Dear Editor,

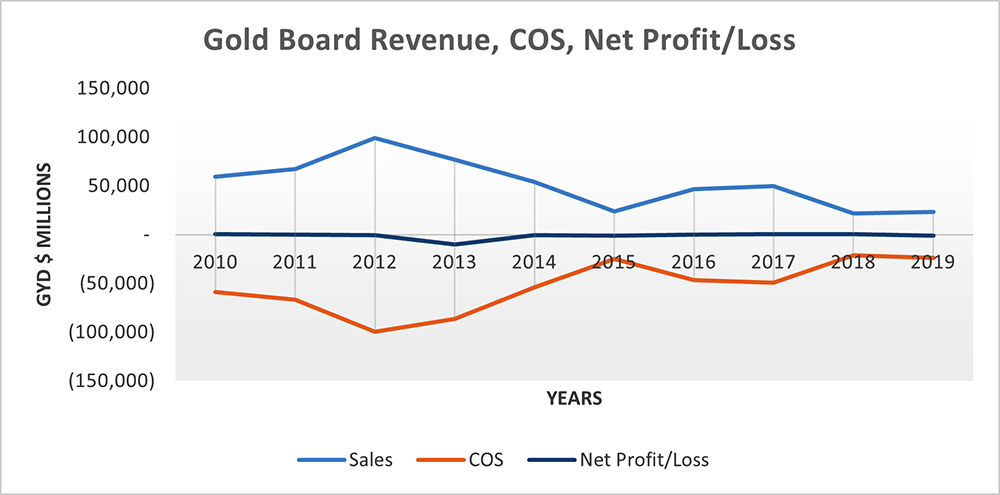

I wish to examine the management of the Guyana Gold Board (GGB/the Board) for the period 2010-2019. Having examined the audited financial statements for the period 2010-2019, the Board recorded profits in 2010 of $372 million, 2011 of $126 million, 2017 of $648 million and 2018 of $422 million. For the other years during this period, the Board recorded losses owing to high cost of sales and price volatility. During this period, the highest average price per ounce was recorded at US$1,665 in 2011 which plummeted in 2013 to its lowest level of US$1,197 per ounce. The price did not recover to its pre-2013 levels until 2017 at US$1,320 and to US$1,479 in 2019 (see chart below). In order to minimize the impact of the losses owing to the foregoing factors, it was only prudent for the management and the Board of Directors to ensure administrative expenses were kept as low as possible.

Source: Author based on Gold Board Annual Reports

Under pre-2015management, administrative expenses increased modestly from $300 million in 2011 to $332 million in 2014, an increase of $32 million or 11%. Conversely, administrative expenses recorded a massive increase from $293 million in 2016 to $413 million in 2019, representing an increase of $120 million or 41%, nearly 4-times the increase recorded for 2011-2014. Employment costs of $82.4 million in 2014 increased to $186.5 million by the end of 2019 or 126%; Meal allowances of $1.153 million in 2014 increased to $3.330 million in 2019 or 189%; Directors’ fees of $402k in 2014 increased to $2.619 million by the end of 2019 or 551%; and Other expenses increased from $7.554 million in 2014 to $63.141 million by the end of 2019, an increase of 740%. Bearing in mind that it was unclear what made up the “other” expense line item in the financial statements.

During the years under review, the Board expended $15,247,945 as payroll expenses on behalf of the Ministry of Natural Resources. Those expenses were not incurred on the operations of the Board and as such were deemed ineligible expenditure. Further audit inquiry revealed that there was no agreement between GGB and the Ministry of Natural Resources for such expenditures which had been recurring since 2012. The Board’s disposed non-current assets totaled $21,180,846 as of December 31, 2017. However, such disposals were not approved by the Board of Directors. There appeared to be a breakdown of internal controls and failure to comply with financial procedures as set out by the Ministry of Finance with regards to disposal of non-current assets.

During 2018, the Guyana Gold Board approved nine (9) dealers’ licenses to trade in gold including exportation. However, the auditors found the following irregularities: There were no documented standard operating procedures offering guidance for approval and issuing of dealers’ licenses. There is no evidence of interviews conducted by the Board of Directors prior to issuance of licenses. Moreover, in 2019, no objection was sought from the Minister of Natural Resources as required, except in one of the nine dealers’ files, evidence of no objection was on file. The Board acquired assets totaling $49.3 million as shown in its financial statements. Of this amount, $8.145 million was used to purchase a generator set of $7.665 million and supply and installation of CCTV cameras of $480k, each sole sourced without quotations for comparable prices and terms and conditions; $16.8 million was spent on electrical works at the new location in Queenstown and acquisition of mercury abatement system, carried out by a contractor without official contract documents between contractor and the GGB.

The Board experienced significant delays with the contractor to complete and hand over the mercury system after 50% of the amount was paid. In the absence of a contract, it was difficult for the GGB to institute penalties. The auditors were unable to determine whether the Board followed established procurement practice in the selection for architectural consultancy services based on the value and scope of works required. The auditors were informed that a previous consultant, Rodrigues Architect Ltd., was recruited but his findings did not meet the Board’s approval. Subsequently, KNA Construction was invited to make their presentation to the Board, which was well received by the Board. Further checks on the background of KNA Construction revealed that the company was registered on May 31, 2019, as a sole trader under the Business Registration Act, and one month later, received a contract. A site visit in February 2021 to the location at Lilliendaal, East Coast Demerara, indicated that no construction work had commenced.

The auditors made several calls to the Office of the Permanent Secretary of the Ministry of Health for an update on the status on the construction of the GGB/Ministry of Public Health offices, but up to the date of the report, no response was forthcoming. Payment of $10.4 million made by GGB to KNA Construction was not recovered from the Ministry of Health. Other procurement breaches cited in the 2019 annual report are: A contract valuing $4 million awarded to Big Boss Transportation Service for clearing of land for construction of head office. Audit examination revealed that the Board did not adhere to established procurement practice using the three quotes system before the selection of a contractor. A contract for $16.660 million was awarded to Integrated Networks. However, auditors were unable to determine whether the established procurement procedure was complied with.

A contract for US$288,000 (G$60 million), was awarded to Axis Guyana Inc., for implementation of a Regulatory Compliance System. According to the contract, the amount represented one year’s subscription payable in quarterly instalments. At the time of the report, total payments to Axis amounted to G$20.964 million with nothing to show any benefits derived. Auditors were informed that further payments were placed on hold on August 21, 2020, by Vickram Bharrat, Minister of Natural Resources. Further review of this contract revealed several inconsistencies infringing upon the tax laws of Guyana. Under the contract, the company requested exemption from corporate taxes for its first three years of operations.

The auditors concluded that the GGB did not receive value for money in relation to the contract with Axis Guyana Inc., and that established procurement procedures were not complied with.

In view of the foregoing egregious revelations, the GGB was fraught with procurement breaches in excess of $120 million, financial irregularities and mismanagement of the agency’s financial resources, and unjustifiably exorbitant increases of the Board’s administrative expenses. It is worth noting that having perused the audit reports for the previous years from 2011-2016, no such breaches, irregularities and mismanagement of the agency’s financial resources was ever conducted/cited prior.

Sincerely,

Joel Bhagwandin