Dear Editor,

With your permission, permit me to explain how total revenue, total cost, and profits are identified in the Guyana oil business, and in particular Liza One. In this regard, knowing the selling price (P) and the average total cost (ATC) of a barrel of oil signals the first decision point of any investment. The average total cost (ATC) of a barrel of oil is defined as the total cost (TC) divided by the number of barrels of oil (Q) extracted from the oil reservoir below the Atlantic Ocean: ATC = TC/ Q. Given this relationship, it is observed that the decision to invest is rejected, if the selling price (P) of a barrel of oil is less than the average total cost (ATC) of a barrel of oil; only losses on every barrel of oil sold will result in this case.

When the price (P) of a barrel of oil is equal to the average cost (ATC) of barrel of oil (P = ATC), this position establishes the breakeven price. For example, if the price (P) of a barrel of oil is US$30.00, and the average total cost (ATC) of barrel of oil is US$30.00, then the profit earned on each barrel of oil is zero; that is: Profit = P – ATC = $30.00 – $30.00 = 0. This outcome is usually called the breakeven price.

Interestingly, in a recent publication, it was reported that ‘…Guyana’s average breakeven price (is) US$36.00 per barrel of Brent crude … a standout figure in the global market, with projects like Liza 2 at US$25.00 per barrel and Payara at US$32.00 per barrel.’ (Oil Now: https://oilnow.gy/featured/oil-story-of-south-americas-newest-producer-built-on-45-discoveries-in-just-nine-years/). Consequently, whenever the price (P) of a barrel of oil is greater than average total cost (ATC) of barrel of oil, the profit on every barrel of oil is positive. For example, if the price of a barrel of oil is US$70.00, and the average cost of a barrel of oil is US$36.00, then the profit on a barrel of oil is US$34.00; that is, Profit = P – ATC = US$70.00 – US$36.00 = US$34.00.

With reference to the Guyana Production Sharing Agreement (PSA), the average total cost (ATC) of a barrel of oil has a cost inflating mechanism which deflates the profit on each barrel of oil. More specifically, the PSA (Article 11.2, page 26) has the condition that the total cost (TC) of oil production is equal to 75 percent of total revenue (TR); that is, TC = 0.75 (TR), where TR is price (P) times the quantity of barrels of oil (Q). As a result, the average cost of a barrel of oil in the PSA is equal to: ATC = (0.75PQ)/Q = 0.75P. When the price of a barrel of oil is US$70.00, the average cost of a barrel of oil under the Guyana PSA is: ATC = 0.75 (US$70.00) = US$52.50 per barrel. Consequently, when this PSA cost of US$52.50 per barrel of oil is compared with the alternative cost per barrel of US$36.00 as identified by Oil Now, the average total cost of a barrel (ATC) of oil under the PSA of US$52.50 is more expensive by US$16.50. Therefore, the US $16.50 per barrel of oil is the hidden profit that is captured by the company as cost oil.

Additionally, it should be noted that whenever the selling price (P) of a barrel of oil increases, the average total cost (ATC) of a barrel of oil increases, even though nothing is changed in the actual extraction (production?) of the oil. This outcome occurs only because the average total cost (ATC= 0.75 P) of a barrel of oil under the Guyana PSA includes the selling price (P), a condition that is not observed in a standardized cost structure. At the same time, it can be stated that whenever the cost of a barrel of oil is more than the price of a barrel of oil, all losses incurred is transferred to the next payment cycle, and these losses are covered in the next revenue period (PSA, Article 11.3, page 26).

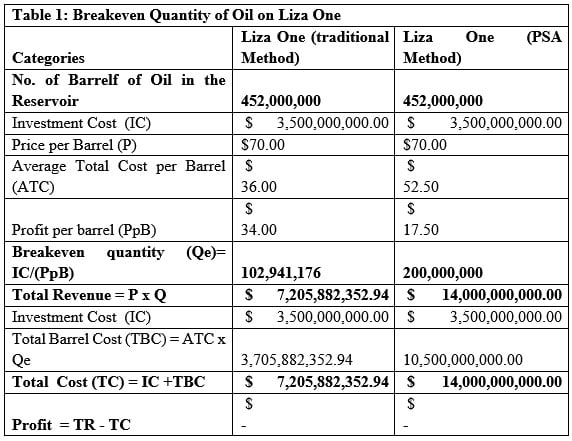

Another important indicator in the oil business is the breakeven quantity of oil (Qe) that must be sold to cover the total investment of cost (IC) in the project. For the Liza One project, the investment cost is recorded at US$3.5 Billion. Therefore, the breakeven quantity (Qe) of oil that must be sold to cover the total cost (TC) in the project is defined by the formula as: Qe = (IC/(P – ATC)). Since the investment cost (IC) in Liza One is US$3.5 Billion and the profit margin per barrel of oil in the traditional method is US$34.00 per barrel (Table 1), the breakeven quantity of oil which must be sold at a price of US$70.00 is 102,941,176 barrels of oil, valued at US$7.2 Billion. In contrast, under the PSA method, it is observed that 200,000,000 barrels of oil must be sold, valued at US$14.0 Billion (Table 1).

It is important to point out the finding that when only 102.9 million barrels of oil are required to establish the breakeven quantity (Qe) in the traditional method, an additional 97, 058, 824 barrels of oil in the PSA model has to be sold to attain the breakeven level of 200.0 million barrels to oil. The main implication which can be drawn from using the PSA method is that there is a loss of profit of US$3.3 billion (= US$34 x 97,058,824) which is absorbed as cost, due to the cost recovery method of 75% of total revenue being captured as cost.

It is reported that some 200 million barrels of oil have already been extracted from the Liza One reservoir, leaving only 252.0 million barrels (https://www.kaieteurnewsonline.com/2024/10/18/exxonmobil-in-discussion-with-govt-to-ramp-up-oil-production-at-liza-two/). Using the breakeven quantity in Table 1, it is clear that Liza One investment cost of US$3.5 Billion has been fully recovered; and therefore, the profits from Liza One on the remaining 252.0 million barrels should be higher as the average cost of a barrel of oil should decline below US$36.00 per barrel, since the investment cost have been repaid.

Using the cost methodology that excludes the price in the average total cost (ATC) of a barrel of oil, as imposed in the PSA; counting the number of barrels of oil and not depending on the number of lifts (oil is not sold by lifts but by the number of barrels of oil sold); employing real time auditing (auditors were recently denied to all the data and information); and commissioning ring-fencing will yield a less than inequitable result that is currently observed.

Sincerely,

Dr. C. Kenrick Hunte

Professor and Former Ambassador