Dear Editor,

Reference is made to Christopher Ram’s letter in the Stabroek News (SN) edition of October 12, 2023, with the caption “my concern has to do with Bhagwandin’s falsehoods being fed to a trusting and unsuspecting public”. Disappointingly, the readers of Stabroek News did not have the benefit of my two letters to which Christopher Ram is referring, because my first response was not published by SN, and the second to which he refers, was substantially edited by SN– that is, substantial parts of it were edited out. Nevertheless, please see my responses hereunder. Christopher Ram wrote: “Bhagwandin cannot get a matter as basic as the date of the 2016 Petroleum Agreement correct – it is the 27 June 2016 and not October 2016 as he asserts – but yet claims that I am “misleading” the country; that I have committed a “multiplicity of errors”; and that I have “inadvertently considered” the 2016 Agreement in respect of Pre-Contract Costs”.

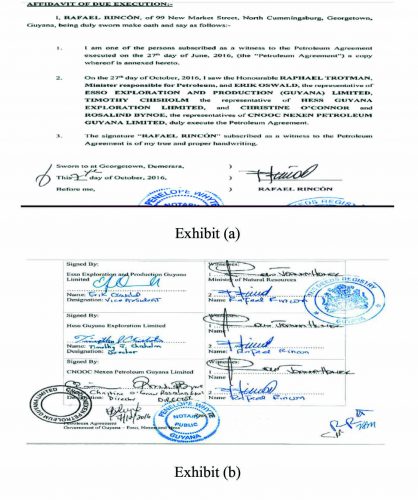

Yes, I stand by my comment that Ram is misleading the country even on this very basic matter of the date of the Contract. According to the Affidavit of Due Exe-cution, the Agreement was executed on 27th day of June 2016, but was duly signed by all parties on the 7th day of October 2016. I am no legal expert to pronounce on the implications and/or the difference between the two dates, but this is what I relied on and here are the screen shots of the Contract to confirm.

Christopher Ram wrote: “in an attempt to rebut my assertion that that the US$460.2M claimed by Esso and Co-ventures as pre-December 2015 expenditure was overstated by around US$92 million, he omits from his extract the relevant and critical words “all such costs incurred under the 1999 Petroleum Agreement prior to year 2015…”.

Christopher Ram wrote: “in an attempt to rebut my assertion that that the US$460.2M claimed by Esso and Co-ventures as pre-December 2015 expenditure was overstated by around US$92 million, he omits from his extract the relevant and critical words “all such costs incurred under the 1999 Petroleum Agreement prior to year 2015…”.

Christopher Ram is being totally dishonest at best here. In my letter I quoted verbatim from the Petroleum Agreement (2016) clause in respect of the “Pre-Contract Costs” which states, “Costs incurred by the Contractor in connection with petroleum operations carried out pursuant to the 1999 Petroleum Agreement, which shall include: (1) four hundred and sixty million, two hundred and thirty-seven thousand and nine hundred and eighteen United States dollars (US$460,237,918) in respect of all such costs incurred under the 1999 Petroleum Agreement between January 1, 2016 and the effective date which shall be provided to the Minister on or before October 31, 2016 and such number agreed on or before April 30, 2017. For purposes of this paragraph, the term Pre-Contract Costs include contract costs, exploration costs, operating costs, service costs and general and administrative costs and annual overhead charge as those terms are defined in the 1999 Petroleum Agreement”.

Then I further asserted that the Petroleum Agreement was signed in October 2016, hence, in accordance with the above clause, the Pre-Contract costs included costs up to 2016 and agreed amounts on or before April 30, 2017, and NOT only up to 2015 which Christopher Ram has inadvertently considered. Note that reference is made to an effective date pursuant to the Agreement which is stated “on or before October 31, 2016”. Though I am no legal expert, my limited knowledge in contract law suggests to me that the execution date of the Agreement, which is stated as June 27, 2016, and the effective date of the Contract are not the same, and legally both may have different implications. Perhaps the October date is the effective date when it was duly signed by all parties.

Christopher Ram wrote: “the distortions and dishonesty do not end there. Bhagwandin claims to have obtained Esso’s financial statements for the period 1999 – 2015. That is most certainly a falsehood. Esso itself admitted to the IHS auditors that it had “purged data prior to 2004” in accordance with its document retention policy. Bhagwandin also claims receipt of audited financial statements of Shell, which had bought a 50% interest in the Stabroek Block. That too, is most likely a falsehood.”

In my first letter published in other sections of the media on October 2, 2023, I said that one would have to examine the financial statements from 1999-2015 to confirm Christopher Ram’s assertions, and which could be obtained from the Deeds Registry. At this point, I was not in possession of same which meant that I had to embark on obtaining same. Upon doing so, the Registry did not have all of the financial statements from 1999-2015 for Shell, Esso, Hess and CNOOC, and I explained the reason for this in my second letter. In this regard, I wrote the following:

Having examined ExxonMobil’s and its Co-ventures financial statements for the period up to 2016, and 2017, total (cumulative) expenses up to 2016 amounted to US$382.3 million and in 2017, total expenses for that year amounted to US$109.3 million, giving rise to a total up to 2017 of US$491.6 million. It is therefore unlikely that the Pre-Contract Costs are inflated (subject to verification through the cost recovery audit by GRA), given that a portion of the costs incurred in 2017 is part of the agreed Pre-Contract costs of US$460.2 million. However, it is important to note that one cannot determine the Pre-Contract Costs by only looking at the sum total of expenses reported on the financial statements for a number of reasons, for example:

The accounting for recoverable costs in the cost bank pursuant to the Petroleum Agreement is determined on a cash basis, whereas the cost accounting for statutory reporting is done on an accrual basis. So for instance, the acquisition of equipment will be subject to depreciation charges over the life of the asset, which would effectively reduce the book value on the balance sheet. But the amount that is recovered is based on the original acquisition cost. During the period 1999-2014, costs were incurred before the establishment of local branches in Guyana. The fact that the companies did not establish Guyana branches since 1999 means that there will be no filing of financial statements in the earlier years following the 1999 Agreement. This explains why all of the costs would not have been reflected under the local subsidiaries’ financials but would have been accounted for by the parent companies.

Of note, while it would not have been possible to ascertain the total expenses by adding all the totals from 1999-2016 for the reasons stated above, one would have to look at the accumulated losses as well for the period which is reported on the financial statements for those years (2016-2017). In so doing, there was no revenue to offset the losses until FY 2020 following the commencement of production in December 2019. With this in mind, there is no need for me to respond to Ram’s other inconsequential arguments because the thrust of my argument was not to confirm or pronounce on the veracity of whether the costs have been inflated or not. The fact is that neither of us are in any authoritative position to do so because neither of us have been involved in the actual audit, and it cannot be determined by only looking at the financial statements. I also reiterated that it is the Guyana Revenue Authority (GRA) that is the sole authority on this matter and in so far as the cost oil audit is concerned, there is a disputed figure of US$214 million and not US$92 million that Ram suggested.

The main purpose of my responses to Christopher Ram was to point out that he cannot determine factually that fraud was facilitated by the government given his methodology of merely adding the expenses when he himself confirmed that he does not have all of the facts before him to consider. I have also demonstrated that his analysis is grossly flawed―that he relied on to support his assertions. This is my main contention to the extent that it is a very irresponsible thing to do, especially for someone of Christopher Ram’s stature.

Yours respectfully,

Joel Bhagwandin