ExxonMobil’s local subsidiary EEPGL is preparing for the drilling of some 12 wells in the offshore Canje Block and may be able to forge ahead as Guyana’s Environmental Protection Agency (EPA) says that the project does not require an Environmental Impact Assessment.

“In accordance with Section11 (2) of the Environmental Protection Act, CAP 20:05, Laws of Guyana, the application for the project listed above has been screened by the Agency to assess the potential environmental impacts. It has been determined that the project will not significantly affect the environment or human health. It is therefore, exempt from the requirement of an Environmental Impact Assessment (EIA),” the notice from EPA states.

“Notwithstanding this decision, in the interest of sound environmental management, the agency will require the preparation and submission of an Environmental Management Plan (EMP) for the project. The EMP will assess any possible impacts on the environment and/or human health, and detail specific mitigation measures to be undertaken in order to ensure that the proposed project is implemented in an environmentally-sound and sustainable manner,” it added.

The EPA is asking anyone who feels they may be affected “to lodge an appeal against the Agency’s decision (EIA not required) with the Environmental Assessment Board within thirty (30) days of the date of the publication of this notice”.

The EPA’s discontinuation of the EIA process for many large projects has been a source of contention here as environmentalists have questioned the rationale.

Of note was when former Director of the EPA, Dr Vincent Adams was here he had proposed having a single EIA for each of the offshore blocks so that the risks would already be covered when individual wells would be drilled.

Then, some had expressed concern over proprietary rights but that was later cleared up since that information was not required in an EIA.

It is unclear what progress has been made in that regard as there has been no update from the EPA on the issue.

ExxonMobil has already drilled three wells in the Canje Block but none has been seen as commercially viable.

Last year, the company announced that it would again from this year aggressively restart works in the block and said that a 12-well drilling and exploration programme was planned.

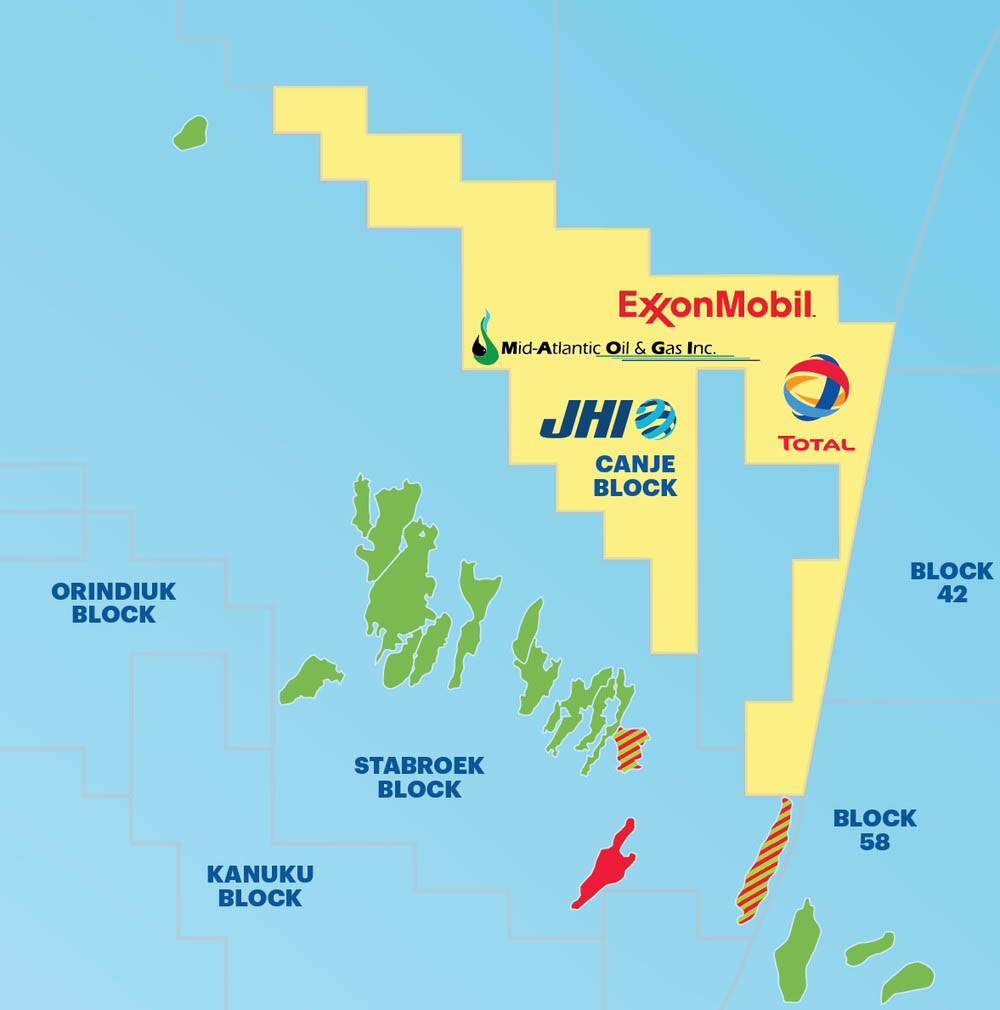

The Canje Block is operated by ExxonMobil (35%), with Total Energies (35%), JHI Associates (17.5%), and Mid-Atlantic Oil & Gas Inc. (12.5%) as partners. Westmount holds a 7.2% interest in the issued share capital of JHI.

According to oedigital.com, Eco Atlantic, also an indirect partner in the block through its 6.4% interest in JHI, said the Sapote-1 well recorded hydrocarbon evidence while drilling, and in the logging sequence, in a deeper interval than anticipated, but had no shows in the upper primary objective horizon.

Last month, Eco announced that it had secured an additional 800,000 common shares in JHI Associates Inc. in return for 1,200,000 new common shares in Eco. The purchase of the 800,000 common shares in JHI was expected to be completed on January 21, 2022, increasing the total number of shares currently held by Eco in JHI to 5,800,000 shares. Eco also retains a warrant to subscribe for a further 9,155,471 new common shares in JHI at an exercise price of US$2.0 per share for a period of 18 months.

“We are committed to creating material value for our shareholders through a multi catalyst, high impact, and exploration portfolio. As such, we are pleased to increase our exposure in the Canje Block by building our equity holding in JHI. This also marks another step in the broader consolidation amongst smaller exploration players, in which we want to lead,” the company quoted its Chief Executive Officer (CEO) and Co-Founder of Eco, Gil Holzman as saying.

“Following the work undertaken on Canje in 2021, which ExxonMobil and partners in the block continue to review, and after the recent highly positive drilling results on the nearby Stabroek Block, we believe this to be another exciting opportunity in our portfolio,” he added.