ExxonMobil is continuing to drill its deepest ever well – the Tanager-1- in the controversial offshore Kaieteur Block and says that it will soon add a 5th drill ship and another next year for exploration in the equally contentious Canje Block.

“We continue to utilize four drill ships to drill exploration, appraisal and development wells. There are plans to add a fifth drillship offshore Guyana around the end of 2020 and a sixth in the first half of 2021,” ExxonMobil’s Public Affairs Advisor, Janelle Persaud told Stabroek News in response to a number of questions.

“The Stena Carron is currently drilling our first well, Tanager-1 in the Kaieteur Block. At ~2,900m water depth this is the deepest well drilled offshore Guyana and indeed globally by ExxonMobil. We expect to drill our first well in the Canje Block in early 2021,” she explained.

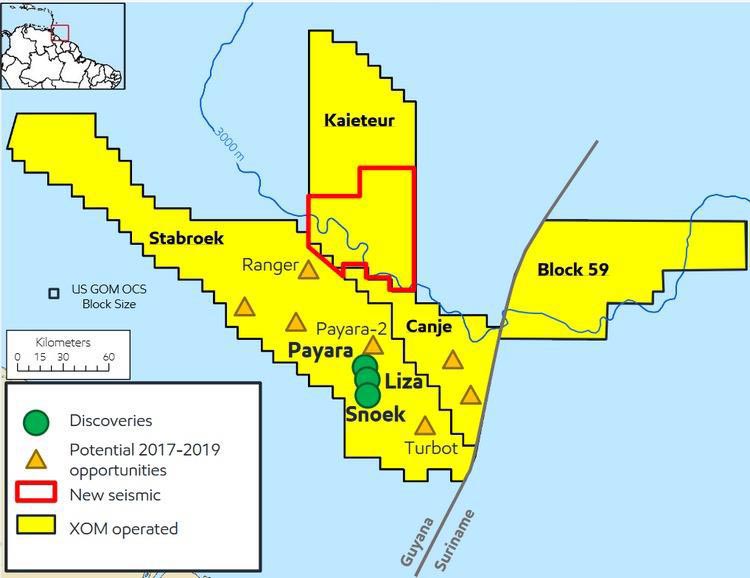

ExxonMobil is the operator of all three deepwater blocks: the Stabroek, Kaieteur and Canje and the circumstances of its buying into the operations of the latter two have come in for much scrutiny. This is because months after the signing of its renegotiated Stabroek Block Production Sharing Agreement (PSA) in June 2016, the company bought shares in both the Canje and Kaieteur blocks. The Canje and Kaieteur Blocks had been controversially awarded in 2015 just prior to Exxon’s first major oil strike in the Stabroek Block. The small companies that snagged the rights did not have the required capital and expertise to explore the blocks.

International transparency watchdog Global Witness in February of this year recommended that more effort be put into the State Assets Recovery Agency (SARA) investigation of the awarding of the licences for the offshore blocks in 2015, saying that key participants, including former Minister of Natural Resources Robert Persaud had not been questioned about the process.

And while Global Witness said that it found no evidence of any illegality in those deals, it called into question what due diligence ExxonMobil did to make sure that the process used to award the companies the Kaieteur and Canje licences were above board.

Relinquished

Of note, according to Guyana Geology and Mines Commission (GGMC) records, was that ExxonMobil and its then partner in the Stabroek block, Royal Dutch Shell, relinquished the area that subsequently became the Canje block in two separate transactions in June of 2010 and June of 2012. The Canje Block was part of the total acreage awarded to ExxonMobil in the original 1999 PSA when the areas were simply named after the first four letters of the alphabet. Shell had first given up its share in 2010 indicating to the Government of Guyana that it was changing its investment strategy. ExxonMobil would in 2012 also let the area be returned to the state as part of the relinquishment agreement under the 1999 PSA. ExxonMobil is now back in the Canje Block as a result of farm-in deal.

