In last week’s article, we began a discussion on the operations of the National Industrial and Commercial Investments Ltd (NICIL) in the light of the controversy over its involvement in the leasing and disposal of State lands under questionable circumstances. This was at a time when the Government’s status was that of an interim Administration, following the 21 December 2018 no confidence vote. The Caribbean Court of Justice had advised that in view of its caretaker status, the Government should exercise restraint in its legal authority, implying that no major decisions, such as the disposal of State assets, should be made.

A clarification is necessary. Inasmuch as NICIL was incorporated as a private limited liability company, it is in fact a government company and therefore comes under parliamentary oversight. Section 344 of the Companies Act 1991 defines a government company as one in which ‘not less than 51 percent of the paid-up share capital is held by the Government and includes a company which is a subsidiary of a Government company’. In addition, since its incorporation until 2002, NICIL received an annual subvention approved by Parliament to meet its operating expenses. Further, by Section 345, NICIL is required to have its accounts audited annually and the related reported presented to the Assembly within nine months of the close of the financial year.

The authorized and paid-up capital of NICIL is $100,000, all fully owned by the Government. The word ‘private’ merely indicates that there are restrictions in the transferability of shares, unlike the case of a public company, such as Banks D.I.H. Ltd. It does not connote that the Government does not have any involvement in the affairs of the company. Indeed, it is the Minister of Finance who is responsible for the appointment of board members. During the period 2002 to 2015, the Minister of Finance was the chairman of the board which also included other key Government officials as well as the former Head of the Presidential Secretariat.

Recap of last week’s article

We traced the history of NICIL’s operations since its incorporation in July 1990 to take over the functions of the Public Corporations Secretariat whose existence came to an end by virtue of the dissolution of the Guyana State Corporation. So far, we have discussed the circumstances under which NICIL was incorporated and its operations to the end of 2001. During this period, NICIL paid over to the Treasury all dividends from public corporations and other companies in which the Government had an interest as well as all proceeds from the Government’s privatization programme as outlined in the Privatisation Policy Framework Paper laid in the National Assembly in 1993. The Paper listed 15 State-owned/controlled entities, or interest in them, that have already been divested, and an additional entities 20 still to be divested.

We also looked at NICIL’s operations post-2001. By virtue of a Management Cooperation Agreement entered into by NICIL, the Privatisation Unit of the Ministry of Finance and the Government, the operations of NICIL and the Privatisation Unit became merged. The Agreement was to remain in force unless the Cabinet decided otherwise, an indicator that once all the entities identified in the Privatisation Policy Framework Paper have been fully divested, the Agreement would come to an end.

With effect from 1 January 2002, NICIL ceased paying over to the Treasury dividends received as well as privatization proceeds and used such funds to finance various projects, such as the Marriott Hotel, the Sparendaam Housing Scheme, Berbice River Bridge and the Amaila Falls project. This was in violation of both Articles 2017 and 2018 of the Constitution that require not only all such proceeds to be paid into the Consolidated Fund but also parliamentary approval via the national budget to incur expenditure on government projects.

NICIL also took on the role of a Project Execution Unit. It received funds from various State agencies to undertake several projects and disbursed such funds either as advance payment or upon the submission of bills/receipts and other supporting documents. NICIL, in effect became a ‘parallel’ Treasury. However, given NICIL’s limited capacity to effectively monitor the execution of these projects, it was not surprising that there was a lack of proper accountability for the funds disbursed.

In today’s article, we continue our discussion on the changing role of NICIL over the years.

Vesting of State property in NICIL

While NICIL is not a public corporation, by Section 66(1) of the Public Corporations Act, the Minister may by notification in the Gazette apply any of the provisions of the Act, with modifications, or such modifications as specified in the notification to any body corporate, not being a corporation, owned by the State or in which controlling interest vests in the State or in any agency on behalf of the State. A notification dated 18 July 2000 was made to the effect that Section 5 of the Act shall apply to NICIL. That section provides for the vesting by order in a public corporation of movable and immovable property upon its establishment. This is to facilitate the commencement of the operations of a new corporation. As NICIL was incorporated in 1990, it is not a new State entity. Therefore, it is not clear how Section 5 could be made applicable to NICIL.

