LONDON, (Reuters) – Unilever unveiled plans today to cut about 1,500 management jobs in a restructuring aimed at easing shareholders’ concerns after a failed acquisition and reports an activist investor has built a stake in the consumer goods giant.

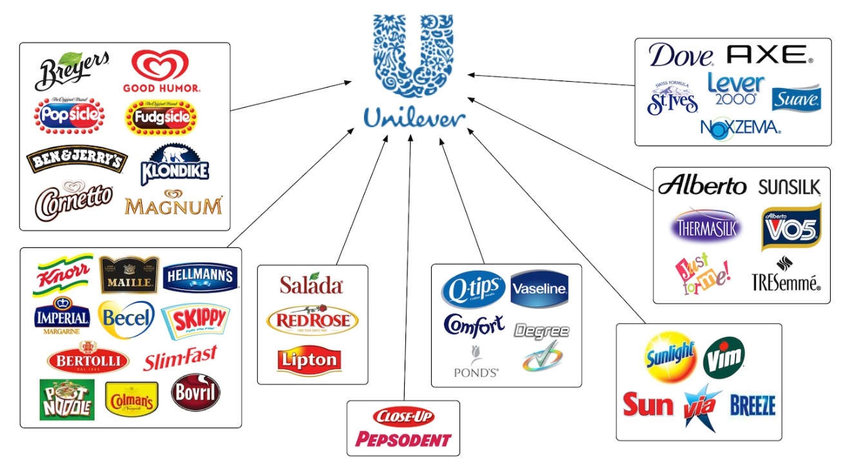

The maker of Dove soap and Magnum ice cream, which employs about 149,000 people worldwide, said on Tuesday the revamp would create five product-focused divisions – beauty and wellbeing, personal care, home care, nutrition, and ice cream.

The move, which Unilever said had been in the works over the past year, echoes the reshaping by rival Procter & Gamble (P&G) three years ago when it created six similar business units, in its biggest reorganisation in two decades.

“Moving to five category-focused business groups will enable us to be more responsive to consumer and channel trends, with crystal-clear accountability for delivery,” Unilever CEO Alan Jope said.

Unilever, whose shares have fallen by about a quarter from their record high in 2019, last week effectively abandon plans to buy GlaxoSmithKline’s (GSK) consumer healthcare business for 50 billion pounds ($67 billion).

Its proposal, rejected by GSK, was widely criticised by investors as being a costly and risky distraction from dealing with pressing challenges to the business, such as surging inflation in emerging markets and weakness in healthy foods.

Days later, reports also emerged activist investor Nelson Peltz’s Trian Partners had been building a stake in Unilever, mirroring a previous investment and push for change at P&G and other consumer goods companies. Trian has not confirmed that it has built a stake in Unilever.

“The decision to cut 1,500 jobs globally shows the significant pressure that Unilever is currently under,” Sean Moran, restructuring specialist at law firm Shakespeare Martineau, said.

“While today’s news may not be directly connected to the company’s failed GSK offer, the timing is unfortunate … When confidence in a business is low, drastic decisions must often be made.”

At P&G, Trian criticized the Tide detergent maker’s falling market share, low organic sales growth, aging brands, bureaucracy and excessive structural costs, among other things.

“It just happens to be right now that Unilever is in the fray,” Barclays analyst Warren Ackerman said. “Peltz has tried at Mondelez, Heinz, PepsiCo – a whole catalogue of consumer goods companies.”

Some investors think Unilever focuses too much on environmental and social strategies and not enough on its core business, he added.

On Thursday, influential British fund manager Terry Smith criticised Unilever in a letter to his Fundsmith LLP investors, calling the lost GSK deal a “near death experience” and urging the company’s management to focus on strengthening performance.

Smith criticised Unilever’s “penchant for corporate gobbledegook as substitute for effective action.”

“The company would benefit from focusing its attention on strengthening its current product ranges and reaching new and existing customers, instead of diversifying into other sectors such as healthcare — as seen in the GSK bid,” GlobalData analyst Ramsey Baghdadi said.

Unilever, which traces its roots to a small soap business in 1880s Britain, said it does not expect factory workers to be impacted by the restructuring.