The first report by the Natural Resource Fund (NRF) Board on its operations is completed and is expected to be made public sometime soon, sources close to the process say. Further, a decision has been made that since the remainder in the fund this year is less than US$500 million, it will be placed in “very safe investments” namely deposits, which is one of two options allowed as per the laws of this country.

“It will go as deposits and not eligible treasury bills because of the amount and because you are getting secure interest overnight, something like 5 per cent, which is very advantageous for us,” officials close to the process told the Stabroek News when asked for an update.

“We will look at the [treasury] bills when we know they are coming down… then you can go long term and lock in to that [amount]. That is not expected to happen until next year though…,” a source explained.

The NRF comprises oil profits and royalties.

According to the Bank of Guyana (BoG), which manages the fund, the closing balance at the end of April totalled US$1,671,933,104.41. The figure for May, 2023 has not yet been updated.

In the first quarterly report, the BoG had disclosed that during the quarter, a formal investment mandate was established for the fund following discussions between the Board of Directors and the BoG. It was mandated that the funds be maintained in the deposit account held at the Federal Reserve Bank of New York earning overnight deposit interest at the prevailing federal funds rate. It was also agreed that BoG will continue to monitor overnight interest rates and inform the Chairman of any changes to consider adopting a ladder approach investment strategy.

The BoG had also explained that over the quarter, the Federal Reserve increased its interest rates target range twice, moving it from 4.25% to 4.5%, 4.5% to 4.75% and then from 4.75% to 5%. As a result of those increases, which caused interest rates on overnight deposits to rise, and a higher account balance, the fund continued to earn a higher level of interest income on its overnight deposits than previous quarters. The fund earned $3,266.13 million (US$15.66 million) in interest income over the quarter compared to $2,356.73 million (US$11.30 million) the previous quarter.

As regards the performance of the fund up to April this year, BoG informed: “The fund recorded a profit of $3,266.13 million (US$15.66 million) this quarter in comparison with $2,356.73 million (US$11.30 million) for the preceding quarter solely due to interest earned on deposits. This resulted in a return of 1.059% for the quarter compared with 0.863% in the previous quarter. The fund earned an annualized return of 0.824% since its inception.”

Sources say that NRF Board Chairman retired major general Joseph Singh ensured that the report was completed and reflected the decision taken. He has also met with the Minister of Finance and another meeting is set when he returns from overseas.

“The report, well its draft is completed and just a few minor things needed to be changed. We were scheduled to meet but the fire [at Mahdia which killed 20 children] happened and that took priority,” a source explained.

That there still is no investment committee is also highlighted in the report. The opposition still has not named its nominee; it is unclear when or if that person will be named.

Several calls to Opposition Leader Aubrey Norton by this newspaper went unanswered.

