The Banks DIH Group has reported a 15.7% rise in after tax profit for 2020 even amid challenges from the COVID-19 pandemic.

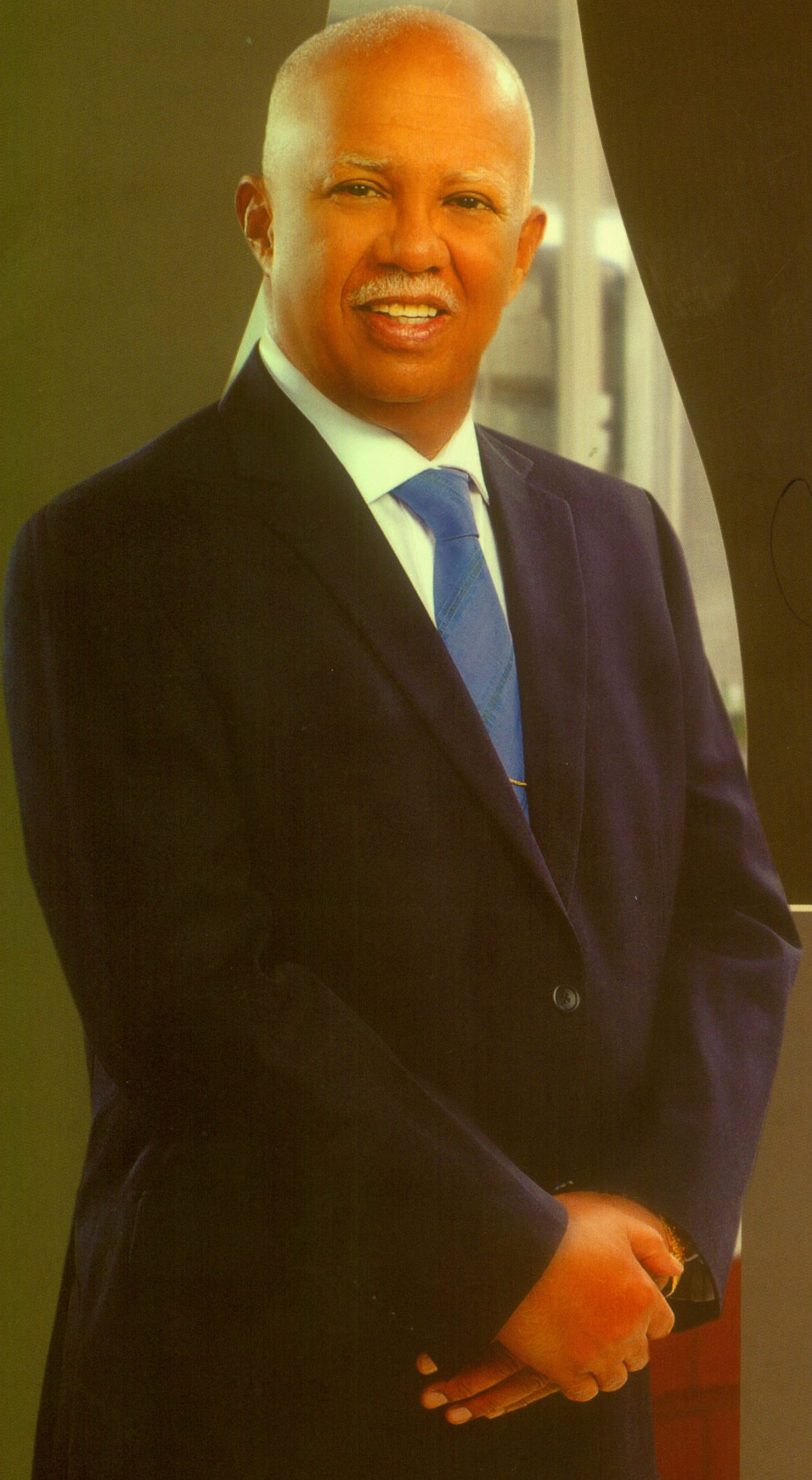

In his Chairman’s address in the 2020 annual report, Managing Director Clifford Reis said that profit after tax attributable to shareholders of the beverages and food company was $5.66b compared to $4.897b in 2019 – a rise of $769m.

