Introduction

Last week’s column wrapped up my rather extended revisit of the Buxton Proposal, BP. This task started on Sunday, September 26, and took thirteen columns, which is much longer than I had originally envisaged. Consequently, except for very brief references to this topic going forward, I do not anticipate having to engage this topic substantially again. Starting today I propose to introduce some analytical and theoretical work of a more or less academic orientation that I firmly believe could aid the general readership’s comprehension of the complex occurrences, which have manifested themselves thus far, as Guyana’s petroleum industry rapidly progresses.

More to the point, my task can be formally expressed as seeking: to advance an hypothesis or formularization which provides a general explanation or reasoned construct that correctly expresses the ruling or governing dynamic which most fittingly captures the clearly unprecedented historical emergence of Guyana’s world-class petroleum finds/discoveries starting with ExxonMobil’s announcement in May 2015 and projected to last, comfortably, up to the end of Guyana’s first decade of oil and gas sector production [2025/26]. Despite start-up setbacks, there has been a steadily emerging consensus, backed by finds, that on its present trajectory, Guyana’s daily rate of crude oil production, DROP, will reach around one million barrels of oil equivalent per day; that is, 1mln boe/d.

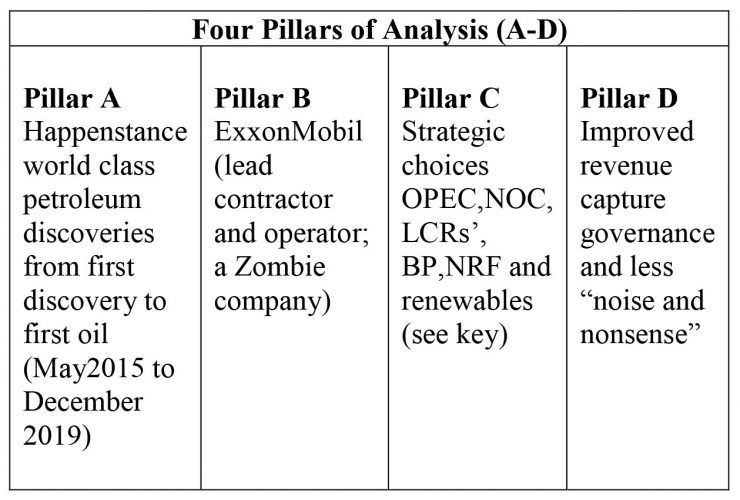

The tasks I have set for myself will be addressed in four sections as indicated in what follows and are constructed around four analytical pillars (A-D). These are: A) the formulization of a general explanation of the unprecedented and explosive growth in Guyana’s creaming curve for petroleum finds/discoveries in the period from the First Discovery [mid- 2015] to Guyana’s First Oil [December 2019]; B) articulating the essential or ruling condition of ExxonMobil, which is presently and continues to be the lead firm, lead contractor, and lead operator, located mainly, but not exclusively, in the Stabroek Block for the entirety of the period of my analysis—that is, the first full decade of Guyana’s oil and gas sector [mid-2015] to [2025/26]; and pillars C and D focus principally on those actions I am advising the Authorities to take. Thus C refers to recommendations, which I have made repeatedly in regard to the Natural Resource Fund, NRF; my proposal to establish a National Oil Company, NOC; advice on whether to join OPEC or not; local content requirements, LCRs; and finally, the Buxton Proposal which I have revisited over the past 13 weeks. Similarly, D refers to improved revenue capture, governance, and public openness, in the face of relentless noise and nonsense in the local social and print media,

For convenience, Schedule 1 below captures the schema described above and from which the analysis will flow going forward.

Schedule 1 – Analytic Pillars [A-D]

KEY: NOC= National Oil Company; LCRs= Local content requirements; BP=Buxton Proposal; NRF= National Resources Fund.

Pillar 1, which I start addressing in today’s column offers a general thesis that explains the essence of Guyana’s recent world class offshore petroleum discoveries. The data reveal that, to date all the recoverable discoveries have been located in the Stabroek Block, and of immense importance, all are under the operational control of ExxonMobil and its partners; the lead Contractor and Operator. As I had earlier observed in this Sunday column series, two other joint venture groups (JVs) have been recognized as being on the cusp of production, However, I believe their reported data give cause for considerable uncertainty on this score.

As far back as half a decade ago, in 2016, when reported discoveries by ExxonMobil and partners were less than one billion barrels of oil equivalent, BoE, I was predicting that Guyana’s discoveries would eventually reach 13-15 billion BoE. In truth, that prediction was based on a combination of 1) gut feelings and intuition, and 2) two lines of reasoning that flowed from my research into research of Guyana’s petroleum studies, back in 2015. The first of the two reasonings is the “Atlantic mirror image” geological principle; and the second reasoning has been derived from two United States Geological Service (USGS) Fact Sheets, which were released in 2000 and 2012.

World Class Petroleum Finds

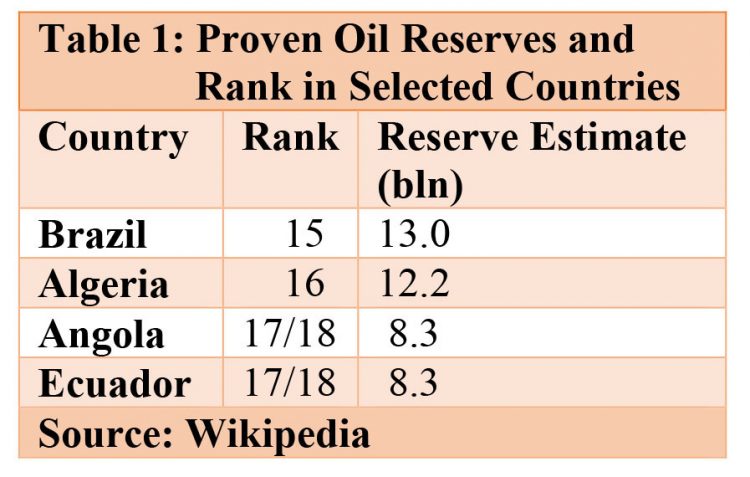

ExxonMobil has announced 27 discoveries and continues to suggest its total recoverable resources is 10+ bln boe. Presently, my assessment of Guyana’s petroleum reserves potential still stands at 13-15 billion boe and 23-43 billion cubic feet of natural gas and natural gas liquids. I readily admit that this is a high prediction. To compare, Wikipedia’s ranking of countries with proven oil reserves, lists Brazil 15th (with a holding of 13.0 billion boe); Algeria is 16th, (12.2 billion boe); and Angola and Ecuador 17th and 18th (with 8.3 billion boe). These data are revealed in Table below.

My estimate is supported by two lines of argument. Firstly, an appreciation of Guyana’s petroleum geological principle of the “Atlantic mirror image”. Secondly, estimates provided by the USGS.

Conclusion

Next week, I continue to document in minimal detail the hard data on Guyana’s world-class discoveries and from which I have developed my analysis based on the twin constructs of happenstance and the zombie character of ExxonMobil, which is the lead contractor and operator.