The Guyana Revenue Authority (GRA) has dispatched what appears to be a demand letter to SOL Guyana Inc (Sol) directing that more than $3.3 billion in Excise Taxes and interest be paid immediately following a probe into tax exemptions on fuel imports.

The monies, according to GRA derive from Sol’s alleged misuse of the Permits for Immediate Delivery (PID) system by commingling tax-exempted fuel with fuel not exempted or partially exempted so as to avoid paying taxes owed on the required basis. Specifically they relate to the alleged misuse of Tax Exemption letters issued to Esso Exploration and Production Guyana Limited (EEPGL), the ExxonMobil subsidiary operating in Guyana.

“SOL Guyana Inc. utilized EEPGL’s tax exemption letters to import and enter quantities of Gasoil…at a lower rate of Excise Tax, and failed to deliver the full amounts to [EEPGL] as required…This act in itself is a flagrant disregard of the laws administered and the Revenue Authority will not condone and allow the government revenues to be used as ‘turn overs’ or in any such manner,” the letter dated March 9 maintains.

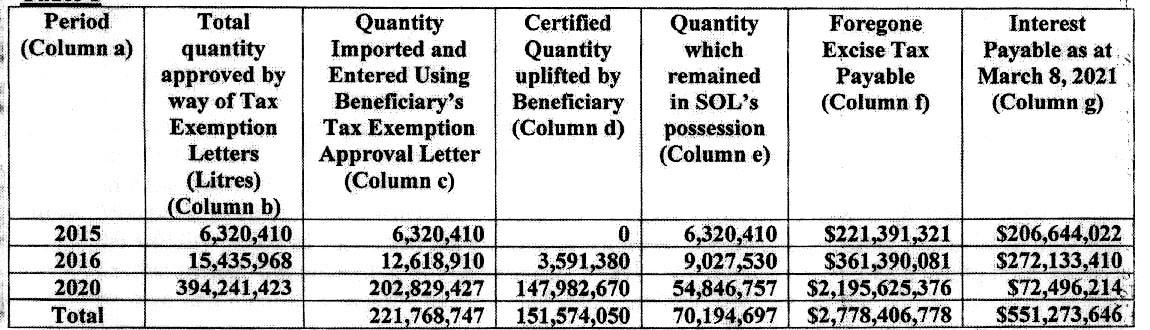

According to the missive seen by Stabroek News, Sol in 2015 imported 6,320,410 litres of fuel for EEPGL but none of this fuel was uplifted by the oil company within the legally prescribed time period. In 2016, a total of 12,618,910 litres was imported for Exxon but only 3,591,380 was uplifted in the required time period while in 2020 a total of 202,829,427 litres was imported and only 147,982,679 litres uplifted.

In total Sol is alleged to have retained 70,194,697 litres of fuel over the three years referenced. The letter explains that $2.8 billion in Excise taxes is owed on that amount while $551 million in interest is owed on the debt.

The letter signed by Deputy Commissioner in charge of the Law Enforcement and Investigation Division (LEID), Jason Moore acknowledges that quantities of fuel in excess of that which was approved may have been imported at duty paid price and delivered to EEPGL at duty free price but maintains that this was an action taken to Sol’s own detriment.

“To engage in such [an] act and dictate the Revenue Authority to adjust its record to possibly offset against additional quantities sold/delivered at duty free price (more than the actual amount respectively approved as duty free by the Authority), would be tantamount to your company having the authority to, among others, grant approvals and extend the validity period of the tax exemption letters,” Moore writes.

However an olive branch is offered in light of the precedent set in a similar case relating to the BOSAI mining company.

Moore indicates that the Authority may upon further review allow Sol in this case only to recoup on the quantity of 57,555,666 litres which may have been imported and entered at duty paid price and delivered to the beneficiary at the duty free price, provided this is proven.

On March 7 Sol had denied the GRA accusations.

“(Sol) is aware of recent statements alleging that fuel importers, including Sol, have abused duty exemptions in Guyana. Sol categorically denies these false, highly misleading, and damaging allegations,” the company’s statement said.