In the 3.3 million acres (13,535 square kilometers) Kaieteur Block, ExxonMobil now holds a 35 percent working interest while Ratio Petroleum and Cataleya Energy Corporation each hold a 25% participating interest. ExxonMobil’s Stabroek Block partner, Hess holds the remaining 15%.

And adjacent to the Stabroek Block, where the company has a 35% working interest in the Canje Block, it has already scheduled drilling and hopes to begin early next year. ExxonMobil said that it has some three wells scheduled to be drilled there.

The remaining stakes in the block are with French oil major, Total with 35%, JHI Associates 17.5% and Mid Atlantic Oil and Gas 12.5%.

And recently increasing its estimate of discovered recoverable resources in the Stabroek Block to nearly 9 billion oil-equivalent barrels, after adding current assessment volumes from the Uaru, Yellowtail-2 and Redtail discoveries in 2020, ExxonMobil told this newspaper that it was prioritising key exploration opportunities along with appraisal wells to better understand the resource base in its three offshore blocks.

Timing

Stabroek News had first reported in March 2018 on the major questions surrounding the award of the smaller offshore blocks – Kaieteur and Canje given the timing – shortly before the 2015 General Elections. Moreover, the awards to small operators such as Ratio Petroleum, Cataleya Energy, JHI Associates and Mid Atlantic Oil and Gas were seen as merely speculative transactions with the hope that an oil major would subsequently buy-in, provide the capital and find oil. In those circumstances the initial awards would not be defensible.

Starting from when the contracts were first released to the public in 2018, under the David Granger administration, it was this newspaper that undertook extensive research and reached out for help both here and internationally. The Stabroek News researched the small companies and principals early in 2018 (https://www.stabroeknews.com/2018/03/25/news/guyana/nothing-sinister-in-oil-deals-signed-on-eve-of-last-elections/).

It had also spoken to former President Donald Ramotar for him to explain the rationale for the awards so close to the 2015 general elections. Ramotar had defended his actions saying he acted on the advice of then Minister of Natural Resources, Robert Persaud, knowing that a principal of Mid-Atlantic, Edris Dookie, had been around working in the oil sector here for decades, even before there was any interest from any of the oil majors.

On Tuesday, Ramotar, who has a libel case in court against the Kaieteur News for its reports about the blocks, told this newspaper that while he daily has to endure his “name being vilified and dragged through the mud without basis”, he has been legally advised that as the case is in the courts, he should not comment further and he will respect the courts.

Global Witness said that more investigations were needed as there were a number of red flags raised. The recommendation that government “redouble the efforts” is contained in the group’s report, titled ‘Signed Away: How Exxon’s exploitative deal deprived Guyana of up to US$55 billion’.

“In particular, the government should ensure that the investigation faces no obstacles in obtaining all the evidence it requires. And if the investigation does uncover evidence of wrongdoing, those involved should be held accountable,” it said.

Such a probe would require access to forensic investigators who could follow money transfers and the paper trail between the various partners in the oil blocks and government officials.

SARA

Stabroek News has reached out to Head of the recently disbanded State Assets Recovery Agency (SARA), Professor Clive Thomas, for comment to no avail, as Thomas has repeatedly said that he will notify this newspaper when he is ready to speak.

In September of last year, Thomas had told this newspaper that the agency had interviewed several “major players” and should it uncover any malfeasance it will push for the recovery of the Kaieteur and Canje blocks and have them auctioned.

The agency had launched its investigations into the awards following specific information from several “whistleblowers.” Concerns about the deals relate to whether there had been advance knowledge of ExxonMobil’s major find, the first of which was made shortly before the 2015 general elections, and whether that information had been used improperly to tie up new deals.

APNU+AFC had around five years to investigate the deals for the Kaieteur and Canje blocks but failed to do this. Its own 2016 PSA with ExxonMobil was seen as a giveaway and there had been repeated calls for an investigation of that deal and its abrogation.

The Irfaan Ali government has said that it would undertake a review of all oil contracts before deciding on how it will deal with the remaining offshore and other potential oil and gas awards.