Following several comments and queries sent by readers I have come to the realization that, perhaps due to the length of the present series and complementing that, the irregularity of some readers of the columns, not surprisingly some of the readers have lost track of the sequence of the treatment on which I am presently proceeding. To recall briefly, the topic under consideration now, started about six months ago. Further, the task I had set myself then was defined “as providing a general formulation, or perhaps thesis, which offers a coherent determination of the overall dynamic that most fittingly captures the historically unprecedented emergence of Guyana’s world-class oil and gas discoveries.

Since ExxonMobil’s announcement in May 2015 and First Oil later, December 2019, it is currently projected that by 2025/26 despite start-up setbacks, but backed by discoveries, on its present trajectory, Guyana’s daily rate of crude oil production, DROP, will reach around one million barrels of oil equivalent per day [1mlnboe/d].

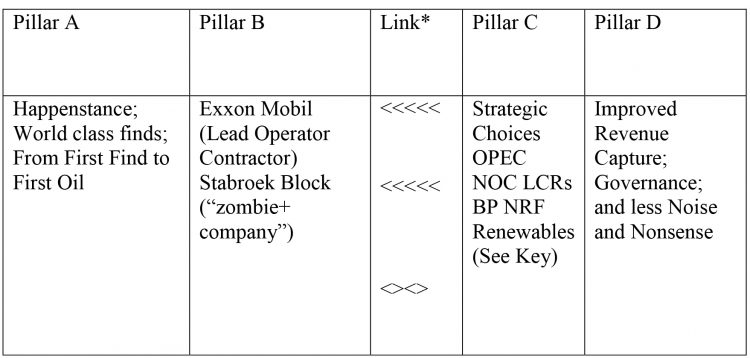

My pursuit of this self-imposed task was originally scheduled to be accomplished in four discrete components founded on four distinct analytical pillars, simply labelled [A-D].

Components A-D

The four pillars of analysis have been previously designated as follows: A] Formulating a general explanation for Guyana’s creaming curve, which as I noted have revealed thus far, unprecedented rates of petroleum discoveries. B] Articulating the essential nature of ExxonMobil, which I project to remain, comfortably, the lead firm, lead contractor, and lead operator, located principally, but not exclusively, in the Stabroek Block going forward to2025/26. In effect, for the entirety of the period of this analysis.

While Pillars A and B are focused heavily on efforts at theorizing, Pillars C and D shift focus principally to policy choices and required actions. Several of these actions, I have been repeatedly recommending to the Authorities for adoption, in the course of this long ongoing Sunday Stabroek series of columns on Guyana’s emerging oil and gas sector.

Thus C] refers to repeated recommendations made in regard to 1] the National Resource Fund, NRF; 2] my proposal to establish a National Oil Company, NOC; 3] updated advice on whether to join OPEC or not ;4] local content requirements, LCRs; and finally, 5] the Buxton Proposal, which I have just revisited in the last 12 weeks of last year.

Similarly, item D] refers to improved revenue capture, governance, and public openness, in the face of relentless noise and nonsense in the local social and print media,

Previously I had used a simple Schedule reproduced at right to illustrate the analytical schema underlining the four pillars as described above. I repeat it here solely for readers’ convenience.

Schedule 1: Analytical Pillars [A-D]

Key: NOC= National Oil Company; OPEC= Oil Producing Exporting Economies; LCRs= Local Content Requirements; BP= Buxton Proposal; NRF= National Resource Fund; *= linking [A+B] & [C+D] analysis.

To recap, thus far I have introduced the notion of happenstance as the most fitting explanation for Guyana’s unprecedented world class oil and gas finds. Following that analysis, I explored in some detail my judgement that, ExxonMobil is what I would classify as a zombie+ corporation. Before addressing Pillars C and D, I had posited it would be analytically necessary to link the theorizing columns [Pillars A and B] to the policy choices and actions ones [Pillars C and D]

