costs are applied in the modeling exercise

Therefore, on ExxonMobil’s (Contractor) “accounting books,” private costs of the Payara project are provided for. But external costs are not reflected on the Contractor’s “accounting books”. Nonetheless they do remain real costs for society (Guyana) to cover, as a result of its production of petroleum products. Indeed, international oil companies (IOCs) are notorious worldwide for striving studiously to ensure that as much of such costs as they are allowed to are effectively externalized, in any given surveillance, monitoring and oversight regulatory framework of laws and institutions.

Externalities

To take the discussion further, I remind readers here that, in economics, the distinction or difference between private and social costs is treated under the more general rubric of “externalities”. An externality is the cost of producing (or the benefit gained from consuming) Guyana’s oil and gas that spill over onto those who are neither producing nor consuming the oil and gas. The externality is negative (negative externality) if costs spill over to those who neither produce nor consume the oil and gas. And the externality is positive (positive externality) if the benefits similarly spill over to those who are not producing nor consuming the oil and gas.

Domino effect

Rystad Energy obliquely recognizes the importance of external costs because when reporting its results, it mentions, but does not analyze, a likely domino effect of delays on other projects in Exxon Mobil’s portfolio arising from the delayed approval of Payara’s final investment decision, FID. In the context of the ongoing 2020 general crisis such an occurrence would represent an immense negative externality. Similar negative effects would occur if the project brings major environmental, health or other harm to Guyana (for example, significant pollution from flaring, oil leaks, loss of bio-diversity, and deteriorating water and air quality)

On the other hand, the delay could bring positive externalities or benefits. These could occur if the delay period is utilized, as some contend it should, to improve Guyana’s institutional and legal petroleum governance capabilities. Indeed some go further and recommend more delay and the use of the Payara project to leverage the renegotiation of the Production Sharing Agreement (PSA) now in force with ExxonMobil and partners.

Causes of delay

Several readers have expressed their appreciation for my bringing to their attention cost of delay modeling and the integral role this plays in modern best practices in all types of project management. Being unaware of the strengths and limitations of this type of modeling, they had accepted the print and social media pamphleteering representation of Rystad Energy’s reports as simply big oil propaganda designed to pressure Guyanese Authorities. I’ll pursue the noise and nonsense in these outdated pamphleteering slogans of the 1990s in next week’s column. For the rest of today’s I draw summary attention to project management research/studies into causes of project delay in the oil and gas sector

Over a decade ago, (2008) M, Salama et al, in a conference paper, had investigated the causes of project delays in the oil and gas sector in the UAE. At that time the authors in their literature review had found that there were few such studies in the oil and gas sector, but nevertheless quite a few in the construction sector. While similarities were found between the two sectors, the differences were also striking. And. perhaps the most notable is the higher level of complexity in oil and gas projects.

Research method and findings

The research method used in the study involved three steps. First, expert interviews were held with key decision makers, technical professionals, contractors and leading operatives, with the view of identifying inputs to a questionnaire designed to assess the causes of actual delays encountered in the sector. Second, this was supplemented by studying questionnaires used in the construction sector. Third, a random sample of 100 practitioners was chosen to respond to the questionnaire. Not all responded; the response rate was 40 percent,

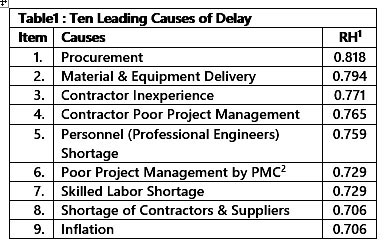

The study identified 35 causes of delay, I list below in the Table the ten most important. The study categorized oil and gas projects into three phases. A conceptual phase (feasibility study); a front end engineering and design phase (FEED); and an engineering, procurement and construction (EPC) phase. The delays are ranked in terms of their relative importance. For the UAE approval delays rank tenth in contrast with Guyana, for which such a delay has generated its first cost of delay study!

Note: 1 = Relative Importance Index; scale 0-1, Likert Scale. 2 = Project Management Committee.Source: M. Salama, M. El Hamid and B. Keogh, 2000.

Note: 1 = Relative Importance Index; scale 0-1, Likert Scale. 2 = Project Management Committee.Source: M. Salama, M. El Hamid and B. Keogh, 2000.

Conclusion

Next week I wrap up my discussion of this topic. I provide further details and also draw attention to some broader generic observations relevant to Guyana’s infant oil and gas sector.