Introduction

In today’s column I begin my appraisal of revealed adverse impacts of the 2020 global general crisis, as I have specified this term and its footprints, on the performance of Guyana’s infant oil and gas sector last year and going forward into the future. My aim is to treat with both the near- to- medium term outcomes; and more speculatively beyond that. To recall, this is the third task that I have set for my announced summary recapitulation cum overview of my already lengthy appraisal of the 2020 general crisis and its impacts on the country’s infant hydrocarbons sector, which I started way back in an introductory column on March 22, 2020. The task indicated here will take a couple of columns to accomplish.

For starters, I urge readers to recall that I went to great pains in my introductory, March 22, 2020, column to make it abundantly clear that, my description of Guyana’s oil and gas sector as “infant” is deliberate. Indeed, it is intended to be taken literally. It is frequently forgotten that the initial goal of the lead contractor group, ExxonMobil and partners, was to commence commercial sale during Q1, 2020.

However, Guyana’s crude oil production for sale was ahead of schedule. This started just over a year ago, on December 20, 2019. Natural gas production, though, is yet to be commercialized for sale. Thus far, produced natural gas has been either flared or re-injected into the wells/ reservoirs.

2020 Performance

The data reveal without any lingering doubt that, as of early 2021, the 2020 general crisis has been accompanied with “much impeded performance” of Guyana’s oil and gas sector last year. Crude oil output over the year has only averaged between about 30,000 to 65,000 barrels per day, bpd, which is considerably down from the operator’s initially projected target of 120,000 bpd. Indeed, that target was only achieved in the closing days of 2020. Moreover, the macroeconomic Authorities (IMF and Government of Guyana, GoG) had modeled Guyana’s oil and gas sector in 2019 on the basis of a daily output of 102,000 barrels of crude oil per day and the contractor at 120,000 barrels per day.

The poor production/output outcomes in Guyana’s oil and gas sector can be mainly attributed to three crisis effects. These are; 1) start-up mechanical problems (compressor design and failure), which the COVID-19 pandemic component of the crisis had impeded speedy correction, maintenance and repairs; 2) the pandemic’s adverse effect on the scheduled deployment of the work crews, both local and foreign, to their offshore work sites (This is attributable to social distancing and health entry requirements); and 3) regulatory delays, particularly those affecting proceeding with the Payara project

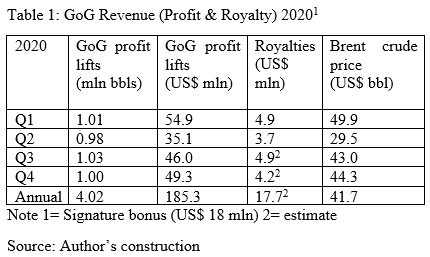

From the outset the Department of Energy, DoE, had projected the GoG profit share for 2020 distribution at uplifting five crude oil shipments, in roughly equal allotments of around one million barrels of crude oil under the Production Sharing Agreement, PSA. However, for 2020 the GoG has only received four of the five originally projected lifts. Relatedly, Guyana did not hedge its crude oil sales on the world market last year, thereby exposing such sales to market variations. Further, the Department of Energy, DOE, has indicated that crude oil sales will be based on the ruling Brent price for the day, until Guyana’s crude oil specifications are firmly established in the market place.

The data show the crisis has led to a dramatic decline in the 2020 crude oil price. Readers should remember the price in 2018 was more than US$71, and briefly fell into a negative value in Q2 2020. It ended the year averaging US$42.

A price of approximately US$55 per barrel was earned on Guyana’s first cargo sale followed with prices of US$35, US$46 and US$49, respectively, in the following quarters. As earlier indicated, no natural gas has been commercially disposed of to date; all the gas so far has been flared or re-injected into reservoirs. Reported earnings from oil and gas, which have been assigned to date into the Natural Resources Fund, NRF, are: 1) about US$185 million earned from the sale of four profit oil cargo lifts in 2020; and 2) the two percent royalty payment of about US$18 million for 2020, which I have estimated from quarterly receipts obtained in H1 2020 from oil produced.

Clearly the expectation is for improved oil prices in 2021. Higher royalty receipts are also anticipated as production increases to meet the 2025 target of 750,000 bpd. Certainly, there are no signs of any intended output cuts from the lead contractor, Exxon Mobil and partners. The first two wells to be exploited, Liza 1 and Liza 2 are on schedule, with the third, Payara officially approved after a delay.

These data are shown in Table 1 below.

Table 1 reveals the quarterly and annual performance of Guyana’s four crude oil cargo lifts, quantity and value. These amounts are 4.02 million barrels of oil for a value of US$185.3 million. The average barrel earned US$46 approximately. This is about US$ 4 above the Brent crude price, average spot. The estimated royalty received is US$ 8 million; the same as the signature bonus

Conclusion

Next week I continue this appraisal, which has focused thus far, on the adverse crisis impacts on the price and quantity of Guyana’s crude oil sales. This was modeled by the Authorities in 2019 at an output of 102,000 barrels a day at a price of US$64 per barrel.