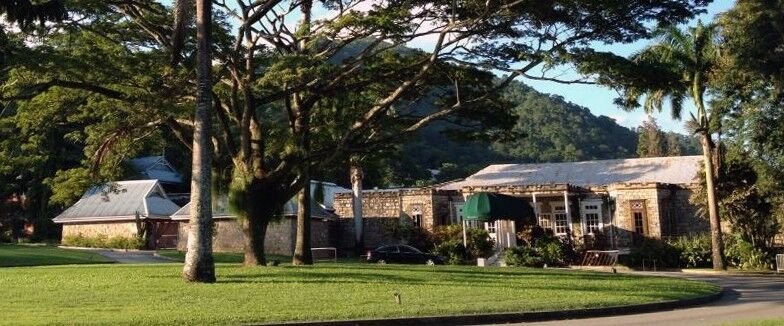

(Trinidad Express) A squabble between siblings of the Fernandes family over the recent sale of the Trinidad Country Club (TCC) in Maraval to the United States Embassy at a cost of TT$316 million has found its way before the court.

The sibling rivalry took the form of an application for injunctive relief filed on March 25, 2022 by Luisa Fernandes and three companies—Domus Trust, AM Investments and Poui Investments.

Luisa Fernandes and the companies brought the action against her brother, Joseph Fernandes and Champs Elysees Ltd (CEL), formerly known as the TCC.

Justice Margaret Mohammed yesterday however refused to grant the application for interim relief.

Joseph Fernandes is the majority shareholder in CEL, personally or through Aquila Ltd. Luisa Fernandes, Domus Trust, AM Investments and Poui Investments hold 21 per cent of non-voting (B) shares in CEL.

There is a dispute of 138 B shares that Luisa Fernandes said she is entitled to.

In the action, the claimants were seeking to have the 138 B shares held by Rathbones Trust, now Hudson Trust Company Ltd, in CEL to be registered in Luisa Fernandes’s name.

In addition, she was seeking a declaration that the business or affairs of CEL were conducted in a manner that was unfairly prejudicial or disregarded the interests of the claimants under the Companies Act.

Further, the claimants also asked for independent auditors to be appointed to look at the books, records, and accounts of CEL; for an independent firm to examine CEL’s unaudited accounts; and for an interim order that all proceeds from the sale should be held in escrow and paid into court.

They were also seeking an order that the board of CEL be replaced.

Irremediable prejudice

In handing down her ruling, Justice Mohammed said in deciding to whether the interim reliefs ought to be granted, she had to consider if by doing so her orders would result in irremediable prejudice.

In the end, the judge found that if the declarations were granted, the prejudice to the defendants would be greater since it would prevent it from having access to the proceeds of the sale of one of its main assets, to continue the business of CEL by operating its wine shops, its restaurant, and developing land in Tobago.

“In my opinion, placing all or any of the sums received from the sale into escrow would cause irreparable damage,” she said, adding that part-payment of the proceeds from the sale of the 12-acres of prime property into court was not workable.

“There is no basis in law to support an order for the payment of 34 per cent of the proceeds of the sale of the property as this is not the declared dividend,” stated the judge.

But even if the court were to make such an order, Justice Mohammed stated it would be something difficult to supervise. Further, she said if CEL was to invest the remaining 66 per cent of the proceeds and declare a dividend, the issue that would then arise was if the claimants would be entitled to receive part of it.

“At this stage of the action the defendants have a stronger case based on the issues to be tried,” stated the judge.

“I am strongly of the view that based on the nature of the order sought with respect to the payment into court of the proceeds of the sale of the property which is in the sum of $316 million, this is a case where the failure to provide an undertaking in damages is fatal to the application.

“Indeed, if I am to make the order to deposit the sum into court and the claimants are not successful at the end of the trial, the defendants would have been deprived of access to substantial funds required to run its business and make investments,” the judge added.

No rights as non-voting shareholders

Affidavits were filed by Luisa, her sister Ana Maria De Meillac, a director of AM; their brother John Paul Fernandes, managing director of Poui; and Hafeez Ali, Luisa’s attorney and a director of Domus.

They contended that in April of last year Joseph Fernandes was fielding offers from the United States for the sale of the property.

While they said they were not objecting to this, they wanted the sale documents to review before they could vote.

Joseph Fernandes and CEL however, contended that the four were not proper claimants in law given they were non-voting shareholders and were not entitled to accounts or audited financial information.

Additionally, it was argued that they had already received dividends from the family’s Fernandes Industrial Centre up to 2021, and since they had no rights as non-voting shareholders they had no input in the management of CEL.

Representing the claimants were attorneys Om Lalla, Dereck Balliram and Sue Chin Hing Ramdhanie while attorneys Stephen Singh and Amanda Adimoolah appeared for Joseph Fernandes and CEL.