Former Auditor General Anand Goolsarran says that the overdraft on the Consolidated Fund – the state’s main account – is vastly understated.

In his weekly column in the January 4th edition of Stabroek News on the 2019 report of the Auditor General on the public accounts, Goolsarran queried the veracity of the figures.

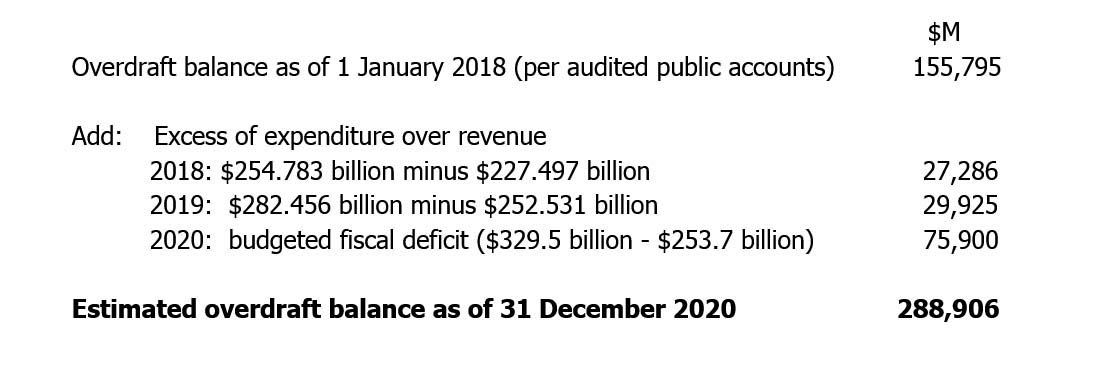

He noted that the Statement of Assets and Liabilities of the Government showed that the Consolidated Fund was overdrawn by $124.288 billion as of 31 December 2019. Further, at the end of 2017, the overdraft was $155.795 billion, a reduction of $31.507 billion despite the fact that Government recorded fiscal deficits of $27.286 billion and $29.925 billion for the years 2018 and 2019, as per the Minister of Finance’s end-of-year reports.

Goolsarran asserted that taking this into account, the overdraft on the Consolidated Fund should have been $213.006 billion, a whopping difference of $88.718 billion.

He pointed out that in 1993, the Monetary Sterilisation Account was established at the Bank of Guyana into which the proceeds of medium-term (182- & 365-day) Treasury Bills are deposited and out of which payments are made as the Bills mature. He cited the notes to the 2019 public accounts on the purpose of the account.

“The purpose of the Sterilisation Account is to remove excess liquidity from the financial system. The vehicle for performing this is that Government issued 182 and 365 day Treasury Bills. The cost to the Government is the interest charge on the redeemed T-bills as they come due. This is a statutory cost charged to internal interest expense. The Monetary Sterilisation Liability should be exactly offset by the Monetary Sterilisation Bank Account, creating a fully funded Liability”.

As of 31 December 2017, Goolsarran said that the Sterilisation Account showed a positive balance of $77.537 billion.

“However, at the end of 2018, the balance was reduced to $21.558 billion with a further reduction to $1.880 billion as of 31 December 2019. This significant reduction was mainly due to the proceeds from the … issuing of the 182- and 365-day Treasury Bills being deposited into the Consolidated Fund, instead of the Monetary Sterilisation Account”, he noted.

Goolsarran added that the Auditor General quite correctly raised this matter as a concern at which point the Ministry of Finance contended that the Minister is empowered under the Fiscal Management and Accountability (FMA) Act to seek funding by way of borrowing in order to reduce the overdraft on the Consolidated Fund and that the issue was more related to bridging a fiscal gap and had no relationship to monetary policy which fell under the remit of the Bank of Guyana. The Ministry cited Section 61 which stipulates that proceeds of any such borrowing by the Government shall be paid into the Consolidated Fund.

Overlooked

Goolsarran however contended that the Ministry overlooked the fact that while Section 60 allows the Minister to approve the use of advances in the form of an overdraft on an official bank account to meet shortfalls during the operation of the annual budget, all such advances have to be repaid before the end of the fiscal year. In addition, Goolsarran said that contrary to the claim by the Ministry, the issuing of medium-term Treasury Bills has more to do with the monetary policy of mopping up liquidity, and not to finance budgetary shortfalls, hence the rationale for the creation of the Monetary Sterilisation Account.

Goolsarran said that in his article of 9 December 2018, he had stated that the overdraft on the Consolidated Fund was estimated at around $210 billion at the end of 2019.

“The then Minister of Finance took us to task and queried the source of our information. He stated that the Bank of Guyana had advised that the overdraft was $62.2 billion as of 7 December 2018. We responded in our article the following week by referring to the audited public accounts for the years 1992 to 2017; the analysis we had carried out (including the presentation of a table as well as a graph); and the Minister’s signature on the Statement of Assets and Liabilities as of 31 December 2017 attesting to the overdraft on the Consolidated Fund of $155.795 billion. We had also emphasized that the Bank’s advice was in relation to the net balance of Government deposits held by the Bank, which balance included the amounts held in the Monetary Sterilisation Account as well as in other government accounts that are not part of the Consolidated Fund”, Goolsarran said in his column of January 4th this year.

Since then, Goolsarran said that there was no further word from the Ministry as regards the overdraft on the Consolidated Fund.

He asserted that while the notes to the public accounts specifically state that the accounting policy for medium-term Treasury Bills is for the proceeds to be deposited into the Monetary Sterilisation Account in order to create ‘a fully funded liability’; such deposits were placed to the credit of the Consolidated Fund in violation of that policy. He said that this raises the important question as to whether this action was not an attempt to mask the true extent of the overdraft on the Consolidated Fund.

“We maintain our previously stated position that the overdraft on the Consolidated Fund at the end of 2017 was $155.795 billion. Considering the reports of the Auditor General for the years 2018 and 2019, that overdraft has been estimated to increase to $213.006 billion as at the end of 2019. When the budgeted fiscal deficit for 2020 is taken into account, the overdraft on the Consolidated Fund as of 31 December 2020 is estimated at $288.906 billion, as shown below”: