Summing-up the Metrics informing the Guyana Petroleum Road Map

Introduction Last week’s column concluded my presentation on the Buxton Proposal.

Introduction Last week’s column concluded my presentation on the Buxton Proposal.

Introduction Today’s column wraps-up discussion on the “reasonings” or developmental rationale for the Buxton Proposal of “oil-for-cash” transfers to Guyanese households.

Introduction In today’s column I shall continue the effort to offer readers, as careful an assessment as I can of the “reasonings” (developmental rationale), underpinning the Buxton Proposal of “oil-for-cash” transfers to Guyanese households, as the final element of the Guyana’s Petroleum Road Map, as I have been describing it.

Introduction Starting today, I shall attempt to offer readers as careful an assessment as I can of the developmental rationale that lies behind the Buxton Proposal, as I formulate it.

Introduction This week’s column considers those processes that are required for making the Buxton Proposal operational.

Introduction Last week’s column introduced four attributes of the Buxton Proposal, which I am certain, if kept constantly to the fore-front of its consideration would allow a deeper understanding of it as a potentially transformational poverty policy intervention, reaching beyond a cash transfers to all households’ scheme (and thus race/ethnic neutral).

Introduction Thus far, I have observed that, from a purely pedagogic perspective, it has been very helpful for ease of explanation and hopefully, understanding, to introduce my presentation of the Buxton Proposal, beginning with a listing of four of its attributes before offering a formal comprehensive depiction or description of it.

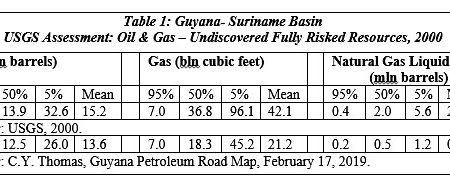

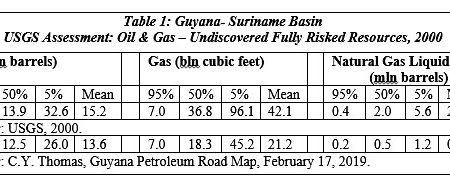

Introduction At the start of 2019, I had set about the long task of portraying for this series of columns the systematic delineation of a strategic road map for both the “getting and spending” of Guyana’s expected Government Take, arising from its fast-emerging oil and gas sector.

Introduction Today’s column concludes the discussion on my Road Map recommendation that “sustained Government of Guyana (GoG) investment in renewable energy becomes a declared priority for optimising the use of its expected petroleum wealth.

Introduction Last week’s column highlighted the two Government of Guyana’s (GoG) foundational spending recommendations that I make, based on Guyana’s projected petroleum revenues.

Introduction Today’s column wraps-up my discussion of Guidepost 4, in Part 2 of Guyana’s Petroleum Road Map.

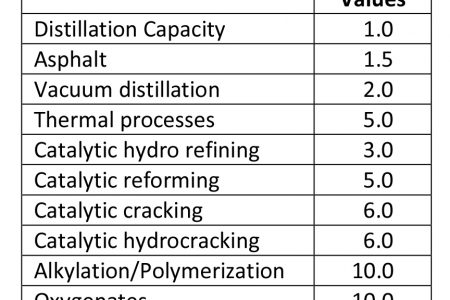

Introduction Today’s column continues the discussion of establishing a domestic oil refinery (or refineries), whether private or state-owned, to process Guyana’s crude slate.

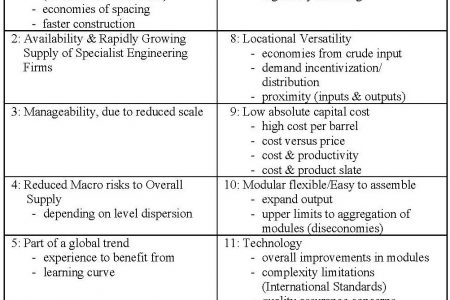

Introduction Last week’s column briefly evaluated the perspective of private investors and their value added proposals for constructing “modular mini-refineries” utilising Guyana’s crude oil.

Introduction In recent weeks my Sunday Stabroek columns have sought to demonstrate the reason why I have advanced the proposition that: a state-owned oil refinery makes no economic sense at this stage of Guyana’s evolving oil and gas sector and/or its economic development, more broadly.

Introduction Today’s column expands further on the reasoning behind the Guyana’s Petroleum Road Map’s finding that there is not sound economic reasoning behind calls to establish a state-owned oil refinery to process (and thereby add value) to its crude oil production at this stage of development of the country’s coming petroleum industry.

Introduction Today I start my discussion of the fourth and penultimate Guidepost listed in the spending dimension of Guyana’s Petroleum Road Map.

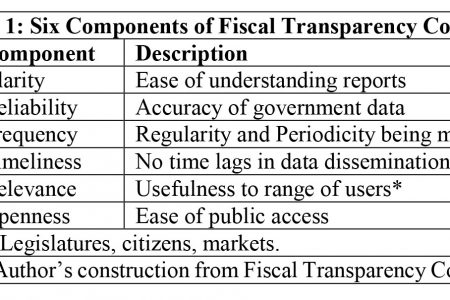

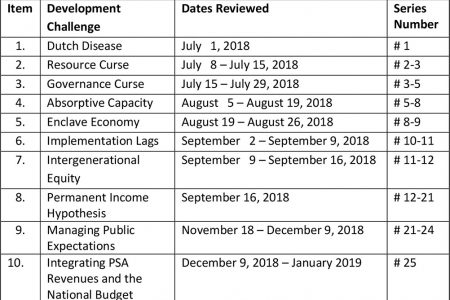

Introduction Today’s column addresses the tenth and final item in my non-exhaustive list of the “top-ten economic challenges”, which Guyana will have to confront as it operationalises its coming petroleum sector.

Introduction Today’s column addresses three additional “top-10 economic challenges” in light of Guyana’s coming petroleum sector; namely: intergenerational equity, the permanent income hypothesis (PIH) budget rule, and managing public expectations.

Introduction This week’s column continues my evaluation of what I had earlier labelled: “a non-exhaustive list of the top-10 economic challenges”, which the Government of Guyana (GoG) will have to confront with First Oil due in 2020.

Introduction This week’s column starts consideration of what I had previously labelled as a non-exhaustive list of the “top-10 economic challenges”, which the Government of Guyana (GoG) has to confront.

The ePaper edition, on the Web & in stores for Android, iPhone & iPad.

Included free with your web subscription. Learn more.