The East Bank Demerara family facing 268 charges for allegedly laundering billions and transferring large sums to 22 companies in China had their business flagged by the Financial Intelligence Unit (FIU) from routine disclosures made by local banks, with the Guyana Revenue Authority (GRA) additionally investigating for possible tax evasion, sources say.

And while proving the laundering case here would not be difficult, this newspaper understands that investigators could seek government intervention through diplomatic channels for securing documents and accounts information from the companies in China to add to their investigation.

Sources told Stabroek News that “although the information is not needed for the case itself, diplomatic channels would have to be used to get documents from China because this country has no jurisdiction over the businesses there.”

While it is unclear what role the GRA played in the investigations, this newspaper understands that the local tax agency conducted investigations of its own.

Almost three years of investigation by the Special Organized Crime Unit (SOCU) came to an end this week when a Herstelling, East Bank Demerara (EBD) businessman and his reputed wife were charged for allegedly laundering billions and transferring large sums to 22 companies in China.

They were represented by attorney Bernard Da Silva.

Their son who did not appear in court with his parents, was later on Wednesday evening surrendered to SOCU by his attorney and also faced joint money laundering charges.

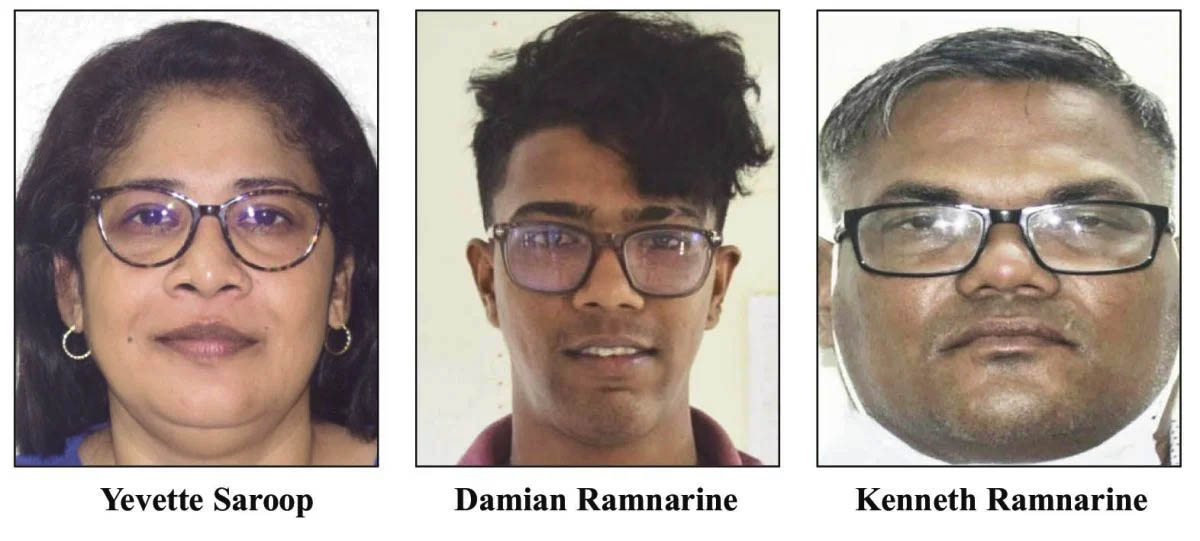

Charged on Wednesday were Kenneth Ramnarine, a taxi driver, his reputed wife, Yevette Saroop, and son Damian Ramnarine, a salesman, all of Lot 274 Somerset Court, Herstelling, EBD. SOCU laid a total of 268 charges of money laundering and conspiracy to launder over $4.1 billion against the family.

Kenneth and Damian Ramnarine were charged jointly, while Yvette Saroop, who was alleged to have conspired with them, was charged separately. Kenneth Ramnarine appeared at the Georgetown Magistrate’s Court on Wednesday before Chief Magistrate Ann McLennan where he was not required to plead to 41 indictable money laundering charges. His son was not present in the court at the time.

The joint Money Laundering charges against them were laid under Section 3 (1) (a) of the Anti-Money Laundering and Countering the Financing of Terrorism Act Chapter 10:11. A summary of all the charges read that they knowingly or having reasonable grounds to believe that the cash in question, whether in whole or in part directly or indirectly represented proceeds of crime, converted or transferred the cash in question knowing or having reasons to believe that the said cash is the proceeds of crime with the aim of concealing or disguising the illicit origin.

Kenneth Ramnarine was remanded until March 06.

The 134 money laundering charges against Saroop were laid under 3 (1) (d) of the aforementioned act. She appeared on Wednesday at the Diamond/Grove Magistrate’s Court before Magistrate Sunil Scarce, where she was not required to plead to the indictable charges. A summary of all the charges read that she conspired with Kenneth and Damian Ramnarine to convert or transfer the cash in question, knowing or having reasonable grounds to believe that the cash in whole or in part directly or indirectly represents proceeds of crime, with the aim of concealing or disguising the illicit origin.

Saroop was remanded to prison until March 6 and she is to reappear in court on March 17 for disclosure.

At the same court, Kenneth appeared before the same Magistrate to answer another 93 counts of money laundering charges for transporting large sums of monies through banks at Diamond, East Bank Area. The charges were laid under the same section, and he was not required to plead. He was remanded and was slated to answer more charges of a similar nature at the Diamond Magistrate’s Court on Thursday.

The son, Damien, was on Thursday remanded to prison after facing 134 joint fraud charges committed during the years 2018 to 2021.

According to the Head of SOCU, Assistant Commissioner Fazil Karimbaksh, reports reaching his unit indicated that the trio conducted multiple suspicious transactions at several financial institutions in Guyana, raising concerns that they may be involved in money laundering activities. He disclosed that his suspicions were based primarily on the large number of unsubstantiated cash deposits made via Kenneth’s business accounts of Ken’s Trading Enterprise. Furthermore, the Sources of Funds declarations were submitted to several commercial banks which showed that most of the deposits are attributed to sales proceeds from biodegradable food boxes sold to local businesses, particularly Chinese restaurants.

Karimbaksh said that a substantial number of wire transfers, amounting to over $3.7 billion were sent to twenty-two companies in China under the pretext of importing raw materials to produce bio-degradable products, while other sums were disguised locally, overall, totalling over $4.1 billion.

He related that his investigators were unable to find any legitimate source of these funds, which the accused wire transferred out of Guyana. The accused’s actions, he noted, suggested that they may be operating as nominees for some Chinese businesses and also facilitating tax evasion through Ken’s Trading Enterprise.