Dear Editor,

Reference is made to two letters carried in the Stabroek News editions of July 5th and 7th 2022 by Professor Kenrick Hunte, former Ambassador and Mike Persaud, respectively. Professor Hunte wrote in reference to an analysis conducted by SPHEREX Analytics on the financial statements of Esso Exploration and Production Guyana Ltd. (EEPGL), Hess and CNOOC. Professor Hunte argued that the notion that Guyana’s net-take of 14.5% will increase above this level after the initial investment of the oil companies is recovered, is false hope. Professor Hunte further contended that to support his view, the 14.5% take that Guyana currently gets is enshrined in the Production Sharing Agreement (PSA).

However, Professor Hunte failed to cite the specific section that states this in the PSA. The reason for his inability to show the evidence of any such clause in the contract though is because it does not exist. The other letter by Mike Persaud essentially concur with the arguments put forward by Professor Hunte. Article 11 of the Production Sharing Agreement (PSA) speaks to cost recovery and production sharing which can be found on page 26 of the contract where, specifically, it states the following:

11.2 All recoverable Contract Costs incurred by the Contractor shall, subject to the terms and conditions of any agreement relating to Non-Oil Associated Gas made pursuant to Article 12, be recovered from value, determined in accordance with Article 13, of a volume of Crude Oil (hereinafter referred to as “Cost Oil”) and/or Natural Gas (“Cost Gas”) produced and sold from the Contract Area and limited in Month to an amount which equals seventy-five percent (75%) of the total production from the Contract Area for such month excluding any Crude Oil and / or Natural Gas used in Petroleum Operations or which is lost.

11.3 To the extent that in any month, Recoverable Contract Costs exceed the aggregate value of Cost Oil and Cost Gas determined in accordance with Article 13 and / or Article 12, the unrecoverable amount shall be carried forward and, subject to limitation stipulated in Article 11.2, shall be recoverable in the immediately succeeding month, and to the extent not then recovered, in the subsequent month or months.

11.4 The balance of Crude Oil and / or Natural Gas available in any month after Recoverable Contract Costs have been satisfied to the extent aforesaid (herein after referred to as Profit Oil and/or Profit Gas as the case may be) shall be shared between the Government and the Contractor for each Field in the following proportions: Contractor fifty percent (50%) and Minister (Government) fifty percent (50%).

As shown in the relevant cited section of the PSA above, nowhere did it state anything about 14.5% as suggested by Professor Hunte that is set in stone. There is another important element on the treatment of cost recovery as mentioned in the clauses above that needs an interpretation and / or clarification. In this respect, reference is made to the section at 11.3 above where it states that: “To the extent that in any month, Recoverable Contract Costs exceed the aggregate value of Cost Oil and Cost Gas determined in accordance with Article 13 and / or Article 12, the unrecoverable amount shall be carried forward and, subject to limitation stipulated in Article 11.2, shall be recoverable in the immediately succeeding month, and to the extent not then recovered, in the subsequent month or months.”.

This does not mean that there will always be such an instance where the cost for a particular month exceeds the threshold and would have to be carried forward to the next month. This provision is in place to cater for rare occasions where there may be events in one month that would result in the cost exceeding the 75% threshold, for example, it was reported in the first quarter report of the Bank of Guyana (BoG) that production from Liza one was paused to facilitate maintenance work. There is also another example with the flaring issue where EEPGL encountered problems with the gas compressor, resulting in the company having to unavoidably flare the gas and thus be subject to a flaring penalty.

It should be noted that to date, neither of the above-named commentators, professors and other professionals alike sought to perform a comprehensive analysis of the approved projects (except for international analytics firms such as Rystad). In so doing, this would inform their opinion from an evidenced based standpoint by employing some element of financial modelling techniques in the analysis. There is sufficient data that is publicly available for each project to derive the project economics of each field and which can be used to construct a financial model for the four approved projects so far, namely, Liza 1, 2, Payara and Yellowtail.