He said that the group’s net asset value per share rose from $45.25 to $50.89 – an increase of 12.5%.

As a consequence the Board of Directors of the company has recommended a dividend of $1.35 per share unit. This is to be considered at its Annual General Meeting (AGM) on Friday, January 29th at Thirst Park. As a result of COVID rules this meeting will be different as only a small number of shareholders’ representatives will be present. The AGM is to be conducted in accordance with a court order. Shareholders will be able to observe the proceedings virtually.

Citizens Bank Inc.

Citizens Bank Guyana Inc. which is a 51% owned subsidiary of Banks DIH, also reported increases in revenue. When compared to $3.422 billion as revenue generated in 2019, Citizens Bank reported its revenue intake as $3.749 billion, representing an increase of $327 million or 9.6%. Profit before tax for 2020 was $1.673 billion compared to $1.599 billion in 2019, an increase of $74 million or 4.6%. Profit after tax (2020) was $982 million compared to $955.3 million (2019), an increase of $26.9 million or 2.8%.

The earnings per share was $16.51 while the total asset base was $63.8 billion. Loan Assets were increased from $29.8 billion to $31.7 billion reflecting an increase of 6.4% or $1.9 billion.

Banks Automotive and Services Inc.,

Banks Automotive and Services Inc., a 100% wholly owned subsidiary generated revenues of $78.2 million; the Profit before Tax was $8.6 million.

Dividends

The Board of Directors declared a first interim dividend of $0.30 per share unit which was paid on May 28, 2020. A second interim dividend of $0.30 per share unit was also paid on October 26, 2020. The Board of Directors now recommends that a final dividend of $0.75 per share unit or an overall cost of $1.147 billion, an increase of $161.5 million or 16.4% over the previous year.

Capital Expenditure

The Chairman also reported that under the period in review, capital projects were undertaken within the production and related facilities enabling a more efficient conversion of raw materials into finished products, which realized better efficiencies and operational controls.

The capital projects cited within the 2020 report included relocation of the Liquor Warehouse to Thirst Park and expansion of the stores to accommodate increased and improved storage. Roofing areas across Thirst Park were upgraded or replaced; new processing, baking and packaging equipment were installed on the biscuits and cone biscuit plants. Rum production facilities were upgraded with new bottle rinsing and capping equipment and chilling and storage capacities. Power generation was enhanced with the acquisition of a new Cummins generator, transformers and a fuel purification system for the Central Services boilers.

New LPG forklifts and trucks were acquired to enhance distribution channels across the company; the Selling and Marketing Functions were improved with the introduction of additional ice-cream freezers, beverage coolers and bottled water dispensers. Additionally, the company’s ICT capacity was upgraded with the installation of new hardware and software systems.

The report also commented on Capital Projects that had commenced at the time of the report, and will be completed in the new financial year (2021). These include beer bottling and soft drinks upgrades, installation of the new CIP system for the rum factory and winery. The installation of additional records storage facilities, and the completion of the new motorized truck washing facilities with the continuing construction of the multi-level parking facility which will be the headquarters for the new Banks Automotive and Services Inc.,

In his report, the Chairman reported on newer and varied challenges for the Year 2020, with the COVID-19 pandemic identified as notable amongst others. The report cited mitigating measures that were deemed a success largely through the efforts of team work and commitment.

Consequent to the onset of COVID-19 pandemic in March, 2020 Banks DIH implemented a company-wide schedule to mitigate its effects. Measures that were implemented were – the creation of sanitizing and washing stations at entry points and designated areas within the company’s facilities; recording of temperatures, fogging and sanitizing of office spaces, production areas and vehicles. The services of the company’s industrial nurse were co-opted to monitor the health status of staff members and oversee quarantining measures, if necessary.