The Government’s projected Financial Plan for 2022 is summarised on page 20 of this Publication. The current balance projects a surplus of $ 120,071 million, a reversal of $136,439 million over revised 2021. Current revenue of $432,013 million represents an increase of $165,790 million 62.3% over the latest estimate for 2021 of $266,223 million.

Budgeted current expenditure is $302,198 million for the year 2022, an increase of $27,227 million or 9.9%, as compared to revised 2021 while Interest Expenditure is budgeted at $9,743 million, an increase of $2,123 million or 27.9%, giving a Current Balance of $120,071 million compared with latest estimates for 2021 of a negative $16,368 million.

Capital Revenue and Grants is budgeted at $10,237 million compared with $5,209.9 million for revised 2021. Budgeted Capital Expenditure is $217,838 million which is some $113,452 million over revised 2021. After Debt Repayment of $23,153 million, an overall deficit of $110,683 million is projected, compared with a deficit of $133,419 million as per revised 2021, 41% of which is expected to be financed by borrowings from external sources and 59% from domestic sources. Of the current expenditure, personal emoluments account for approximately 29.7%. Debt service as a percentage of current revenue is projected at 7.6% in 2022, a decrease from 9.6% in revised 2021.

Revenue

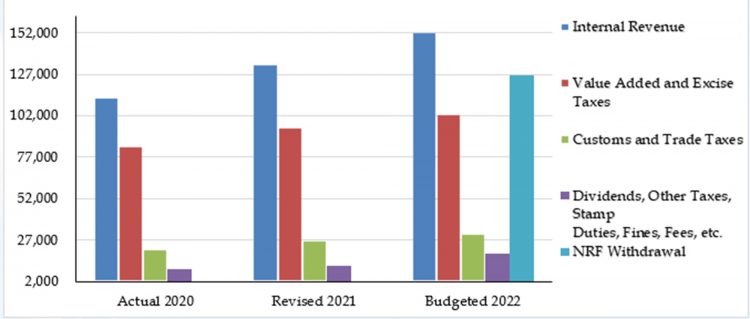

The striking feature of the Revenue statement is the towering entrance of Oil money into the public finances of the country. See Chart below. The Guyana Revenue Authority is expected to account for revenues of $286,816 million or 66.4% of total revenue, an increase of $31,731 million or 12.4% when compared to revised 2021.

Current revenue by type

Of the GRA’s collections, Internal Revenue is projected to account for $152,732 million compared with $133,253 million in revised 2021, an increase of 14.6%, while Value-Added and Excise Taxes are expected to earn $102,937 million compared to $94,778 million in revised 2021, an increase of 8.6%. Collections by the Customs and Trade Administration are anticipated to be $31,146 million, an increase of $4,093 million or 15.1%.