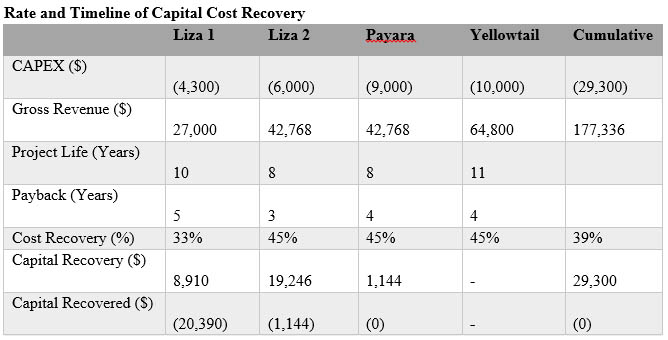

Across the four approved projects, the estimated reserves to be recovered is approximately 2.64 billion barrels of crude of which Liza 1 accounts for an estimated 438 million reserves, Liza 2 an estimated 600 million reserves, Payara an estimated 600 million reserves and Yellowtail an estimated 1 billion reserves. The total estimated capital investment across the four projects amounts to US$29.3b. Liza 1 has an estimated productive lifecycle of 10 years; Liza 2, 8 years; Payara 8 years and Yellowtail 11 years. The estimated gross revenue is approximately US$177.3b; the total Government’s Take is an estimated $49b or 28% while the Oil Companies’ Take is an estimated US$42b or 24%. Notably, Government’s Take will peak at approximately US$4.8b annually during the period 2025 – 2029 when the four projects will be producing concurrently. The four projects altogether have an estimated NPV of US$35.4b; an average IRR of 22% and average ROI of 332%.

Table 1 (b) above demonstrates the rate and timeline of capital recovery for the four approved projects. The analysis takes into account the general financing model employed for the development – that is, the current / producing projects will finance the future developments. This is an important aspect of the analysis to determine how long these projects will repay for itself plus the CAPEX of future developments within the Stabroek block by means of the 75% cost recovery ceiling: where 30% of cost oil represents the OPEX and the other 45% allocated towards capital recovery. In so doing, the profit share for Guyana will potentially increase to about 35% of gross revenue up from the 12.5% of gross revenue during the cost recovery period.

In view of this background, the findings of the analysis demonstrate that Liza 1 will recover its CAPEX in five years following which it will generate sufficient cash flow to finance about 77% of the total estimated CAPEX for Liza 2, and Liza 2 will recover the remaining 23% of the total estimated CAPEX. Liza 2 will then generate sufficient cash flow to finance 100% of the estimated CAPEX for Payara and 89% of the estimated CAPEX for Yellowtail. By the time Payara starts producing, it will only have to recover 11% of the CAPEX for Yellowtail which will be covered from Payara’s first year’s production.

In other words, it can be safely deduced that of the four approved projects, Liza 1 and 2 plus a mere 1.8% of the gross forecasted revenue for Payara would finance 100% of the CAPEX for all four of the approved projects (those that are currently producing and the future developments). Consequently, about 98.2% of Payara’s gross revenue and 100% of Yellowtail’s gross revenue will be subject to a higher profit share for both the oil companies and the Government – where the operating profit could potentially increase from 25% during cost recovery of CAPEX to 70% post recovery of the capital cost.

The analysis conducted herein under a conservative base case scenario shows that Guyana is poised to earn close to US$5b annually when the four approved projects are producing concurrently by 2025 through 2030 at 810,000 boe/d across the four projects. Further to note, Guyana’s Net Take in royalty and profit oil is higher than the oil companies after capital costs are fully recovered and operating expenses deducted / recovered. Guyana’s share of profit oil will also increase relative to the gross revenue when the capital costs for all of the developments are fully recovered owing to relatively low operating costs of 12% – 30% of revenue.

Sincerely,

Joel Bhagwandin

Financial Analyst