Businessman Mohamed Shaw Jahan has filed a suit against the Guyana Revenue Authority (GRA) to have a Toyota Land Cruiser he imported be classified for commercial use and not as a private passenger vehicle.

The implication of the classification by the GRA, he says, requires him to pay almost $14 million in taxes, as opposed to $1.8 million if the vehicle is classified for the transport of goods.

Saying that he cannot afford to pay the large sum, Jahan is asking the court to make a number of declarations and grant him several orders, including to prohibit the Commissioner General from making any assessment of duties or taxes payable in respect of the vehicle under what he says is “the drastically higher taxation scheme applicable” to a vehicle principally designed for transporting people.

He also wants the court to compel the Commissioner to take all necessary steps to have the vehicle reclassified for the transport of goods, and to specifically assess the taxes and duties accordingly, which he says would amount to the total sum of $1,871,457 he has already paid.

Jahan wants the court to declare the classification done by the GRA as being, among other things, unreasonable and irrational, and to reclassify it.

The final order being sought by the businessman is for the Commissioner General and the Revenue Authority (the Respondents) to compensate him for the storage fee he owes John Fernandes Ltd for the past three months and which he said he is being charged daily.

Jahan (the Applicant) wants aggravated and exemplary damages as well for what he describes as the “unlawful, highhanded abuse of power and oppressive and unfair conduct” of the Respondents.

He said it is their “unlawful conduct” that has caused a delay in him clearing the vehicle and why they should be made to pay the storage fee owed.

Jahan also wants court costs and any further order the court may deem just to grant.

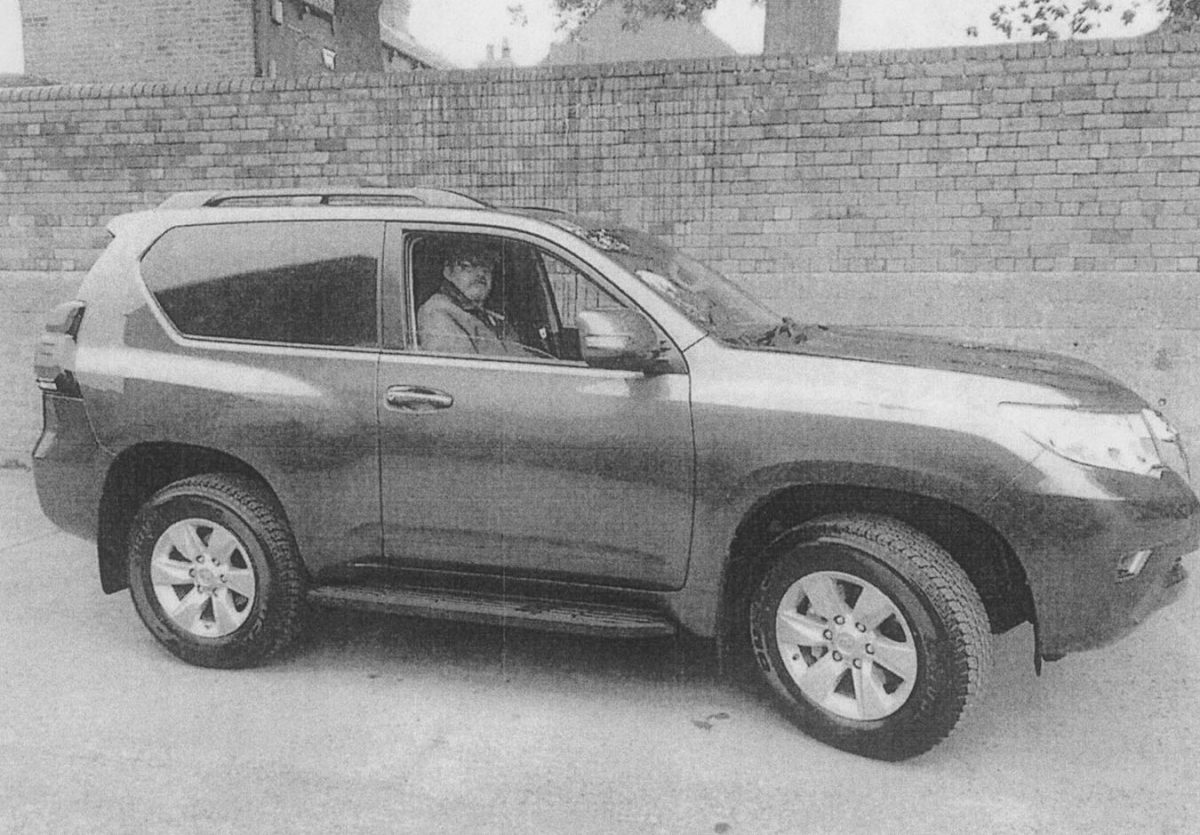

In his application, Jahan said he imported the vehicle, styled by its manufacturer as a “Land Cruiser Commercial Utility Van” from the United Kingdom, which he purchased to assist him in ferrying goods for his business.

According to him, the vehicle has

features characteristic for being used for the transport of goods in accordance with the Customs Act.

Listing the features consistent therewith, Jahan said that the vehicle has only two doors, two seats, only two ventilation windows, a cabin for the driver and passenger and an area behind the driver separated by a metal barrier.

Additionally, he said the rear comprises a distinct flatbed cargo area with a bare tray, devoid of comfort features such as carpeting, ventilation and seatbelts. He said, too, that it has a 2,800cc diesel engine which is slow but capable of fetching and hauling heavy loads.

These features, he said, are recognized by the Act as being indicative of a vehicle used for the transport of goods.

Jahan argues that it is these very features which are used in determining whether a vehicle is to be classified for goods and in fact are relied upon by the GRA to decide on issues of classification as they occasionally arise.

Jahan said that he cannot afford to pay what he described as the “burdensome” taxes under the “less favourable taxation regime.”

He goes on to depose that from December 28 last year the vehicle has been on the John Fernandes wharf, where it has been exposed to the elements, without proper security and incurring daily storage costs.

The businessman said that the misclassification by the GRA goes against its own policy and is without legal foundation and authority.

Attorney Siand Dhurjon said that his client’s claim has national significance because the GRA’s policy on goods-vehicles appears to be arbitrary and not applied equally for the benefit of all.