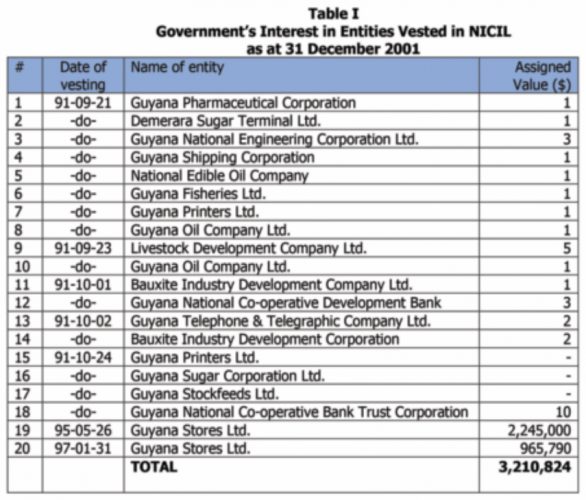

During the period 1991 to 1997, Government’s investments in 19 public corporations were vested in NICIL with assigned nominal values ranging from $0 to $10, except in the case of Guyana Stores Ltd. which was shown at a valuation of $3.2 million as at the end of 2001, as per Table I:

During the period 2002-2014, 35 orders were issued for the vesting of State properties/assets in NICIL. By Order No. 45 of 2008 dated 29 December 2008, 209.343 acres of land at Block LPT lettered XXX were transferred from GUYSUCO to the Government of Guyana. Of this amount, 103.88 acres were transferred to NICIL via Order No. 4/2010 dated 12 March 2010, free of cost. Similarly, on 29 December 2008, 400.340 acres of land at Cummings Lodge, Industry and Ogle from GUYSUCO were transferred to the Government of Guyana, but it is unclear whether any of these lands were formally vested in NICIL.

NICIL acting as an agent for GUYSUCO properties

NICIL acted as an agent for the sale of GUYSUCO properties. A total of 21 properties mainly in Georgetown, East Bank Demerara and West Coast Demerara, were sold to individuals and agencies, including Demerara Bank, Republic Bank, Guyana Bank for Trade and Industry, and Mines Services Ltd.

Disposal of State properties by NICIL

During the period 1995 to 2011, NICIL sold 65 State assets/properties, the titles of which were transferred by way of vesting orders signed by the Minister of Finance, including Sanata Textiles Ltd., Guyana Pharmaceutical Corporation, and some of GUYSUCO lands on the East Coast Demerara that were vested in it. The authority quoted for doing so was Section 8 of the Public Corporations Act which reads as follows:

The Minister may by order transfer to a corporation or to any other person, or place under its or his control the whole or part of – (a) any undertaking or any other property of any other corporation or any other person or other body corporate owned by the State or in which controlling interest is vested in the State or any agency on behalf of the State; (b) any commercial, manufacturing or research undertaking of the State.

However, the notification of 18 July 2000 only refers to Section 5 of the Act dealing with the vesting of State assets/properties in NICIL.

Vesting of assets of the closed sugar estates in NICIL

In mid-2017, the Special Purpose Unit within NICIL, was established by Cabinet decision with responsibility for the disposal of all of GUYSUCO’s assets, except those of Albion, Blairmont, and Uitvlugt Estates. By order dated 29 December 2017 signed by the Minister of Finance, these assets were vested in NICIL ‘absolutely, free and clear from all claims and liabilities’. The order cites Sections 8 and 11 of the Public Corporations Act as the Minister’s authority for doing so. Section 8 has already been discussed. Section 11 deals with reconstituting any public corporation or other body corporate; merger of two or more corporations; transferring to a corporation or placing under its control whole or part of undertaking; and dissolution of a corporation. Although the notification of 18 July 2000 refers to Section 5, both Sections 6 and 11 appear to be applicable. Section 6(2) states that:

Any body corporate owned by the State or the controlling interest in which vests in the State or any agency on behalf of the State, may be reconstituted under this Act by the Minister by order and there upon the reconstituted body corporate shall be deemed to have been established as a corporation under this Act…

In mid-2018, NICIL secured a $30 billion bond arranged by the Republic Bank to recapitalize GUYSUCO and the bring it back to profitability, based on GUYSUCO’s strategic plan. The lending rate is 4.75 percent and bond is for five years. However, there is disagreement between the two entities in relation to how the funds should be used. With the Government guaranteeing the repayment of the bond, the public debt to GDP ratio is likely to be adversely affected.

To be continued –