Another one of Republic Bank’s customers is calling for the bank’s swift intervention to retrieve money that has gone missing from his account due to unauthorised online transactions and the bank in a public notice has since announced that transactions proven to be fraudulent will see reimbursement.

According to the customer, Samuel Whyte, he discovered close to $270,000 missing from his account and upon further checks with the bank he was able to confirm that his account was hacked.

Whyte explained that he observed something was amiss on Thursday after making a withdrawal from his account via an ATM. Upon retrieving his receipt he was stunned at the remaining balance since it was lower than what he knew should have been there.

Republic Bank in a page two advertisement in the Stabroek News yesterday said that the bank has detected suspected fraudulent online payment activities at some global merchants online.

“Republic Bank assures its customers that affected accounts with transactions proven fraudulent will be reimbursed the sums withdrawn. This process is in keeping with existing standard global practices for disputed international debit card transactions,” the bank assured as it apologised for the inconvenience caused.

In a bid to prevent any recurrences, the bank has since introduced enhanced security measures.

According to the bank, whenever there are identified cases of customers’ cards being compromised and accounts debited, it will contact those customers to alert them. It has since implemented a system where it will also facilitate cancellation of cards and free replacement.

Customers were encouraged to actively monitor their account activity via statements of account, RepublicOnline, or RepublicMobile, and contact their nearest branch to validate any transactions suspected to be fraudulent.

Whyte, a freelance journalist from Berbice said that when he visited the bank, he was informed that they will have to investigate the matter with the VISA card company.

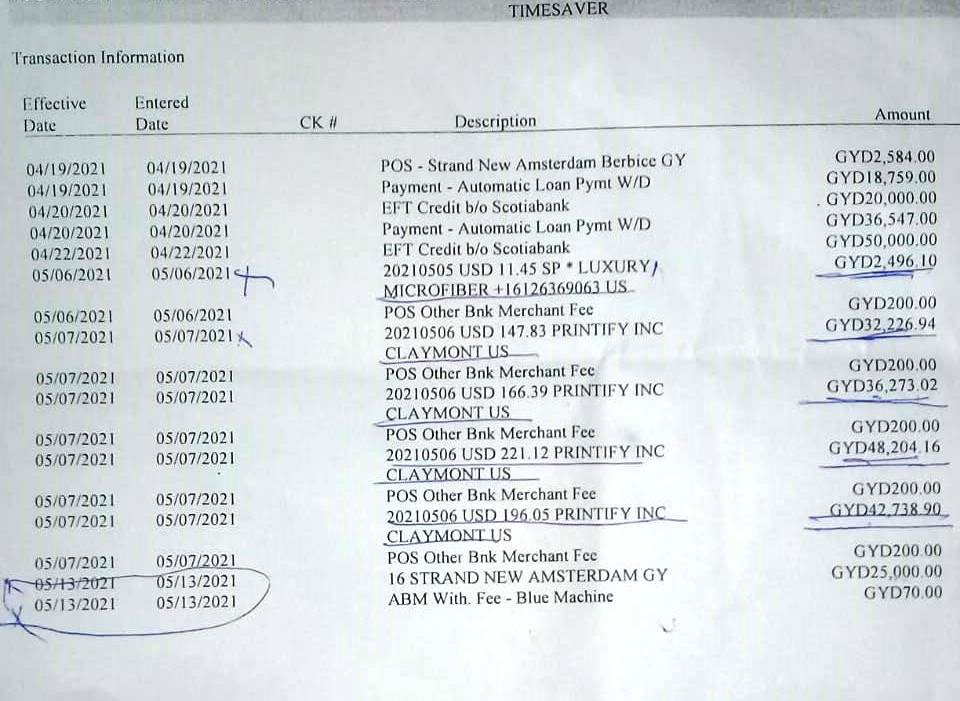

He noted too that the bank was attempting to stop transactions totalling $108,000 and recover the amount. All of the transactions occurred during the course of this month with the highest totalling $48,204 towards Printify Inc, Claymont, US and the lowest transition being made to Luxury Microfiber of $2,496. With every transaction, Whyte was billed $200, the standard fee for international transactions.

Whyte is hoping that the bank can conclude its investigation swiftly since some of the money in the account is not his and the remainder is to pay for his medical bills.

“All of the money is not even mine and some has to be used to assist me with my medical conditions. I cannot afford to lose all of this money. I have medical cheques and bills I have to deal with regularly. This whole thing now puts me in a jam,” he lamented as he expressed shock over his discovery.

Just two weeks ago, Kellon Rover, a Communications Officer at the Department of Public Information, discovered $200,000 missing from his account after attempting to make a withdrawal at the end of April.

The discovery came as a shock to Rover, who stated that he had never used his account or card to shop online.

“I’ve never purchased anything online with my card and they even hinted that someone took my card and did transactions,” he said, while adding that it would not have been possible for him as he had never even uncovered the CVV (Card Verification Value) number at the rear of the card until that day. The CVV number is necessary for the completion of transactions online.

As a result, he was subsequently given a hardcopy of the statement which did not show exactly what was purchased but gave transaction dates and amounts. These statements, which were seen by this newspaper, showed over 100 transactions which came with a banking fee of GY$200 per transaction. It also showed that a majority of the purchases were made on AliExpress, London, with most of the transactions being made on April 27, 28, and 29.

A few other transactions were discovered prior to those dates being made at Walmart and Wish.com among others. The transactions ranged between $1,000 and almost $5,000.

Republic Bank has been forced to reimburse millions to hundreds of its customers due to unauthorised online transactions that resulted from the compromising of their VISA debit cards in recent years.

In 2019, the bank had said there was a spate of “Brute-Force” attacks which resulted in fraudulent transactions through its international VISA OneCard.

The bank had explained then that such attacks were a trial-and-error method used by fraudsters to obtain, within seconds, payment card information, such as an account number and card expiration date.

“Once that information is obtained, the fraudsters attempt numerous transactions at online merchants globally,” it had said.

In the following year, the bank once again announced that some of its customers’ accounts had been compromised and their accounts debited as a result of fraudulent online card payment activity.