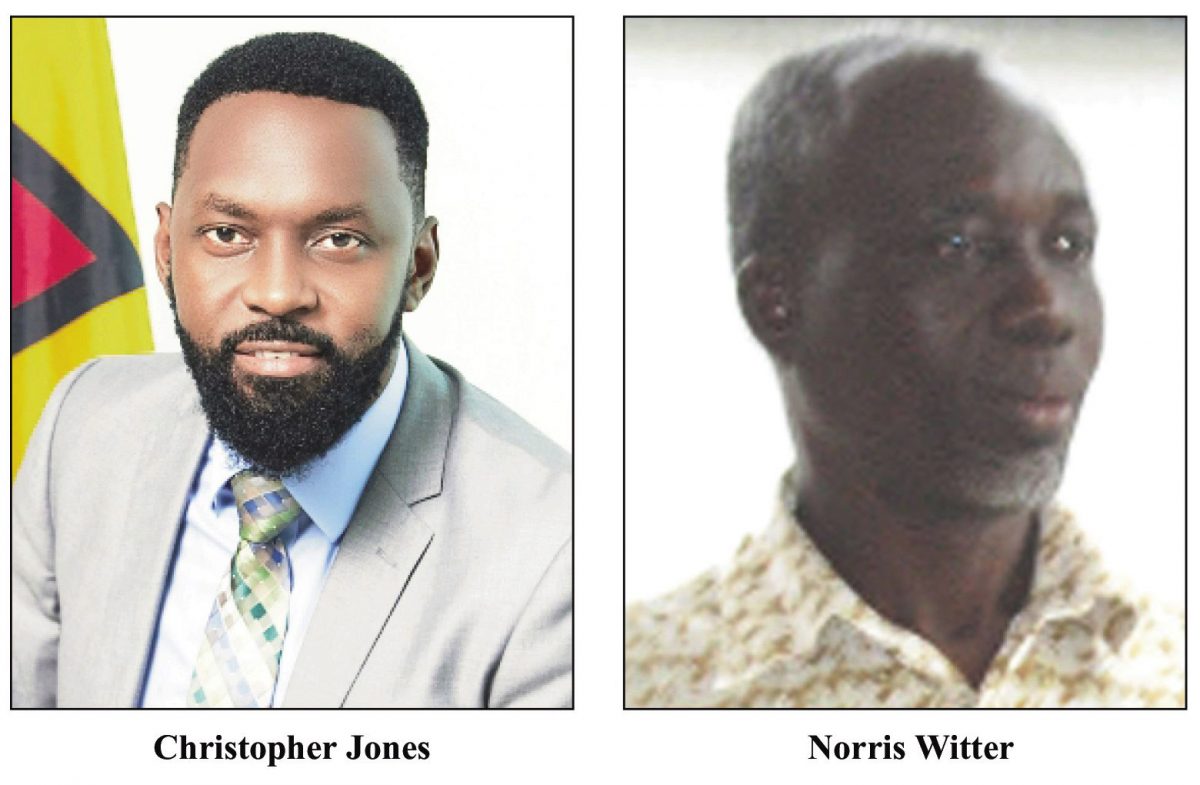

Opposition Chief Whip Christopher Jones and trade unionist Norris Witter have challenged the legality of the NRF. Their main contention is that because of the absence of the authentic mace from the parliamentary chamber and members not being seated during the voting process, the Bill could not be regarded as having been lawfully passed. Attorney General Anil Nandlall had asked the court to strike out the action, arguing, among other things, that it was an abuse of process and baseless. The defendants are the AG, Minister of Finance, the Speaker of the National Assembly, the Clerk of the National Assembly and Parliament Office. That case comes up before Justice Navindra Singh on the 19th of this month when he is expected to deliver his ruling.

The structure of the NRF follows the commonly used manager model, in which the Ministry of Finance is responsible for the overall management of the NRF and the central bank – Bank of Guyana – is responsible for the operational management of the NRF in accordance with an investment mandate and an operational agreement.

Proceeds from petroleum operations including royalties, a share of oil profits, and income tax or corporate income tax, are directly deposited into the NRF. The Ministry of Finance, with the advice of an investment committee – comprising suitably qualified and experienced financial experts – has responsibility for providing the Bank of Guyana with an investment mandate. Eligible investments are defined in the NRF Act and are to be managed according to the principles of passive investment management. The NRF Act also identifies two investment streams: 1) very safe investments which are limited to eligible bank deposits and eligible treasury bills; and 2) long-term savings for which investments in eligible asset classes are restricted by floors and ceilings.

As the operational manager, BoG can, through a competitive and open procurement process, hire private managers to manage part of the NRF, as well as custodians for the safekeeping of investments. The BoG is also responsible for providing the Ministry of Finance with monthly and quarterly reports on the performance of the NRF, as well as audited financial statements and any other information required for the preparation of the annual report. The Ministry of Finance is responsible for publishing these reports, among others, on its website within time frames identified in the NRF Act.

The NRF will, for the first time, be activating its investment protocols for money set aside for future generations and will continue to use the current daily deposits investment class at the Federal Reserve Bank of New York.

“It brings in a daily return on all the funds there… and it is a safe investment…,” one source pointed out.

The purpose of the NRF Fund is to manage the natural resource wealth of Guyana for the benefit of present and future generations, in an effective and efficient manner, by ensuring that volatility in natural resource revenues does not lead to volatile public spending; that natural resource revenues do not lead to a loss of economic competitiveness; fair transferals of natural resource wealth across generations, thus ensuring that future generations benefit equally from Guyana’s natural resource wealth, and using this natural resource wealth to finance national development priorities including any initiative aimed at realising an inclusive green economy.

The NRF Act 2021 came into operation on 1st January, 2022, and as part of the 2022 Budget process, parliamentary approval was granted for a total of US$607.6 million to be transferred during fiscal year 2022 and that was done.

In keeping with the NRF Act 2021, the government has said that as part of the Budget 2023 process, parliamentary approval was granted for a total of US$1.002 billion to be transferred during fiscal year 2023.

The Ministry of Finance had last month announced that the government had made its second withdrawal of the year to the tune of $41.6 billion. “… A further US$200 million equivalent to $41.6 billion has been transferred from the Natural Resource Fund to the Consolidated Fund to finance national development priorities,” the ministry said in a release. It recalled that in February a withdrawal of a similar amount was made. This brings the accumulated withdrawals to date in 2023 from the NRF to US$400 million, equivalent to $83.2 billion.

The Act states how monies in the fund should be invested. “The funds shall only be invested in eligible classes,” the Act says, and it outlines these. But since the sum available this year is below US$500 million, all of it has to be invested in what the Act calls very safe investments.

“Where the balance of the fund is less than five hundred million United States Dollars, then all of the Fund shall be invested in very safe investments,” the Act says. According to Section 23:1 of the Act, “… the term very safe investments means eligible bank deposits and eligible treasury bills only”.

The Act also points out that the total amount requested for emergency financing for a fiscal year shall not be subject to the ceiling calculation, thus in the event of a national emergency in this calendar year, monies could come from the US$257 million in the fund through a supplementary appropriation bill. The minister will, however, have to provide, in such a case, a detailed report on why the money is required and a report describing the major natural disaster including impacts on the environment and population of Guyana.