The infamous tax certificates

We recall from Column 119 that while the tax is paid by the Government of Guyana, the oil companies receive from the Guyana Revenue Authority ‘proper tax certificates’ in their names. These certificates are not some paper transactions but grant to the oil companies real economic value and substance since they produce them with their tax returns in their home countries as evidence of having paid those taxes and received a credit therefore. Just as a reminder, the current tax rate applicable to oil companies as a non-commercial company is 25% of their taxable profit.

Other tax goodies

This brings us to another tax benefit. Under Guyana tax laws, subject to any Double Taxation Agreement – which in any case does not apply to any of the oil companies – the remittance or deemed remittance of profits is subject to a withholding tax of 20%. The benefit of the exemption from withholding tax – for itself and its affiliated companies, (cousins and all!) – which is seen from this simple example: a Guyanese resident abroad who owns and leases her house in Guyana for an annual rental of G$100,000 will have to bear Withholding Tax of $20,000 on that amount. If for some reason, the Government agrees not to enforce that obligation, that person benefits from $20,000 – without a receipt! The value of the receipt is an additional benefit.

The 2016 Agreement provides that the oil companies are not subject to any “tax, duty, fee, withholding, charge or other impost, applicable on interest payments, dividends, deemed dividends, transfer of profits or deemed remittance of profits from contractors, affiliated companies or non-resident subcontractors branch in Guyana to its foreign or head office or to affiliated companies.”

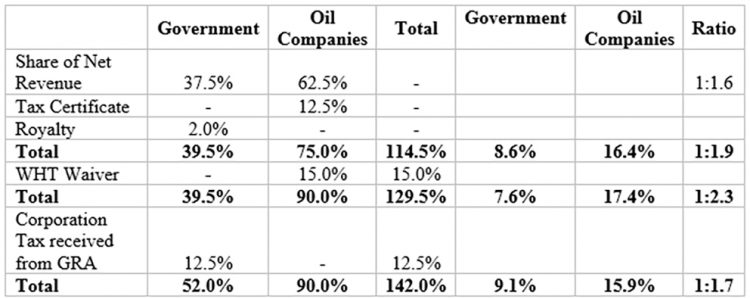

As shown in the table, the value of that benefit is 20% of the 75%, or 15% .

Exclusive of the corporation tax receipt to the Government (into the Consolidated Fund from the Natural Resource Fund), but inclusive of the tax benefits to the oil companies, the Government gets 39.5% and the oil companies get 90%. If we include the tax receipt to the Government, the Government gets 52% while the oil companies benefit to the tune of 90%.

Source: Columnist’s compilation

As the Table shows, regardless of what is included or excluded, the oil companies receive far more from their operations in Guyana than the Government of Guyana does, ranging from 1:1.6 to 1:2.3. Or we can put it another way. For every barrel of oil Guyana gets, the oil companies can receive twice as many. Regardless of how it is computed, or what is included or excluded, our total gross share is 9.1%. It is simply amazing that any Guyanese would accept, let alone defend this atrocity.

Net versus gross

One final point. The receipts by the Government are gross of expenses. The oil companies walk away with pure economic value, including the cash proceeds from their share of profit oil. Out of its earnings, the Government has to meet all the expenses of the administration and oversight of the sector. These include the Ministry of Natural Resources, the Environmental Protection Agency, the ministerial audit, the use of the court system to fight Guyanese seeking a fairer deal and better contract administration.

This in no way is intended to suggest that the country has not benefitted from the production of oil. One only has to look at the national budget of which oil revenue accounted for 36% of budgeted revenues in 2023, and significant foreign exchange earnings from which the country benefits. Against these, the economist would consider the externalities arising from oil production. But that is outside the scope of column written by an accountant.

The debate of 50:50 profit share has blinded Guyanese about the obnoxious scale of generosity offered to Exxon and why it is so resistant to talk of renegotiation. Not only do the oil companies not pay any Corporation Taxes, but they walk away with a certificate for the taxes and are exempted from any taxes in Guyana – right up to 2057! Given that this is a post-discovery contract which should not have been awarded in the first place, it might possibly be the worst oil contract ever!

When Exxon threatened Newell Dennison in April 2016 at its Texas campus with no investment without a new Agreement, these were the benefits it wanted to secure. When Brooke Harris, Exxon’s top official, was bombarding Trotman and Legal Officer Ms. Joanna Homer of the Ministry of Natural Resources Ministry, with emails, the objective was no different. When Harris drafted the Cabinet Paper for Trotman, it was no different. And when Exxon complained to Granger that Trotman was having “misgivings”, Granger was blind to Exxon’s objective and the consequences for Guyana.

Over time, the media have unmasked the travesty with which the Granger Administration has shackled Guyana for more than a generation. It can be no excuse that the model used for the 2016 Agreement originated from then President Donald Ramotar and Natural Resources Minister Robert Persaud. To overcome the inconvenience that no oil company could get a second agreement over blocks already relinquished, it is highly unlikely that Exxon and some of our own people, did not have a hand in the concoction called the bridging deed. On top of all of these, Trotman unwisely used a pre-discovery model agreement for post-discovery circumstances. That was a most unforgivable and catastrophic error by the APNU+AFC.

Conclusion

The advertisement by Exxon reproduced in column 119 is more than mere distortions and propaganda. It is an insult to the senses and sensibilities of Guyanese. Not even the British colonisers ever boasted of “building Guyana”. Here, the greatest coloniser of all, aided, abetted and enabled by the current Government telling us that they are building Guyana. They are indeed, if by “building” Guyana they mean exploiting our country’s natural resources for a measly 2% royalty, paying no taxes, forcing our government into an international conspiracy to defraud the US IRS, demands absolute security and protection while posing grave risks to the environment and eroding the country’s reputation as a protector of the environment.

I close with this thought. Would a counter-billboard to that placed by Exxon to rebut Exxon’s deception be permitted by the Demerara Harbour Bridge?