On 29 July 2024, the Chief Justice ruled that the 30 percent excise tax imposed by the Guyana Revenue Authority’s (GRA) on a vehicle brought into the country by a remigrant on 28 June 2024, was unlawful. During the hearing, the GRA acknowledged that it had made a mistake since the related regulations of 10 July 2023 signed by the Minister of Finance were neither published in the Official Gazette nor tabled in the National Assembly before the new tariff could be brought into force. The regulations increase the excise tax on vehicles with engine capacity of over 3,000 c.c. from 10 percent to 30 percent. For vehicles with engine capacity of between 2,000 c.c. and 3,000 c.c., the tax has increased from 10 percent to 20 percent.

The Chief Justice also stated that the GRA must inform all affected taxpayers of the error and issue the necessary refunds. The following day, the regulations were published in the Official Gazette with effect from 1 September 2023. The Minister’s decision to have the new tariffs applicable retroactively has been severely criticized as an act of bad faith that undermines the Chief Justice’s ruling on the matter.

The contract for the Conversation Tree Road Project was awarded in the sum of $830.3 million in September 2022 to the Trinidadian contractor Kalco, of which an amount of $465.2 million, or 56 percent of the contract sum, was paid to the contractor as advanced payment. The Ministry of Public Works terminated the contract because of unsatisfactory performance. It is, however, not clear whether the advanced payment, or a portion thereof, relates to the grant of a mobilization advance. While it is normal for a mobilization advance of between 20 percent and 30 percent to be granted for major contracts, it is not the practice for further advances to be made during the execution of the project since one of the evaluation criteria used in the award of a contract is the contractor’s ability to execute the contract using his/her own financial resources. As the works progress, payments are made based on valuation certificates signed by the Engineer, after the deduction of a percentage of the mobilization advance in such a manner that by the time the final valuation certificate is prepared and approved, the mobilization advance is fully recovered.

It has also been the established practice for a mobilisation advance to be covered by a bank guarantee to ensure that, in the event the contractor fails to deliver and there is an outstanding balance of the advance, the Authorities can levy of the bank guarantee. In the case of Kalco, it does not appear that such a guarantee was in force at the time of the termination of the contract. According to the Minister, an “amicable settlement” was reached with Kalco that includes the seizure of $153.6 million worth of equipment to offset the outstanding advance payment, leaving an amount of $311.6 million still to be recovered. It is unclear how the value of the equipment was arrived at.

A new contract was awarded in the sum of $844.1 million to S. Jagmohan Construction and General Supplies Inc. for the completion of the works, which is $13 million more that the Kalco contract. One would have thought that any new contract for the completion of the works would take into account the value of the works completed by Kalco. It is not clear whether this is so, or whether the scope of the works was expanded to justify the value of the new contract. That apart, the contract was awarded using the sole source method of procurement. Section 28 of the Procurement Act provides for the use such method of procurement where:

(a) The goods or construction the goods or construction are available only from a particular supplier or contractor, or a particular supplier or contractor has exclusive rights with respect to the goods or construction, and no reasonable alternative or substitute exists.

(b) The services, by reason of their highly complex or specialized nature, are available from only one source.

(c) Owing to a catastrophic event, there is an urgent need for the goods, services or construction, making it impractical to use other methods of procurement because of the time involved in using those methods.

(d) The procuring entity, having procured goods, services, equipment or technology from a supplier or contractor, determines that additional supplies must be procured from that supplier or contractor for reasons of standardization or because of the need for compatibility with existing goods, services, equipment or technology, taking into account the effectiveness of the original procurement in meeting the needs of the procuring entity, the limited size of the proposed procurement in relation to the original procurement, the reasonableness of the price and the unsuitability of alternatives to the goods in question; or

(e) The procuring entity applies section 3 (2) of the Act, to procurement involving national defence or national security and determines, as a result of national security concerns, that single-source procurement is the most appropriate method of procurement

Requirements (a), (b), (c) and (e) are clearly not applicable to the new contract, while item (d) does not apply to construction works. It is also not clear whether an Engineer’s Estimate was prepared for the works, and whether the National Procurement and Tender Administration Board and the Cabinet were involved in relation to the contract award. In the interest of transparency and proper accountability, an explanation from the Ministry of Public Works into what appears to be a breach of the Procurement Act will be most helpful.

Last Friday, the National Assembly approved two financial papers presented by the Minister of Finance seeking Supplementary Estimates in the sum of $40.8 billion. This was one day before the Assembly was expected to proceed on a two-month recess. It will be recalled that on 2 February 2024 the Assembly had approved of a budget for 2024 in the sum of $1.146 billion. Taking into account the Supplementary Estimates, the revised budgetary allocations for Ministries, Departments and Regions now amount to $1.187 billion.

