Every Man, Woman and Child in Guyana Must Become Oil-Minded – Column 130

Introduction

This week’s column features the financial statements of the Guyana branch of ExxonMobil Guyana Limited, a 45% stakeholder, and the designated Operator, in the Stabroek Block. In what was a first for any company in Guyana, the financials, part of a wider report, were presented at a media event hosted by the branch President Mr. Alistair Routledge. The very colourful cover pages mirror the annual report of the US parent, in appearance, content and excitement, except that the parent’s report flaunts metrics like earnings, shareholder distributions, return on average capital employed and annualised total shareholder returns. Perhaps with only mild exaggeration, the US parent report states that its work in Guyana continues to be among Exxon’s most exciting and successful – for its business, the people of Guyana, and the world. Exxon has brought prosperity to the world – truly a unique blessing.

In the case of the Guyana branch, it is about what the deus ex machina, our great white knight, has done for Guyana, including the 1,700 “unique” Guyanese companies which supply Exxon’s operations, the thousands of Guyanese individuals it employs, its contribution to the Natural Resource Fund, the monies invested in communities across Guyana, and the volume of business it brings Guyanese suppliers. Even when Exxon acknowledges the country’s natural resources, it takes the credit for the successful optimisation of those resources. To use its own words, “it is not that Exxon is merely extracting resources; [they] are expanding the potential of the nation.” Halleluiah!

Income statement

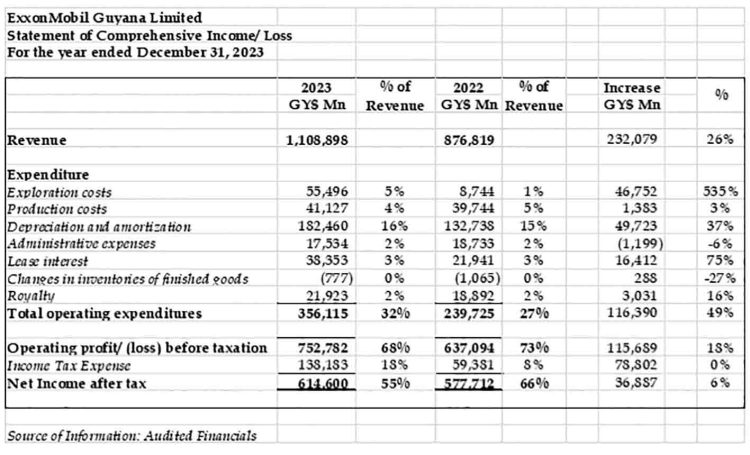

While its blurbs and Fast Facts confuse and mislead, no doubt deliberately so, the performance of the Guyana operations in 2023 is probably without industry equal. Revenue has moved from $876,819 Mn. to $1,108,898 Mn, an increase of 26% while its operating profit has moved from $637,094 Mn. to $750,782 Mn., an apparently more modest 18% increase. But that is largely due to the fact that this reckless government allows the Exxon and its co-venturers to use part of our share of profit to explore for new finds as the date for exploration comes to an end in 2027. It may sound harsh, but it is hard to think of anything more absurd and violative of Guyana’s interest.

Another astounding measure derived from the financials is the negligible production cost which in 2023 accounted for a mere 4% of revenue, down from 5% in 2022. In fact, the only cost which accounts for more that 10% of revenue is Depreciation and Amortisation, accounting for 16% of revenue. Lease interest, an accounting rather than an actual expenditure, is stated at $38,353 Mn., a 75% increase over 2022. This increase is due to a $206,777 Mn. addition to Drill Rigs.

The fake tax charge

After all actual and other expenses, the branch reports Operating Profit before tax of $752,782 Mn., an increase of $115,688 Mn., or 18.2% increase. The Income Statement which is summarised below shows a charge for taxation of $138,183 Mn. and it is only when one looks at Note 7 to the financial statements does one realise that the so-called tax expense is actually paid by the Government of Guyana – another unique feature of our oil arrangements. By now, we all know that there is no charge to the company, which not only walks away with the full amount of $752,782 Mn., but also with a receipt issued by the Guyana Revenue Authority which Exxon then uses to obtain a tax credit from the US Government. Without raising anything about exemption from withholding tax which is required to be paid by ordinary companies on distributions and interest, the actual money that Exxon walks away with is the $752,782 Mn. plus a tax receipt for $138,183 Mn., making a total of $890,965 Mn! In a single year.

Balance Sheet

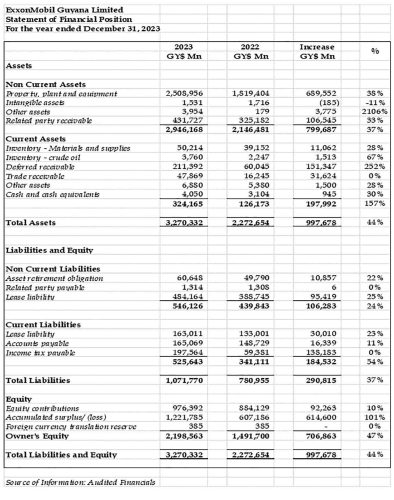

Total assets of the branch at the end of 2023 was $3,270,332 Mn., an increase of $997,678 Mn., or 43% over 2022. As is evident from the Summary Balance Sheet extracted from the branch’s audited financial statements, there were significant increases in Property, Plant and Equipment; Other Assets which had a 2,106% increase; Inventory of crude oil; and Deferred Receivable. The notes to the financial statements (found on chrisram.net) show that of the assets acquired, 35% were on lease but accounted for as additions, to meet accounting rules. It is worth noting that the item of asset with the most significant increase (Other Assets) is not supported by any explanatory note and is therefore uncertain. Like Hess, this branch also shows a significant closing inventory of crude oil, which is at least surprising, since their sales are more than likely within the Exxon family. Deferred Receivable increased by 252% but the only elucidation offered in the accompanying Notes is that the amount of $211,392 Mn. includes non-customer receivables. Interestingly, that includes the Tax Recoverable from the Government of Guyana – all part of an accounting myth.

Total liabilities of $1,071,770 Mn. represents a 37% increase over 2022 but here too, some of these arise out of accounting convention, such as Lease Liability and Income Tax payable which is totally misleading if not grossly incorrect. Accumulated Surplus at 31 December 2023 of $1,221,785 Mn. reflects an increase of $614,600 Mn. which is the amount of profit after (fictitious) taxation of $138,183 Mn.

Exxon’s contribution

By its own admission, and stripped of all its contrivances, the true value of the investment in the branch at 31 December 2023 is stated in the line item Equity Contributions as $976,392 Mn. The note explains that “Equity contribution relates to amounts paid into the Branch by its head office.” In other words, the return on average equity of $930,260 Mn. is a unique 96%! And we must not forget that the Branch’s Head Office was the architect of the fraudulent inflation of its pre-2015 costs and the diversion – in violation of the 2016 Agreement – of moneys received from Hess, CNOOC and Shell (twice), for their investment in the Stabroek Block.

Despite all these shocking revelations, disclosures and discoveries, our Oil Czar sees the 2016 Agreement as inviolable, sacred and untouchable. His only objection is that Exxon does not share the kudos for oil’s bonanza with him. Anyone who places the sanctity of a hugely questionable and lopsided contract above sovereignty is no better than the incompetent who signed the contract in the first place.

These results and the audited financial statements of Exxon and its two joint venture partners render as nonsense the proposition that Guyana and the oil companies are in a 50/50 partnership. This must surely be the petroleum equivalent of the Stockholm Syndrome.