Business and Economic Commentary by Christopher Ram

Part 7 June 21, 2024

Introduction

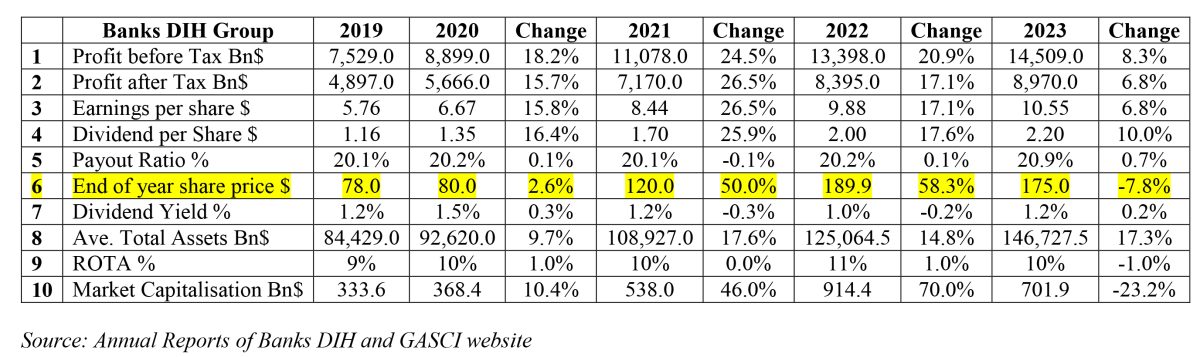

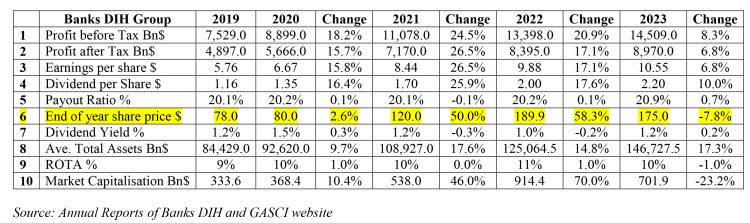

Banks DIH Limited, a blue-chip company on the domestic scene, has asked the Securities Council of Guyana to suspend the trading of its shares on the Guyana Stock Exchange. While I am not aware of any precedent for such a request in Guyana, the request is often justified where there are concerns about unfair trading or market manipulation. In a circular to its thousands of members, the company’s Board of Directors expressed concern that there is a continuing pattern of an unusual reduction in the price of BDIH shares involving very small trading. It notes that for the period 2019 to 2023, revenue increased by 48.8 % and profit after taxation increased by 79.7 % but yet the Company’s share price declined from $300 per share in March 2022 and to $115 per share in May 2024. The Circular added that “such a comparison of the price of shares going down at the same time that profits are going up defies any logical explanation” and raises fundamental questions as to the integrity of the Stock Market. Even more strongly, the Circular added that “[A]ny reasonable person would consider that the Stock Market in Guyana cannot be taken seriously!”, with an exclamation mark.

An accusation of market manipulation is a serious one indeed, particularly coming from one of the country’s best-known public companies. What is worse is that the company appears to have formed its conclusions, even before calling on the Security Council to undertake an investigation of the reasons for the price movement and to “rectify the present state of affairs.” To put the small shareholders at some ease, the fall does not affect them and others who do not intend to sell their shares, but only traders, brokers, pension schemes and similar entities which are forced to recognise the loss in value.

There is another side to the question of the share price of the company which this columnist has raised before. The significant increase in the share price over the period 2019 to 2023 was correspondingly much greater than its increases in profits, as reflected in the Table below, previously published by me as a letter to the Editor. (S/N 02 -02- 2024). Seeing their results as much as a public relations issue as a statement on their performance, companies take credit when their share prices increase but seek to avoid responsibility when they fall.

The company should also address the historical, low dividend yield arising from the ownership of its shares and to offer an explanation and justification for the company’s policy of hoarding cash at the expense of shareholders. A small holding in the company is hardly worth the transaction cost for the modest dividends paid to its multitude of small shareholders, in three separate tranches. At the time of writing, I have on my desk three Banks DIH share certificates, one for 135 shares, one for 90 shares and the other for 910 shares, all issued by the company which the owner is offering for sale. Shareholders obviously have a right to sell their shares and if the company wants to stop small trades, then it needs to amend its by-laws and/or carry-out a large scale buy back of such small holdings.

The company should also address the historical, low dividend yield arising from the ownership of its shares and to offer an explanation and justification for the company’s policy of hoarding cash at the expense of shareholders. A small holding in the company is hardly worth the transaction cost for the modest dividends paid to its multitude of small shareholders, in three separate tranches. At the time of writing, I have on my desk three Banks DIH share certificates, one for 135 shares, one for 90 shares and the other for 910 shares, all issued by the company which the owner is offering for sale. Shareholders obviously have a right to sell their shares and if the company wants to stop small trades, then it needs to amend its by-laws and/or carry-out a large scale buy back of such small holdings.

Share price performance also reflects other variables. For example, the directors recently persuaded its shareholders to support the adventurous idea of converting itself into a holding company while making this iconic company into a private company. To borrow from the Circular, that step “defies any logical explanation,” but despite grave questions being raised, there is no indication that this move will not take place.

Observers are aware too that this company has been lukewarm at best on an effective Code of Corporate Governance and not only holds to a single person being the Chairman and the CEO, no succession plan and a majority of directors who are employees of the company and the Group. No wonder then that in relation to the ordering of goods from Europe through a company in Miami, the directors have opened themselves to the criticism of not protecting the best interest of the company. While one cannot be sure where this breach is on a scale with the accusation which the company is making against anonymous persons, to ignore such concerns only compounds the absence of responsible and proper governance in the company. For the company to be taken seriously, it must be willing to urgently review the governance and procurement practices of the entire group and to discontinue wasteful practices.

One final thought. While the company calls for the suspension of trading in its shares, it advises shareholders that their shares can be transferred at the Banks DIH Shares Registry, which would seem to be an avenue of share trading which is no more transparent than the issue being complained about.

Conclusion

It is true that the company has increased turnover and profits substantially over the years but its inconsequential revenue from exports shows the absence of any serious strategies and policies over those very years, or for the future. Investors in Guyana long for investment opportunities and look to the existing as well as new companies to offer fresh ideas and possibilities. Hopefully, the company will cooperate fully with any investigations by the Securities Council and the Stock Exchange. It must be prepared to share information on share activities by its own Share Registry and to actively support the efforts of the Securities Council to put in place a modern Code of Corporate Governance and Social Responsibility.

c

Error and Apology for Oil and Gas Column 131

I sincerely apologise to the editor of the Stabroek News, readers and CNOOC for incorrectly stating the share capital of the company which operates a branch in Guyana as US$200. The correct amount is US$200,000. Christopher Ram