Editor OilPrice.com October 20, 2020

While the deeply impoverished South American country of Guyana is attracting the lion’s share of attention when it comes to oil, it is neighbouring Suriname where the next major petroleum discovery could occur.

ExxonMobil’s raft of discoveries in offshore Guyana, including the latest Redtail-1 find – its 18th offshore discovery in the impoverished former British colony – underscores the considerable potential held by the Guyana-Suriname Basin. The growing regional importance of Guyana and Suriname’s burgeoning oil boom was highlighted by U.S Secretary of State Michael R Pompeo visiting both countries last month. That visit was designed to show support for the newly elected leaders of both countries after they experienced political turmoil and crises. It was in early August that Irfaan Ali was sworn in as Guyana’s president after a tense and long standoff with outgoing president David Granger, who had declared victory after the March 2 election. It was early July when Suriname’s parliament chose former police chief and justice minister, Chandrikapersad Santokhi to replace Desi Bouterse who is facing murder and narco-trafficking charges. U.S energy majors, notably Exxon and Hess, have taken the lead in exploring and developing offshore Guyana while Apache is seeking to replicate their considerable success in Suriname. Those political crises, increasing Russian influence in Venezuela, and growing investment from U.S energy majors emphasizes why the U.S needs to strengthen its relationship with the deeply impoverished South American countries.

The considerable oil potential of the Guyana-Suriname Basin, which the U.S Geological Survey estimates to hold almost 14 billion barrels of crude oil and 32 trillion cubic feet of natural gas, makes both countries important geopolitical prizes. Russia’s growing relationship with the Maduro regime in neighboring Venezuela, along with Iran assisting Caracas with defeating sanctions, underscores Guyana and Suriname’s geopolitical importance. Apache and partner Total made three oil discoveries in Block 58 offshore Suriname since the start of 2020. These were the Maka Central-1 well in January, April’s Sapakara West-1 well, and the Kwaskwasi-1 well in June. Apache expects to replicate Exxon’s success in offshore Guyana in Suriname. Malaysian energy major, Petronas, roughly one week ago, spudded the high-profile Sloanea-1 exploration well in its Block 52 Offshore Suriname. It is anticipated that this well will replicate Apache’s success. In May 2020, the company announced it had inked a farm-out deal for Block 52 with Exxon, the world’s third largest publicly traded oil company, buying a 50% interest in the block. That places Exxon in an ideal position to leverage off the expertise and experience gained in offshore Guyana.

Those events, along with the installation of a new democratically elected President and Paramaribo’s focus on developing Suriname’s vast petroleum potential will attract further offshore investment leading to additional major petroleum discoveries. Earlier this year, Suriname’s national oil company raised $150 million from a bond issue to fund its 2020-2027 investment program and fund the $99 million of debt instruments which matured during May 2020. In response to the March 2020 oil price crash and the COVID-19 pandemic, Staatsolie slashed annual spending to $20 million and wound-down its drilling program to 30 wells this year rather than the 96 it had originally planned. The national oil company’s focus is onshore Suriname with offshore blocks being awarded to international energy companies. In July 2020 a Staatsolie representative stated a key reason for winding back investment in its onshore properties was: “We are preparing for the moment when a decision should be made to invest in participation in offshore oil production in Block 58, together with Apache and Total.”

It is Suriname’s offshore blocks which hold the most potential, as Exxon’s experience in offshore Guyana demonstrates. There have been a variety of breakeven prices for oil production in Guyana. The CEO of Hess Corporation stated in February 2020 that production at the Stabroek block it shares with Exxon, will breakeven even at $35 per barrel Brent. That price is expected to fall further as infrastructure is developed, drilling technology improves and technical knowledge develops.

Guyana ranks at the lower end of the global scale for breakeven prices with the Middle East the lowest where they are believed to range from $19 to $27 per barrel pumped. This makes Guyana an attractive investment jurisdiction for international energy majors, particularly when it is considered that the offshore breakeven price is less than many other locations in South America. Nearby Colombia, which is Latin America’s third largest oil producer, pumps each barrel at an average breakeven of $40 to $45 Brent, while Argentina’s Vaca Muerta, touted as the world’s next hot shale play, has breakeven prices of over $50 for new projects.

The growing demand for light crude will also amplify offshore Suriname’s attractiveness. Around the world there is a growing push for low sulfur fuels as governments push to meet global warming emissions targets and reduce environmental damage. That triggered an uptick in demand for light sweet crude oil, because of its low sulfur content and cheaper refining costs. Apache’s offshore Suriname discoveries were found to be light sweet crude. Oil at the Maka Central-1 discovery was determined to have an API of 40 to 60 degrees at 50 meters and 35 to 40 degrees at 73 meters. The Sapakara West-1 well’s crude had an API of 35 and 40 degrees at 30 meters and 40 to 45 degrees at 36 meters. The latest July 2020 find at the Kwaskwasi-1 well was found to have API gravities of 34 to 43 degrees. Those API gravities make those discoveries attractive to develop, particularly once the potential for low operational breakeven prices is considered.

Suriname is on-track to repeat Guyana’s success, especially with Exxon moving ahead with the recently approved offshore Guyana Payara development and taking a 50% interest in offshore Suriname Block 52.

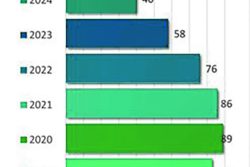

That will see additional infrastructure and expertise brought into neighboring Guyana which can be leveraged for developing blocks in offshore Suriname. Investment bank Morgan Stanley believes offshore Suriname could hold up to 6.5 billion barrels of crude oil. When coupled with the increasing likelihood of low breakeven costs and lower geopolitical risk since Chandrikapersad Santokhi was inaugurated as president, Suriname is becoming an especially attractive jurisdiction for international oil companies. Once oil prices recover, with some institutions including Goldman Sachs and Bank of America predicting $60 to $65 Brent during 2021, offshore Suriname will become the next hot play in South America. That will be a boon for an impoverished country which has been battered by the COVID-19 pandemic. The IMF estimates Suriname’s economy will shrink by 13% during 2020, compared to neighboring Guyana’s expanding by an impressive 26% because of its oil boom.