Introduction

In today’s column I shall address, respectively, the second [USGS Assessment] and third lines [bullish expert opinions] which underpin my own “strongly bullish stance” on Guyana’s likely recoverable petroleum resources that I have assumed to hold over the long run. Last week, I had addressed my first line of reasoning; that is, the petroleum geology of the Guianas Basin.

With the schedule laid out above, I shall endeavour in this column to continue the wrap up of this discussion on Guyana’s projected recoverable petroleum resources.

Reasoning 2: USGS Assessment

As indicated, my second line of reasoning, following on the Atlantic Mirror Image theory, is derived from the data revealed in two United States Geological Surveys, World Energy Assessments of Undiscovered Oil and Gas Resources in Central and South America along with the Caribbean (2000 and 2012). These treated our Region as a subset of its World Assessment. These assessments covered the volume of undiscovered conventional petroleum resources.

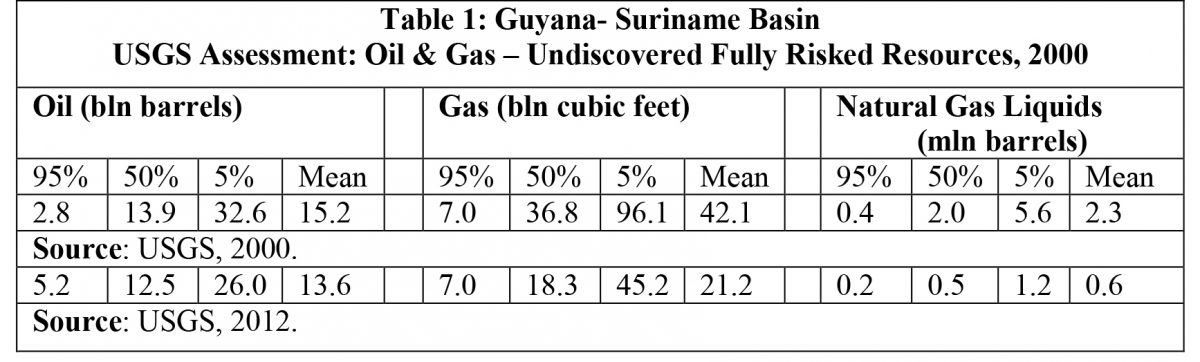

As reported in previous columns, this information relates to: 1) “fully risked” reserves; 2) presenting the estimates at levels of 95, 50, and 5 per cent probability—and further, the mean probability is reported, where fractiles are additive, under the assumption of perfect positive correlation; and 3) estimates for gas fields include all liquids. Undiscovered gas resources are therefore the sum of non-associated and associated gas. Both Survey results are shown in Table 1.

For the 2000 assessment, estimates range from at least 2.8 billion barrels of oil at 95 per cent likelihood to at least 32.6 billion barrels at 5 per cent likelihood. The 50 per cent likelihood is at least 13.9 billion barrels of oil equivalent and the mean is at least 15.2 billion barrels of oil equivalent. For the 2012 assessment estimates range from at least 5.2 billion barrels at 95 per cent and 26.0 barrels at 5 per cent. The 50 per cent likelihood is 12.5 billion barrels and the mean is 13.6 billion barrels. Current discoveries reveal amounts much larger than the 95 per cent likelihood estimate for both assessments.

Two observations are warranted here: First, these estimates are for a virgin frontier region and therefore remain reliant on petroleum geology assessment. Second, the mean natural gas estimates are for 42.1 and 21.2 billion cubic feet, respectively.

In my original presentation I had used a measured mean probability to arrive at my guestimate of 13-15 billion barrels of oil equivalent in the Guyana basin. Assuming a regular continuum ranging from strongly bearish to strongly bullish this is a mid-point. I shall revise this guestimate as a product of my present re-visit of this topic.

Reasoning 3: Bullish Expert Opinion

In my Chapter entitled “Guyana and the advent of world-class petroleum finds” in Prof. Robert Looney, ed, Handbook of Caribbean Economies 2020, I provide a sample of bullish expert opinions in support of mine. I reproduce this sample below.

Consider:

1. Drilling Offshore

The December 3, 2018 issue of Drilling Offshore, cites petroleum expert Luiz Hayum’s claim: “With about 17 projects still to drill [Guyana] will easily become the fourth largest oil producer within the Americas by the end of the next decade, if Venezuela and Mexico’s production decline continues”.

2. Offshore Energy Today

This publication’s February 14, 2019 edition states: “US oil major ExxonMobil can’t stop finding oil in Guyana” (my emphasis). This assessment followed the recent (January 2019) discoveries: Tilapia 1 and Haimara 1, which make for 12 successful discoveries in the Stabroek Block.

3. ExxonMobil

ExxonMobil’s Exploration Company notes: “We see a lot of development potential in the Turbot area [in the Stabroek Block] and continue to prioritize high potential prospects … we expect the area to progress to a major development hub providing substantial value to Guyana, our partners and ExxonMobil”.

4. Rystad Energy

Similarly, Rystad Energy has reminded us: “US oil major Exxon was the leader of the pack among the top oil and gas explorers in 2018. ExxonMobil was exceptional both in terms of discovered volumes and value creation for exploration”.

5. Energy Group, Canada

The Energy Group has labelled Guyana’s “reservoir quality exceptional with low development costs and low risk”. Furthermore, “of the top 50 developments [the Group] surveyed, on average, Guyana’s figures are among the lowest”.

6. Wood Mackenzie

In September 2018, Wood Mackenzie depicted Guyana as “a new planet in oil’s solar system” (my emphasis). This same piece projected that Guyana would become one of an “elite group” of oil exporters, “exporting more than one million barrels a day, when four years ago it produced none”.

7. The National

Finally, Robin Mills in The National asked the question “who will be world’s largest oil producing country per person in the 2020s? And, responded “Guyana may be the next big beast in global oil” (my emphasis).

These superlatives reinforce the substance behind my bullish outlook.

Conclusion

In the coming weeks I shall: 1) offer brief comments on the fourth consideration that under-pins my strongly bullish outlook on Guyana’s recoverable resource potential; and 2) re-visit my use of the Atlantic Mirror Image theory and the two USGS reports in order to provide an updated guestimate of Guyana’s recoverable conventional petroleum resources.