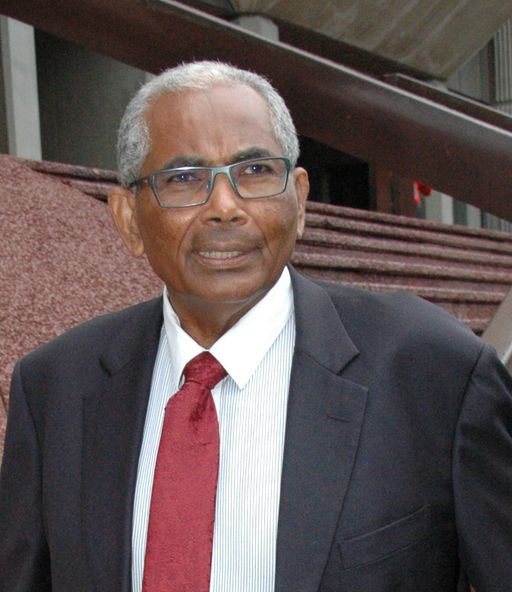

(Trinidad Guardian) Former CL Financial executive Andre Monteil has lost his final appeal before the UK Privy Council regarding a disputed income tax assessment of over $20 million.

The Appeal was dismissed yesterday by Lord Hodge, Lord Briggs, Lord Sales Lady Rose, and Lord Richards.

The case revolved around Monteil’s 2007/2008 income tax return, where he declared his income as derived solely from employment salary. The Board of Inland Revenue (BIR) initially accepted the return but later audited it and on October 1, 2012, issued an assessment for additional income tax liabilities. The BIR claimed Monteil’s actual emolument income significantly exceeded the declared amount, placing the onus on him to pay the shortfall.

Monteil’s argument hinged on the PAYE (Pay-As-You-Earn) system outlined in Section 99 of the Income Tax Act, which mandates employers to deduct and remit income taxes. He contended that the BIR should recover the unpaid taxes from his employer rather than directly from him.

However, the Tax Appeal Board dismissed this argument, ruling that the PAYE system does not limit the BIR’s authority to assess individuals for unpaid taxes under Sections 83 and 89 of the Act. This decision was upheld by the Court of Appeal and, subsequently, the Privy Council.

The Privy Council judgment, delivered on November 21, 2024, reaffirmed the BIR’s authority to raise assessments directly against individual taxpayers, even where an employer has failed to comply with PAYE obligations.