It underscored that the company holds strong to its “core values of Integrity, Respect, Safety and Community” and they are the pillars of its operations.

Sol said that it has worked with the GRA collaboratively and has systems in place to ensure its compliance at all times.

“We have worked collaboratively with the Guyana Revenue Authority and want to assure our customers, partners, and the people of Guyana that we have robust procedures in place to ensure that we remain in compliance with our duty obligations as well as our other legal and corporate social responsibilities,” the company stated.

“As part of its assurance process, Sol has commissioned an independent third party to conduct a verification and reconciliation of its duty position, which confirms Sol is current and compliant with duty exempt importation regulations,” the company said.

“Sol is proud to be a safe and reliable supplier of fuels and energy solutions to the people of Guyana, and will vigorously defend the strong reputation it has built over many years against libelous and damaging statements,” it added.

Approached

Stabroek News had previously reported that the GRA had approached Minister with responsibility for Finance Ashni Singh and Attorney General Anil Nandlall to institute legal proceeding against Sol so as to recoup monies owed the entity for misuse of the PID system.

A letter from Commissioner General Godfrey Statia dated March 2 explained that it was the practice of the Revenue Authority for several years to allow the major oil companies (mainly SOL, Rubis and GUYOIL) to import and enter tax exempted fuel for various businesses who benefitted from partial or full exemptions on fuel.

“On so doing, the oil companies are required and expected to, inter alia, deliver the full exempted quantities imported and entered to all such beneficiaries, which the beneficiaries are expected to utilise for the intended purposes,” he wrote.

However, a 2017 investigation and reconciliation by the Law Enforcement and Investigation Division (LEID) of the GRA found that the PID system was being misused as oil importers were utilising exemption letters to clear PIDs without regard to whom the fuel was destined for, i.e., whether the fuel was fully exempted, partially exempted, or subjected to the tax.

An explanation that the fuel was held in “virtual tanks” for delivery to the beneficiaries showed that there was commingling and the oil importers were abusing the system since not all exempted fuel cleared by the importer was being cleared by the beneficiary, thus allowing the oil importer to benefit from increased cash flow by not paying the government on the required basis.

Both LEID and the Customs, Excise and Trade Operations conducted a reconciliation which indicated that while all three major oil importers were allegedly involved, Sol was allegedly engaged in the practice to a major extent.

It was found that oil importers had imported and entered the fuel at duty free rate using the beneficiaries’ tax exemption letters, but failed to deliver the full quantities to the beneficiaries.

Letters held by the Guyana Gold and Diamond Miners Association were used to avoid payment of $482 million in taxes, Bosai’s letters were used for $606 million in un-acquitted exemptions, $53 million for Aurora Gold Mines and $61 million for Rusal.

A specific example is referenced where for the Period January 1 to September 30, 2020, a total quantity of 34,554,080 litres of Gas Oil was imported and duty entered by SOL Guyana Inc. using both Bosai companies’ tax exemption letters with references (named).

Of this quantity, certified records submitted by SOL Guyana Inc. and both Bosai companies revealed that only the accumulated quantity of 20,691,379 litres was delivered to the beneficiaries. This meant that the balance of 13,862,701 litres should have remained in SOL’s possession,” he explained.

“To this effect, and based on the incontrovertible evidence obtained, the Revenue Authority demanded the forgone Excise Tax in the sum of six hundred and six million, nine hundred and seventy-eight thousand, three hundred and sixty three dollars [$606.9M] on the 13,862,701 litres of Gas oil which was imported, duly entered free of Excise Tax and was not delivered to both Bosai companies to be utilized for the intended purpose,” the March 2 letter indicated.

It further noted that in an email, late last November, SOL had accepted liability but said that in the past it had supplied an excess to the company without the requisite exemption letters.

“The alleged quantity (24M litres) stated in paragraph 4 above when reconciled was found to be only 20.3M litres, clear evidence that SOL Inc. , does not keep adequate records of acquittal,” the letter says.

GRA officers, according to the agency’s Head, are currently examining Bosai’s Exemption records to see whether the company acquitted fuel from other importers in 2018 and 2019, since they were in receipt of exemptions during the period claimed.