Today’s column concludes this 14-part series devoted to re-visiting Guyana Government’s Take ratio and estimates of its of recoverable hydrocarbons. These columns have had three aims. First, given the spirited public exchanges on the topics, they have sought to provide in a single source, published calculations of Guyana Government’s Take ratio, while clarifying important methodological issues. Second, they provide the rationale informing my original estimate of Guyana’s recoverable resources. And thirdly, five years later, I update that original `prediction.

Today’s final column offers observations on two broad thematic areas; namely, 1] the ruling and newly announced PSA template intended for auctions of additional oil blocks and 2] the secular trend in the global energy mix and the opportunity window for Guyana’s hydrocarbons.

Observation -1 Government Take

Ruling PSA

Worldwide, PSAs vary significantly in their constituent fiscal measures and metrics. Therefore, the “basic ABC” of PSAs is that they cannot be fruitfully evaluated by referencing one or some constituent elements. Despite this oft repeated caution featured in every textbook, the noise and nonsense in the local social and print media propagandize otherwise dis-information.

The fact is that all constituent features of a PSA must be aggregated in order to determine the price which an investor [Contractor] has to pay the Resource Owner [Government] in order to engage in extraction. As I have repeatedly observed in this series, the IADB’s Report [A Slippery Slope, 2020] expresses this price as the equivalent of an Average Effective Tax Rate, AETR.

Furthermore, since 2016 I have repeatedly noted in these Sunday columns that, the “Nobel Prize winning economic theory of incomplete contracts” assures a process where there will be constant pressure to revise/re-negotiate Guyana’s ruling PSA

Proposed Template

The announced template for the auction of oil blocks next year shows significant upward-biased adjustments in revenue terms to: 1] the size and location of exploration zones; 14 new blocks are on offer, 11 in shallow water and three in deep water. These blocks vary in size from 1000 to 3000 square kilometers; while clustering around 2000, While there is no limit to the number of fields Investors can bid for, only three will be awarded to any one Investor.

2] signature bonus; adjusted to US$10 million for shallow water blocks and US$20 million for offshore deep water blocks 3] royalty rate; raised to 10 percent 4] cost recovery terms; limit now capped at 65 percent, with profit split ratio of 50/50 maintained; 6] the introduction of ring-fencing provisions; 7] corporation taxes; now set at 10 percent.

In addition, the new PSA template situates itself in a universe where discoveries are proven before the auction so frontier zone risks are somewhat reduced, thereby making the timing of the auctions propitious. Emphases are also placed on the work programmes, financial offers, and local content proposals of bidders.

Although no auction has taken place as yet, by simple inspection one notes that, overall, the fiscal metrics in the new PSA template trend upward; displaying the intended increase in the price required by the Authorities for future oil blocks contracted for extraction by investors. From business and economics, we know an increase in supply cost/price leads to reduced incentives or dis-incentivization for normal investors. Such dis-incentivization reduces investors’ willingness to invest. At the heart of every PSA on offer, the Authorities face this trade-off; finding the right balance between Government Take and investment flows.

ExxonMobil “Stingy” Stratagem

ExxonMobil and its co-ventures [Hess and CNOOC ] are aware of all the above, leaving me to conclude that as a bargaining strategy the group has been adopting a stingy or miserly bargaining stratagem of downward bias in their publicly declared recoverable resources

Observation-2 Climate Transition

In this section I offer observations supporting my prediction that, despite the on-going global climate transition. Guyana faces a decades-long opportunity to become and remain a significant global player as a primary energy supplier. The global transition away from petroleum is, at best, around three decades away.

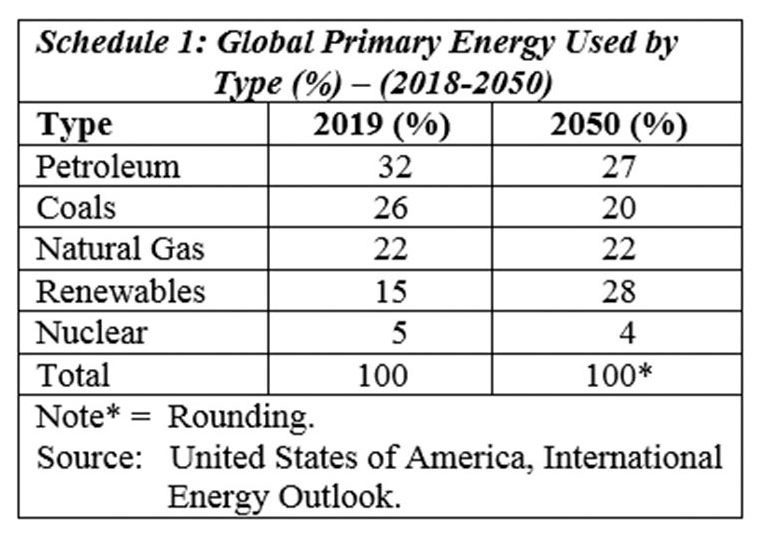

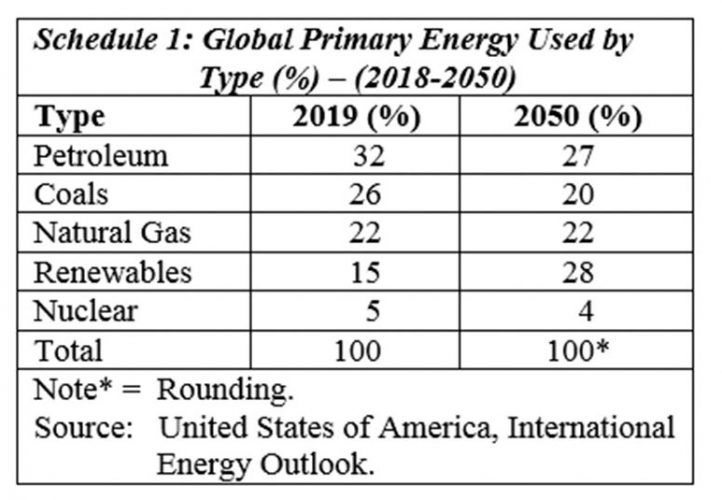

As I have argued in the Part 9 column, the US, EIA’s International Energy Outlook estimates global energy shares from pre-Covid 2018 up to 2050; centring on five modes of primary energy supply. The projected shares by 2050 are: renewables 28, petroleum liquids 27, natural gas 22, coal 20, and nuclear 4, percent.

Petroleum loses its pre-eminence held in 2018 and declines as a share of global primary energy supplies. The share of renewables rises from 15 to 28 percent; natural gas remains constant over the period, at 22 percent; with coal’s share falling the most, from 26 to 20 percent, and, finally, nuclear power’s share declines from 5 to 4 percent, remaining a marginal source.

The EIA projects over 2018-50 the fastest growing energy source annually is renewables [3 percent]; natural gas [1.1 percent] petroleum [0.8 percent]od. These data are summarized in Schedule 1.

Looking into the future there will be an inflection point for global crude oil production circa 2050. This is attained when petroleum is overtaken as the leading primary energy supply, but between now and then its global demand is projected to increase by a whopping 30 percent! Thus, the existential threat to Guyana’s infant oil and gas sector remains a secular prospect. This is a key outcome, for my appraisal of the probable impacts of the global climate transition on that sector.

Conclusion;

Sadly, last year’s COP27 outcomes confirm and do not restrict the relentless march of carbon emitting fuels.