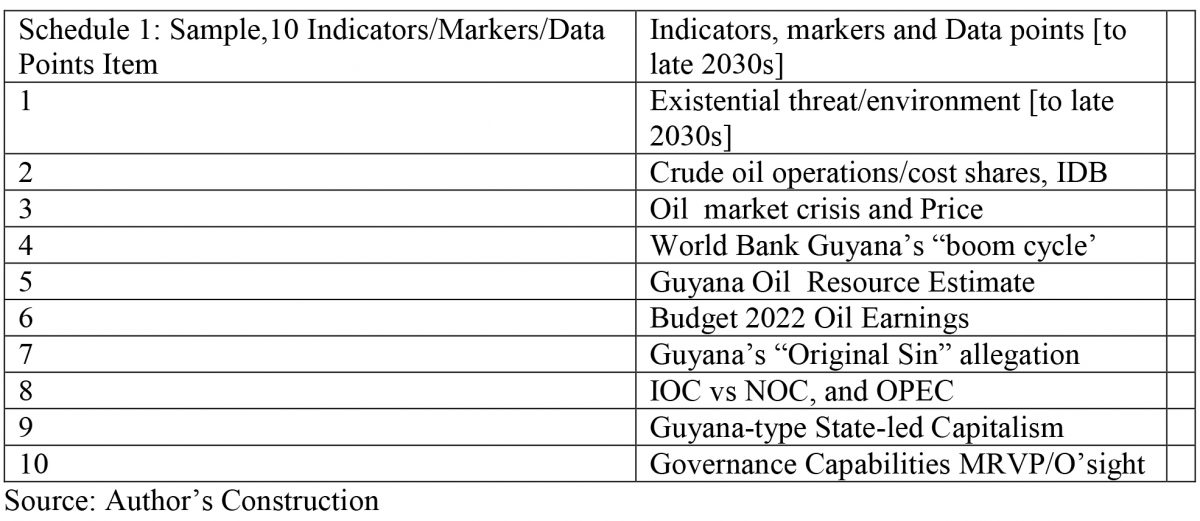

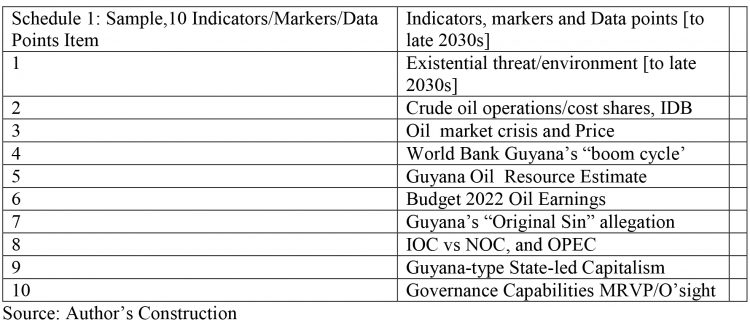

I have done so by seeking to portray the present condition of Guyana’s oil and gas sector. I did this utilizing a sample of ten key indicators, markers, or data points that I have introduced over the years to represent the state of Guyana’s oil and gas sector, going forward over the next decade and a half

Item 1 refers to the existential threat created by Venezuela’s territorial claims on Guyana over the next decade and a half as well as a similar time-frame existential threat, but this time posed by a catastrophic environmental event happening in Guyana’s offshore petroleum operations. Item 2 refers to the modelled shares of cost of operations projected by the IDB to 1925/6. Item 3 refers to the ruling oil market price over the timeline. Item 4 refers to the boom cycle, which the World Bank has projected for Guyana going forward. Item 5 provides a realistic handle on Guyana’s oil resources

Item 6 refers to the key projections on offer by the Government as indicated in its National Budget 2022. Item 7 refers to a defect in the PSA that relates to the acquisition and regulation of exploration licensing. Item 8 refers to the private public distribution of global crude oil production. Item 9 refers to the nature of Guyana’s capitalist system. Finally, Item 10 speaks to the petroleum governance framework in Guyana

Conclusion

In the course of the above, I had observed that while over the years I had offered numerous markers/specifics and data points, the sample which I used was adequate for accurately capturing the state of play in Guyana’s emerging petroleum sector.

I have completed all the above. Starting in the next column I treat with the policy choices and actions listed in Pillars C and D of the schema [see Schedule 1]