Last Thursday, Britain issued a travel ban on Equatorial Guinea’s Vice-President Teodoro Obiang Mangue. His UK assets have also been frozen. Obiang is accused of misappropriating millions of dollars to fund a lavish lifestyle that includes luxury mansions, private jets and a US$275,000 glove worn by the late Michael Jackson. He bought a US$100 million mansion in Paris, a US$38 million private jet, a luxury yacht, and dozens of luxury vehicles including Ferraris, Bentleys and Aston Martins. In 2016, the Swiss authorities confiscated a collection of luxury cars belonging to Obiang, while in 2017, he was convicted for corruption by a French court, fined €30 million and handed a three-year suspended jail term. His luxury assets in France were also confiscated, to be sold and the proceeds returned to Equatorial Guinea. In 2018, the Brazilian authorities seized millions of dollars in cash, including a set of luxury watches from a delegation travelling with the Vice President following a search on their private aircraft. Equatorial Guinea is a significant oil producing nation in Africa, but more than 76% of the population live in poverty, according to the World Bank.

In Tunisia, President Kais Saied dismissed several public officials, including the Prime Minister, ministers of defence and justice, the army’s chief prosecutor, and the head of the national television channel Wataniya. He also suspended Parliament, assumed executive and judicial powers, lifted the immunity of lawmakers, and ordered an investigation into three political parties suspected of receiving foreign funds before the elections in 2019. Key civil society groups, however, warned against any “illegitimate” extension of the 30-day suspension of Parliament. There are allegations that close to US$5 billion has been looted from the country through various means. The names of hundreds of officials alleged to have been involved include politicians and members of parliament. The North African nation is beset by a crippling economic crisis, including soaring inflation and high unemployment, as well as surging COVID-19 infections.

In Tunisia, President Kais Saied dismissed several public officials, including the Prime Minister, ministers of defence and justice, the army’s chief prosecutor, and the head of the national television channel Wataniya. He also suspended Parliament, assumed executive and judicial powers, lifted the immunity of lawmakers, and ordered an investigation into three political parties suspected of receiving foreign funds before the elections in 2019. Key civil society groups, however, warned against any “illegitimate” extension of the 30-day suspension of Parliament. There are allegations that close to US$5 billion has been looted from the country through various means. The names of hundreds of officials alleged to have been involved include politicians and members of parliament. The North African nation is beset by a crippling economic crisis, including soaring inflation and high unemployment, as well as surging COVID-19 infections.

In neighbouring Brazil, people took to the streets demanding the impeachment of President Jair Bolsonaro due mainly to the government’s response to COVID-19 pandemic as well as allegations of corruption in the procurement of a vaccine from India. Similar demonstrations have taken place in Guatemala calling for the resignation of President Alejandro Giammattei after the firing of a well-known anti-corruption prosecutor who headed of the Special Prosecutor’s Office Against Impunity.

On the climate change front, thousands of scientists have repeated calls for urgent action to tackle the climate emergency, warning that several tipping points are now imminent. They have signed on to an initiative declaring a worldwide climate emergency, arguing that governments have consistently failed to address “the overexploitation of the Earth”, which they consider the root cause of the crisis. A similar call was made in 2019 where the scientists noted an “unprecedented surge” in climate-related disasters, including flooding in South America and Southeast Asia, record-shattering heatwaves and wildfires in Australia and the United States, and devastating cyclones in Africa and South Asia. They reiterated their previous calls to eliminate fossil fuels, slash pollutants, restore ecosystems, switch to plant-based diets, move away from indefinite growth models, and stabilise the human population.

In today’s article, we discuss Guyana’s 2018 Extractive Industries Transparency Initiative (EITI) report – the second of its kind – which was published on 21 April 2021.