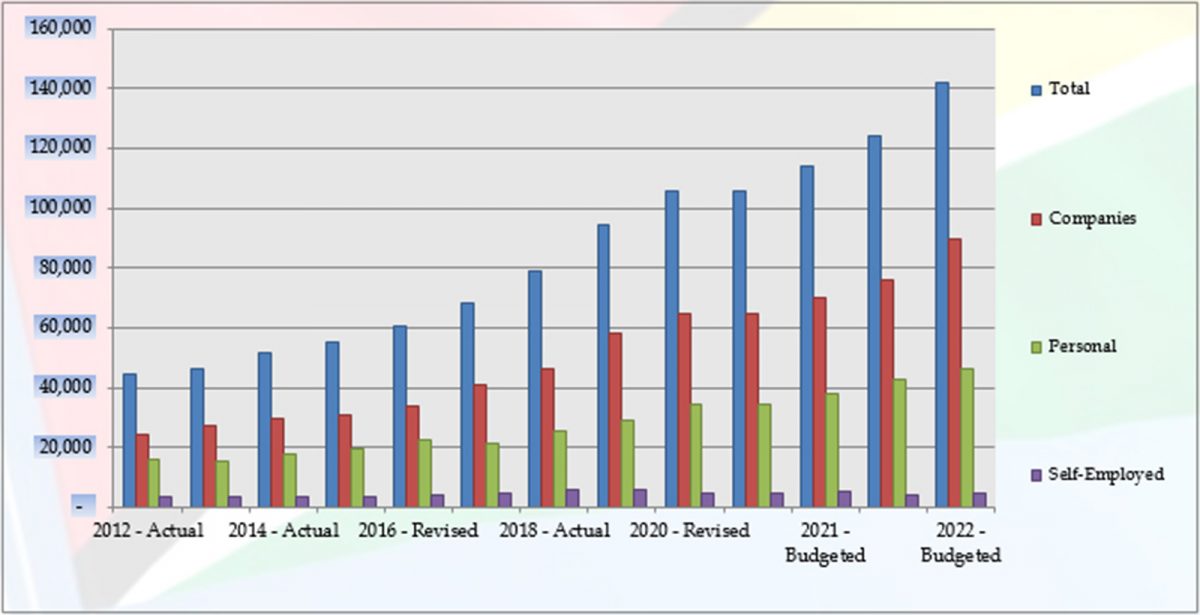

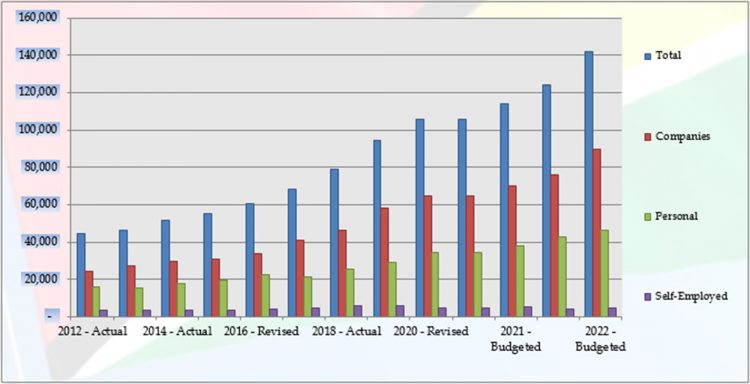

An examination of revenue projections for full year 2022 show Companies Taxes increasing by 18.2%, Personal Tax by 8.4 % and Self Employed by 17.6 %.

Analysis of Internal Revenue by type of taxpayer

Source: Estimates of the Public Sector, Volume 1. All amounts shown are actual except 2017 and 2021 being revised and 2022 being budgeted (G$ Millions)

Excise Tax payable mainly on vehicles, alcohol and tobacco is projected to remain flat at $40.3 billion.

Capital revenue and grants in 2022 are projected to increase to $10,237 million from $5,209 million or 96.5%, of which Project and Programme funds are projected to increase by $5,032.9 million or 96.7%, whereas HIPC and MDRI will once again not contribute in 2022.

Capital expenditure for the year is budgeted at $217.8 billion or 39% of the total budget expenditure. The allocation is 109% above the latest estimate 2021 and 187% above 2020 capital expenditure.

Interest expenditure is projected to increase by $2,123 million or 21.7% from $7,620 million. Domestic interest is projected to increase by $1,085.4 million or 38.9%, while interest on external debt is projected to increase by $1,038.4 million or 21.5%.

The principal element of debt repayments is projected at $23,153 million (2021: $17,874 million), made up of domestic debt repayments of a projected $9,680 million (2021: $5,799 million), while external debt repayments are projected to increase to $13,472 million (2021: $12,074 million).

Ram and McRae’s Comments:

This is the first year during which income from profit oil and royalty is brought into the estimates. This transaction touches on Article 216 of the Constitution and the Fiscal Management and Accountability Act. The latter states that all public monies are part of the consolidated fund but that would be subject to the precedence of Article 216 of the Constitution, it would therefore seem that from both an accounting and legal perspective, the accounting method chosen for the revenue brought into the consolidated fund is permissible and appropriate.

We have some doubts however regarding the sum which is transferred to the Consolidated Fund. Our understanding of the 2016 Petroleum Agreement is that the taxes paid by the Government for the Oil companies come from that Fund. Accordingly, only the net sum held in the Fund is available for transfer. In any case, the payment of the Oil companies’ taxes has to be accounted for some place. That does not appear to have been done.

Transfer payments is now the single largest item of current expenditure by the government. This item would include the motley of cash grants and presumably includes allocation of five billion ($5,000 million) for possible assistance to the most vulnerable to cushion the impact of rising cost of living. Such payments have been growing exponentially and the amount in the financial plan significantly exceeds the amounts paid as personal emoluments. This is tantamount to the issue of a blank cheque. We consider this an appropriate area for examination by the Auditor General on a continuous basis.

Please see section Who Gets What in 2022 on page 22 for the allocation of current and capital expenditures by ministries and departments.