Financial Paper No. 1 of 2024 – Replenishment of advances made from the Contingencies Fund

Financial Paper No. 1 relates to two advances made from the Contingencies Fund totalling $8.6 billion covering the period 1 April to 30 July 2024 to meet additional operational costs of Guyana Power and Light Inc. ($4.0 billion), Guyana Rice Development Board ($534 million); and Guyana Sugar Corporation ($4.043 billion). The Contingencies Fund was established by Article 223 of the Constitution authorizing the Minister to make advances from the Fund if he/she is satisfied that there is an urgent need for expenditure for which no other provision exists. Where any advance is made, the Minister is required to present a Supplementary Estimate in the Assembly to enable it to authorize the replacement of the amount advanced and to increase the budgetary allocation(s) of the concerned Ministry, Department or Region by the said amount.

Section 41 of the Fiscal Management and Accountability (FMA) Act elaborates on the use of the Contingencies Fund. The Minister may approve of an advance from the Fund if he/she is satisfied that an urgent, unavoidable and unforeseen need for expenditure has arisen: (i) for which no moneys have been appropriated, or for which the sum appropriated is insufficient; (ii) for which moneys cannot be reallocated as provided for under the Act; or (c) which cannot be deferred without injury to the public interest. The total of the amounts permitted to be drawn from the Contingencies Fund cannot exceed two percent of the estimated annual expenditure of the last preceding fiscal year as shown in the annual budget proposal approved by the Assembly, or such greater sum as the Assembly may approve.

The Minister is required to report at the next sitting of the Assembly on all advances made from the Contingencies Fund since his/her previous report, which report must specify: (i) the amounts advanced; (ii) to whom the amounts were paid; and (iii) the purpose of the advances. When the Assembly approves the related Financial Paper, a Supplementary Appropriation Act is passed covering the amounts advanced.

Financial Paper No. 2 of 2024 – Request for additional funding via a direct Supplementary Estimate

In accordance with Article 220 of the Constitution, where it is found that the amount appropriated by an Appropriation Act is insufficient, or a need for expenditure arises for which there has been no appropriation, or moneys have been expended in excess of the amount appropriated, the Minister is required to present a Supplementary Estimate, or a Statement of Excess as the case be, showing sums required or spent.

The FMA Act provides some elaboration. Section 22 permits the Minister to reallocate spending authority across programmes within a budget agency. Appropriations for current expenditure may be reallocated to capital expenditure but not the reverse. Additionally, any reallocation of expenditure must not exceed 10 percent of the amount appropriated under a programme, and no new appropriations can be created. By Section 24, any variation of an appropriation other than those referred to above must be authorised by a supplementary appropriation Act prior to the incurrence of the expenditure. When introducing a supplementary appropriation Bill in the Assembly, the Minister must give reasons for the proposed variations and provide a supplementary document describing the impact that the variations, if approved, will have on the financial plan outlined in the annual budget. No more than five supplementary appropriation Bills can be presented in the Assembly in any fiscal year, except in circumstances of grave national emergency.

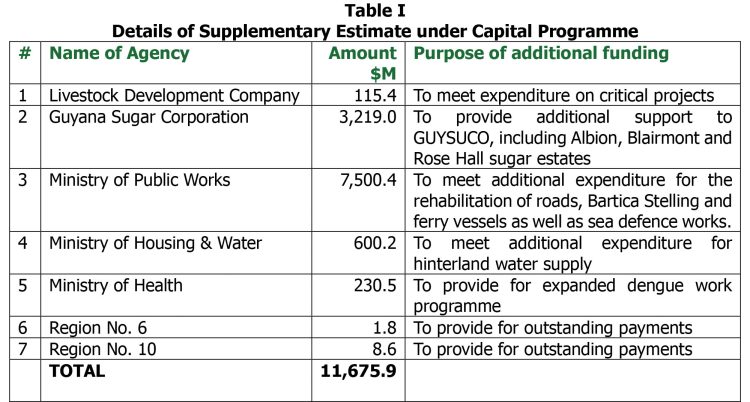

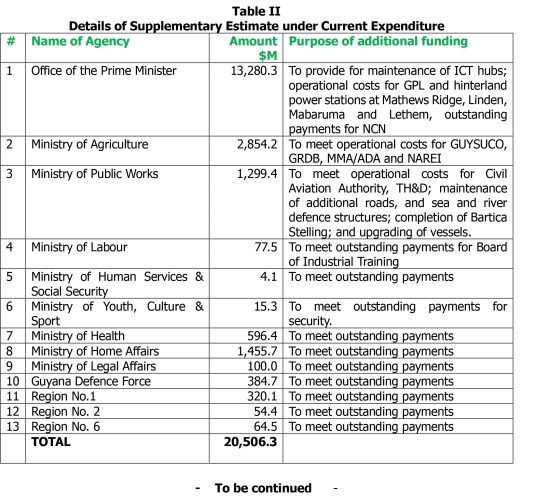

Financial Paper No. 2 covers a Supplementary Estimate of $32.2 billion for both capital and current expenditure in the amounts of $11.7 billion and $20.5 billion, respectively. Tables I and II provide a breakdown under capital expenditure and current expenditure, respectively: