As the global price for crude oil continues to rise steadily, Guyana has received the highest rate since petroleum production began offshore in December of 2019, averaging US$61 per barrel on its latest and fifth lift of one million barrels.

Government yesterday also announced that over US$267m has accrued to the country inclusive of royalty. The government said that this money was “received into the Natural Resources Fund Account”.

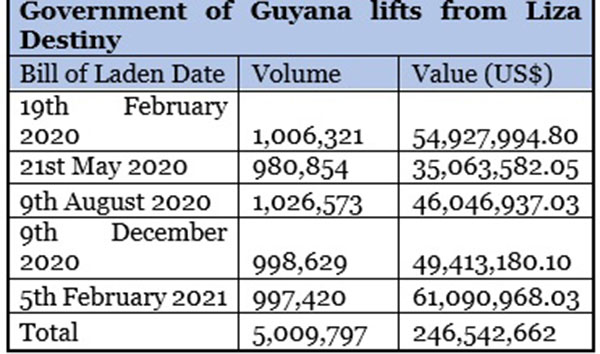

“On February 05, 2021, 997,420 barrels of oil were lifted from Liza Destiny with a value of US$61,090,968.03 with a grand total to date of 5,009,797 barrels of oil worth US$246, 542, 662,” the Ministry of Natural Resources said in a statement.

Further, it added, “Inclusive of Royalties the total in the Natural Resources Fund Account now stands at US$267,668, 709.12.”

It is unclear what Natural Resources Fund Account the government is speaking of. At last word the money was in the New York Federal Reserve Bank and awaiting the activation of the Natural Resource Fund legislation which the administration is yet to act on despite being in office for more than seven months.

The Brent crude price for the month of February shows that it averaged between US$59.48 and US$61.17 per barrel between February 5th to February 8th 2021. Prices continued to increase gradually daily, reaching its peak of US$69.95 on March 5th but then declined yesterday to around US$68 per barrel.

The Wall Street Journal reports analysts predicting an even bigger increase in the price for oil with Brent prices expected to reach $70 per barrel in the second quarter from the $60 it predicted previously and $75 in the third quarter from $65 earlier.

It said also that Morgan Stanley expects Brent crude prices to climb to $70 per barrel in the third quarter on “signs of a much improved market” including prospects of a pick-up in demand.

Government said that it remains committed to providing updates on oil lifts and sales as may be necessary, to ensure all stakeholders and members of the public are informed.

And as government continues to await the awarding of a contract to a marketer for its oil, Stabroek Block partner Hess continues to undertake the task via spot sale.

Vice President Bharrat Jagdeo had said that the process of selecting a company would be completed by the time this country’s next 1 million barrels share comes around again, sometime in April.

“The last two shipments, what we would have had to do was to get three bids from Hess, Exxon and CNOOC. The bid that won was Hess. They gave the best terms. We don’t know about the shipment in February but all are selling at Brent preference. All are selling at the same price but the difference is in marketing commission etcetera,” he said.

In late September last year, 29 companies responded to government’s retender of the Request for Proposals (RFPs) to market Guyana’s share of oil from the Liza Destiny FPSO and this was reported in the October 1st 2020 edition of the Stabroek News. The submissions followed an announcement by the PPP/C government, after taking office in August last year that it had scrapped the shortlist of 19 companies from the 34 that had participated in the first process under the APNU+AFC government back in April of 2020.

The tenders submitted in April last year came while the country was in the middle of a political crisis and awaiting the results of the March 2nd General Elections. Jagdeo announced last month that 28 of the 29 were deemed non-responsive from the process because of the “nonsensical” inclusion of evaluation of tender documents.

He had said that government was then mulling the removal of the criteria and inviting all companies which submitted proposals to resubmit their documents.

It is unclear when again in April this country is scheduled for its next lift but production offshore continues at 120,000 barrels of oil per day and the three partners ExxonMobil, Hess and CNOOC receive their respective shares on a rotation system followed by Guyana.