Background to the report

The EITI was first launched in 2002 at the World Summit on Sustainable Development in Johannesburg, South Africa. This was followed by a conference in London in 2003 at which several countries, companies and civil society organisations agreed to a 12-point Statement of Principles to increase transparency over payments and revenues in the extractive sector. The EITI shares the belief that the natural resources of a country belong to its citizens and should be exploited for their benefit. Accordingly, there should be high standards of transparency and accountability:

A country’s natural resources, such as oil, gas, metals and minerals, belong to its citizens. Extraction of these resources can lead to economic growth and social development. However, poor natural resource governance has often led to corruption and conflict. More openness and public scrutiny of how wealth from a country’s extractive sector is used and managed is necessary to ensure that natural resources benefit all.

The EITI has promulgated standards which participating countries are required to observe. A key requirement is for countries to publish timely and accurate information on key aspects of their natural resource management, including how licences are allocated, how much tax and social contributions companies are paying and where this money ends up in the government. Through the EITI, companies, governments, and citizens increasingly know who is operating in the sector and under what terms, how much revenue is being generated, where it ends up and who it benefits. From the perspective of the State, the EITI helps to improve the investment climate by providing a clear signal to investors and international financial institutions that there is commitment to greater transparency. It also assists in improving governance and promoting greater economic and political stability.

In October 2017, Guyana was accepted to the membership of the EITI. One of the requirements of the EITI Standard is the publication of an annual report within eighteen months of a country’s membership of EITI. The report is to be prepared by an Independent Administrator who must: (i) be perceived to be credible, trustworthy and technically competent; (ii) possess expertise and experience in the oil, gas and mining sectors as wells as in accounting, auditing and financial analysis; and (iii) have a track record in similar work. The 2017 Guyana EITI report was issued in April 2019. Significant shortcomings/deficiencies as well as non-compliance with the EITI Standard were identified and recommendations were made for remedial action, including:

Establishing an open database, especially as regards beneficial ownership of companies operating in the extractive sector;

Inventorising licences/permits and maintaining a register;

Publicising mining agreements and maintaining an archive;

Awarding mineral agreements based on tendering and providing a clear definition of and distinction between large-scale licences and medium-scale permits; and Accelerating reform of the petroleum legislation;

Key findings of the Guyana 2018 EITI Report

The following are the key findings of the Guyana EITI report for the fiscal year 2018:

Revenue Received

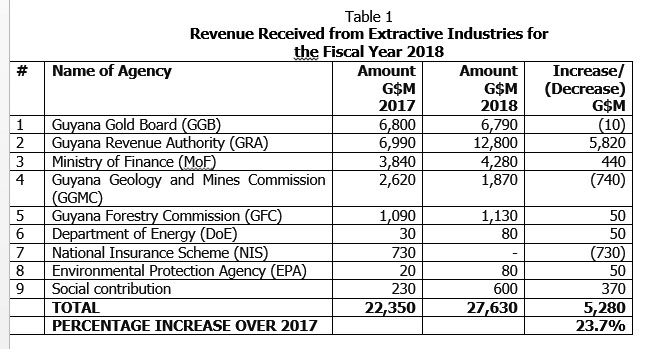

Total revenue received by Government agencies from the extractive sector amounted to G$27.630 billion, compared with G$22.350 billion in 2017, an increase of G$5.280 billion or 23.7 percent, as shown at Table 1.

Taken together, the extractive sector contributed 17.7 percent of the total Gross Domestic Product, 74.4 percent of total export earnings and 11.3 percent of government revenues. A total of 44,063 persons were employed in the sector, representing 18.2 percent of the labour force.

