Introduction

Budget Speech 2022 came against the backdrop of rising domestic prices, increasing international oil prices, a steady stream of deaths from the COVID – 19 pandemic, further discoveries in the fecund Stabroek Block and leadership issues in the main opposition PNC-R/APNU. The parliamentary sitting was held at the Arthur Chung Convention Centre where days earlier, chaos had broken out when the Natural Resource Fund Bill was rushed through the National Assembly by the Government over widespread calls from the parliamentary opposition and civil society for the Bill to be referred to a Select Committee of the National Assembly. The Government was less receptive to consultation, as it had been over the Local Content Bill. For an overview of the Local Content Act see Legislation 2021 and for the National Resource Fund Act, see Commentary and Analysis.

This third Budget of the 12th. Parliament was read Dr. Ashni Singh whose Speech ran for over five hours, interrupted only by sips of fresh coconut water. While the 2021 Budget was presented against some apparent semblance of distancing between the Government and Esso Exploration and Production Guyana Limited over the Payara Development Plan and flaring by Esso as the Operator of the Stabroek Block. On this occasion not even water, let alone oil, or the Environmental Protection Agency could get between the Government and the oil companies.

Days earlier the Commonwealth Secretary-General, Patricia Scotland QC, on a visit to Guyana, had called on the Government to be a responsible oil producer using the requisite policies and frameworks, balancing oil extraction with the need to fight climate change.

The Budget Speech almost coincided to the day with the publication of the Transparency International Corruption Perception Index for 2021. The publication showed Guyana slipping in the absolute score with many of the guardrails to detect and prevent corruption – such as the Procurement Tribunal, the Integrity Commission and the Access to Information Act – either non-existent or under-resourced. With the increasing use of cash grants involving billions of dollars, the possibility of corrupt practices and transactions going undetected increases significantly.

The Minister received formal representations prior to Budget Day from business and labour and, no doubt, informal calls from other stakeholders. The measures proposed by the Private Sector Commission included the obligatory call for the lowering of corporate tax by a “minimum of 7%” and the raising of the personal Income Tax threshold to $100,000 per month.

The TUC, in its proposal addressed to President Irfaan Ali, called for the restoration of free collective bargaining (a constitutional right), the renegotiation of the royalty clause in the 2016 Petroleum Agreement, a plan for GuySuCo, direct Oil Benefit/Cash Transfers, the restoration of tax allowances for children and dependent parents, unemployment benefits and the raising of the national private sector minimum wage to $72,000, among a host of other measures. Notably, the TUC called for $25 million dollars to be made available to 70 villages each for job creation, poultry raising, cash crops, cattle rearing, computer training, dressmaking and numerous other activities to uplift rural villages. Villages and their communities have been ravaged by poor policies, complete neglect by Central Government and the takeover of their commercial activities by Chinese businesses. Acceding to this request with strict conditions offers the opportunity to revitalise the economies of those villages and logically, that novel request costing about one-third of one percent of the National Budget deserved serious consideration. It would seem that it did not receive such attention.

Budget Focus can simply repeat what it said last year: “Clearly the Private Sector Commission (PSC) appears to have had a more favourable response to their request.” In fact, it does seem as if some of the measures announced by the Minister in the 2022 Speech came straight from PSC’s proposals!

It is also clear the PSC has an unhealthy sway over this Administration, having played a critical role in the attempted rigging of the count of the March 2020 elections which brought the PPP/C back to power. The immediate Past Chairman is a key advisor to the President while the current Chairman heads the Boards of two of the major Government companies.

Interestingly, in a mini-survey carried out by this Firm prior to the Budget presentation, twenty-five respondents across sectors and regions, the lowering of direct and indirect taxes came well behind Measures to strengthen Government Agencies (#1) and Measures to improve Government efficiency (#2).

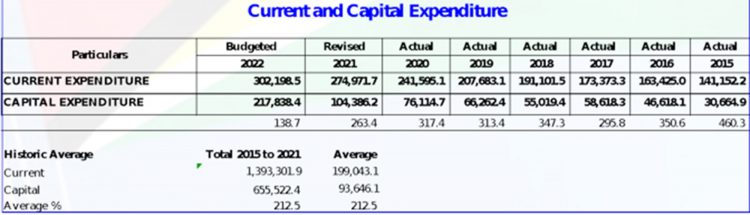

The Budget marked the first year in which the proceeds of oil revenue and royalty payments found their way into the Consolidated Fund. While Transfer Payments continue their inexorable feature of national Budgets, this year marks a profound shift from Current Expenditure to Capital Expenditure, not all of which meet the accounting test of such expenditure.

As the Table below shows, whereas in 2015 Current Revenue was 460.3% of Capital Expenditure, in 2021 it was 263.4% and is projected to drop to 138.7% in 2022.

Source: Estimates of the Public Sector 2022

Despite the transfer from the Oil Fund, the Budget and accompanying statements show that deficits will continue for some time to come as many of the capital projects are multi-year, some of them for as much as three years. For the years 2020 to 2022, budget deficits will be some $345 Bn! Even by the Government’s own projections, despite the contribution from Oil, the Budget will be running significant deficits for years to come.