Data on production

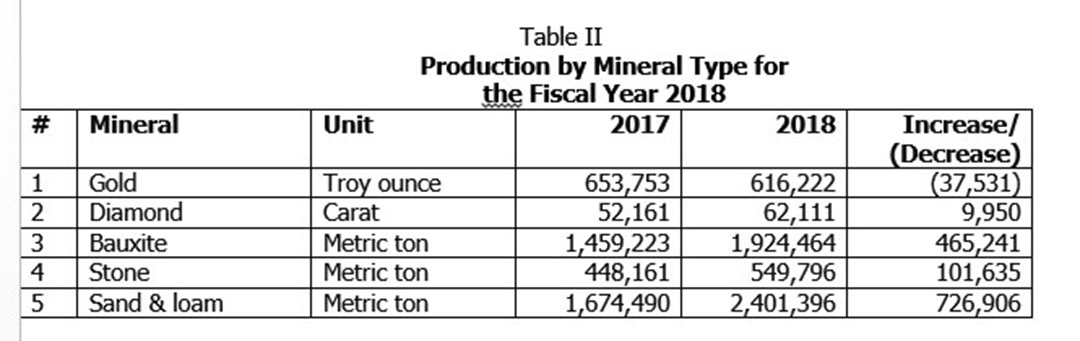

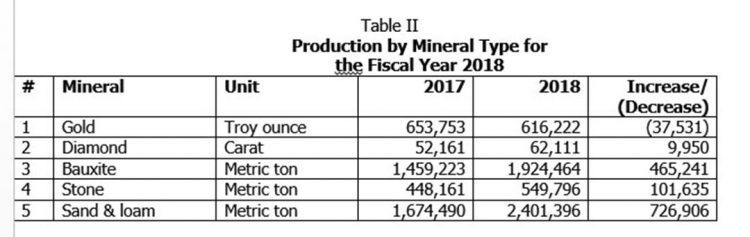

Table II shows production by mineral type. Except for gold, production in 2018 exceeded that for 2017 by 3.4 percent in value:

The overall production of forest products was slightly higher than that of 2017. The value of production in 2018 was G$23.72 billion, compared with G$22.15 billion in 2017. In relation to fisheries products, overall production performance was, however, lower. In terms of value, production in 2018 was G$25.96 billion, compared with G$28.70 billion in 2017.

The overall production of forest products was slightly higher than that of 2017. The value of production in 2018 was G$23.72 billion, compared with G$22.15 billion in 2017. In relation to fisheries products, overall production performance was, however, lower. In terms of value, production in 2018 was G$25.96 billion, compared with G$28.70 billion in 2017.

Data collection and reconciliation

A total of 47 of the largest extractive entities as well as 12 oil and gas exploration companies holding active licences, were selected for reconciliation of the revenue received by the government agencies. The selection covers 65 percent of the revenue received. An important aspect of the reconciliation relates to the submission of reporting templates in support of the amount of revenue received. The MoF, however, did not submit templates for 57 extractive entities, and the related revenue from these entities was not included in the G$4.28 billion shown at Table I. In relation to the GRA, due to issues of confidentiality, it was unable to submit reporting templates for 48 extractive entities. The NIS and National Industrial and Commercial Investments Ltd (NICIL) did not submit any reporting templates.

The report noted that the total revenue collected by GRA, MoF, NIS and NICIL from the extractive entities could not be estimated because of the lack of corresponding reporting templates from government agencies. It stated that the extractive entities were reluctant to submit such templates because of security concerns if personal data would be disclosed. The Independent Administrator concluded that ‘we were unable to conclude that this report covers all significant contributions made by extractive entity to the revenues of Guyana in the fiscal year 2018’.

Reporting templates submitted by government agencies for G$6.86 billion and representing 38 percent of reconciled revenues, were not certified by the Auditor General. In particular, the Auditor General’s report only covers revenues collected by GRA, the MoF and GGB based on audited financial statements. GGMC, EPA, NIS and NICIL did not submit audited financial statements. Additionally, three extractive entities submitted unsigned reporting templates while five submitted reporting templates without their audited financial statements. The Independent Administrator concluded as follows:

Given the significance of the matters stated above, it was not possible to conclude that the financial data submitted by reporting entities and included in this report were subject to audits that have been performed in accordance with international standards.

These observations and conclusions are similar to those contained in the EITI 2017 report. However, this is not considered good news in that from an auditing perspective, the conclusions represent a disclaimer of opinion in relation to the amount of G$27.630 billion shown as having been collected for the fiscal year 2018.